- Tariff hike announcement affects stock market sentiment, driving significant declines.

- Apple, Nvidia, and others see 5% drops.

- Coinbase and Circle fall significantly, sparking market volatility.

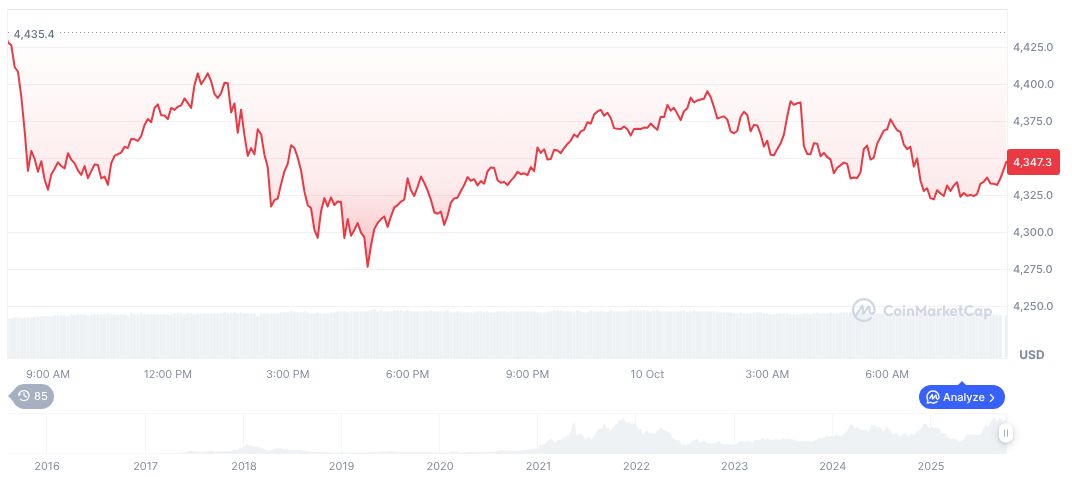

On October 10, 2025, U.S. stock markets saw significant declines following President Donald Trump’s announcement of potential tariff increases on Chinese imports, exacerbating U.S.-China trade tensions.

Major technology and blockchain-related stocks plummeted, with investors concerned about heightened trade risks, yet the specific impact on cryptocurrencies like BTC and ETH remains unclear.

Tech Giants and Crypto Hit by Trump’s Tariff Threat

President Donald Trump stated plans for a “massive increase of tariffs” on Chinese imports, contributing to 5% declines in prominent tech stocks such as Tesla and Nvidia. This announcement has been linked to a drop in the Dow Jones by 1.9%, while the Nasdaq Composite saw a sharper decline of 3.5%. Coinbase experienced a significant drop of 7.75%, and Circle’s value plummeted by 11.66%. Trade experts like Adam Crisafulli suggest the situation may be seen as posturing, yet the economic risks pose a real concern for investors who now face heightened trade-related uncertainties.

Market responses were swift and pronounced. Adam Crisafulli of Vital Knowledge noted a perceived increase in trade-related concerns, suggesting that these geopolitical moves could have broader economic implications. As speculation over future tariffs builds, investors are preparing for continued market volatility.

Trade-related risks have increased, noted Adam Crisafulli of Vital Knowledge, highlighting the growing concerns among investors.

Historical Parallels and Future Outlook for Blockchain

Did you know? The last comparable sharp decline in both technology and blockchain stocks occurred during the 2000 dot-com bubble, demonstrating the vulnerability of tech-centric markets to geopolitical and economic shifts.

Ethereum’s price stands at $3,852.90 with a market cap of $465.06 billion. Ethereum has seen a 24-hour decline of 11.86% as per CoinMarketCap data. The 30-day and 60-day views also reflect negative trends, with declines evident in broader cryptocurrency sentiments.

Coincu’s research team predicts further technological uncertainties could exacerbate market instability. Restrictive policies might influence blockchain growth potential in the short term, although long-term innovation prospects remain strong.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/us-china-tariff-impact-tech-crypto/