- Bitcoin trades around $112,450, rebounding after a 10% flash crash that erased over $7 billion in positions.

- Trump’s 100% tariff on Chinese goods triggered panic selling, pushing BTC into critical $110K support.

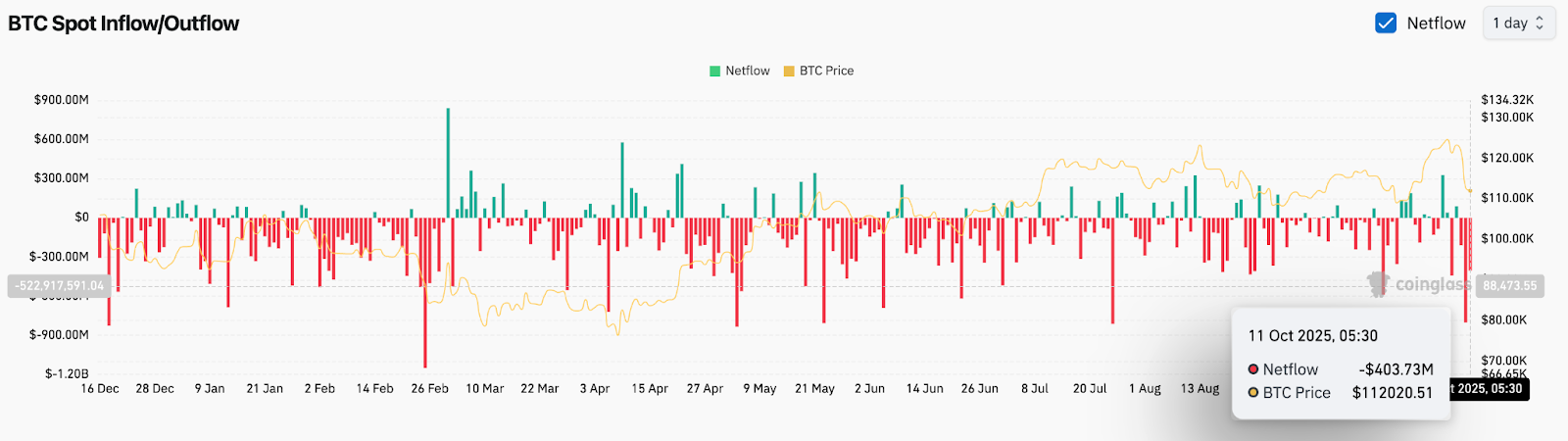

- Exchange outflows above $400M signal accumulation as whales buy the dip despite near-term caution.

Bitcoin price today trades near $112,450, recovering slightly after a violent 10% flash crash triggered by renewed U.S.-China trade tensions. The selloff, which erased over $7 billion in leveraged positions, sent BTC tumbling from the $120,000 zone to as low as $111,100 before buyers stepped in. The drop marks one of the steepest intraday declines of 2025, pushing Bitcoin toward its key ascending trendline support.

Bitcoin Price Faces Major Technical Breakdown

The daily chart shows Bitcoin breaking decisively below the 20-day and 50-day exponential moving averages (EMAs), which now act as short-term resistance near $115,800 and $117,500. Price briefly pierced the ascending trendline that has guided the rally since May but closed just above it, preserving structural integrity for now.

If BTC fails to reclaim $113,500–$115,000, momentum could deteriorate quickly toward the 200-day EMA near $107,800 — the next critical defense zone. The on-balance volume (OBV) indicator remains elevated at 1.74 million, showing that while selling was intense, longer-term holders have not yet capitulated.

Trump’s Tariff Shock Triggers Flash Crash

Friday’s market meltdown followed U.S. President Trump’s announcement of a 100% tariff on Chinese goods, reigniting fears of a global trade war. Crypto assets plunged instantly, with Bitcoin falling over $12,000 in hours.

The announcement came after markets had already weakened on reports of new export controls from China on rare earth metals. Trump’s late-afternoon post on Truth Social, confirming the additional tariff from November 1, triggered panic selling across both spot and derivatives markets.

Analyst Bob Loukas described the event as “Covid-level nukes,” comparing it to the March 2020 crash. Others, like Lumida Wealth’s Ram Ahluwalia, noted that “overbought conditions and leverage build-up amplified the decline.”

The move highlights Bitcoin’s ongoing sensitivity to geopolitical shocks, particularly when macro uncertainty collides with stretched positioning.

Exchange Outflows Point To Dip Accumulation

Coinglass data shows a $403.7 million net outflow on October 11, following the $522.9 million withdrawal recorded earlier in the week. This consistent outflow trend suggests that despite volatility, investors are pulling Bitcoin off exchanges — a sign often linked to accumulation or long-term storage.

While short-term traders faced widespread liquidations, on-chain data indicates whales and long-term holders were net buyers near the $110,000 zone. Historically, deep liquidations of this scale have coincided with local bottoms, particularly when followed by sustained outflows in subsequent sessions.

Technical Picture Turns Cautious

From a technical standpoint, Bitcoin remains at a crucial inflection point. Resistance sits at $115,800 and $117,500 (the 50-day and 20-day EMAs), followed by $120,000 as the upper rejection zone. On the downside, the $111,000–$107,800 area forms a confluence of horizontal and EMA support, while deeper demand lies at $103,000.

The RSI has fallen sharply toward the mid-40s, confirming a loss of momentum but not yet oversold territory. The MACD remains in bearish crossover, reinforcing the likelihood of continued consolidation unless BTC reclaims $116,000.

| Bitcoin Technical Forecast | Levels |

| Resistance levels | $115,800, $117,500, $120,000 |

| Support levels | $111,000, $107,800, $103,000 |

| Key EMA cluster | 20 EMA $117,493 – 50 EMA $115,792 |

| Momentum bias | Bearish below $115,000 |

| OBV reading | 1.74 million (neutral to accumulation phase) |

Outlook: Will Bitcoin Go Up?

Bitcoin’s next move depends on whether buyers can stabilize price action above the $111,000 support and re-establish strength near the $115,000 zone. The current rebound is modest, and market sentiment remains cautious after heavy liquidations and macro-driven uncertainty.

However, on-chain data showing sustained outflows and resilient OBV hints that larger investors continue to accumulate. If Bitcoin reclaims $117,500, a relief rally toward $120,000 could unfold quickly.

Until then, traders should watch $111,000 as the key pivot. A breakdown below that level would likely expose $107,800 and even $103,000. For now, Bitcoin remains under pressure but structurally intact within its long-term uptrend — a setup that still favors recovery once macro conditions stabilize.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.