- XRP whale alert shows $50M/day sell-off as ETF delay pressures price.

- Whale flow data stay negative with support near $2.72–$2.80 range.

- Ripple’s EU progress offsets U.S. regulatory uncertainty short-term.

Whale-tracking dashboards flashed a fresh XRP whale alert as large holders accelerated sales. Data from Santiment show wallets controlling 1 million to 10 million XRP cut balances by around 440 million tokens over 30 days, bringing their combined holdings to approximately $6.51 billion.

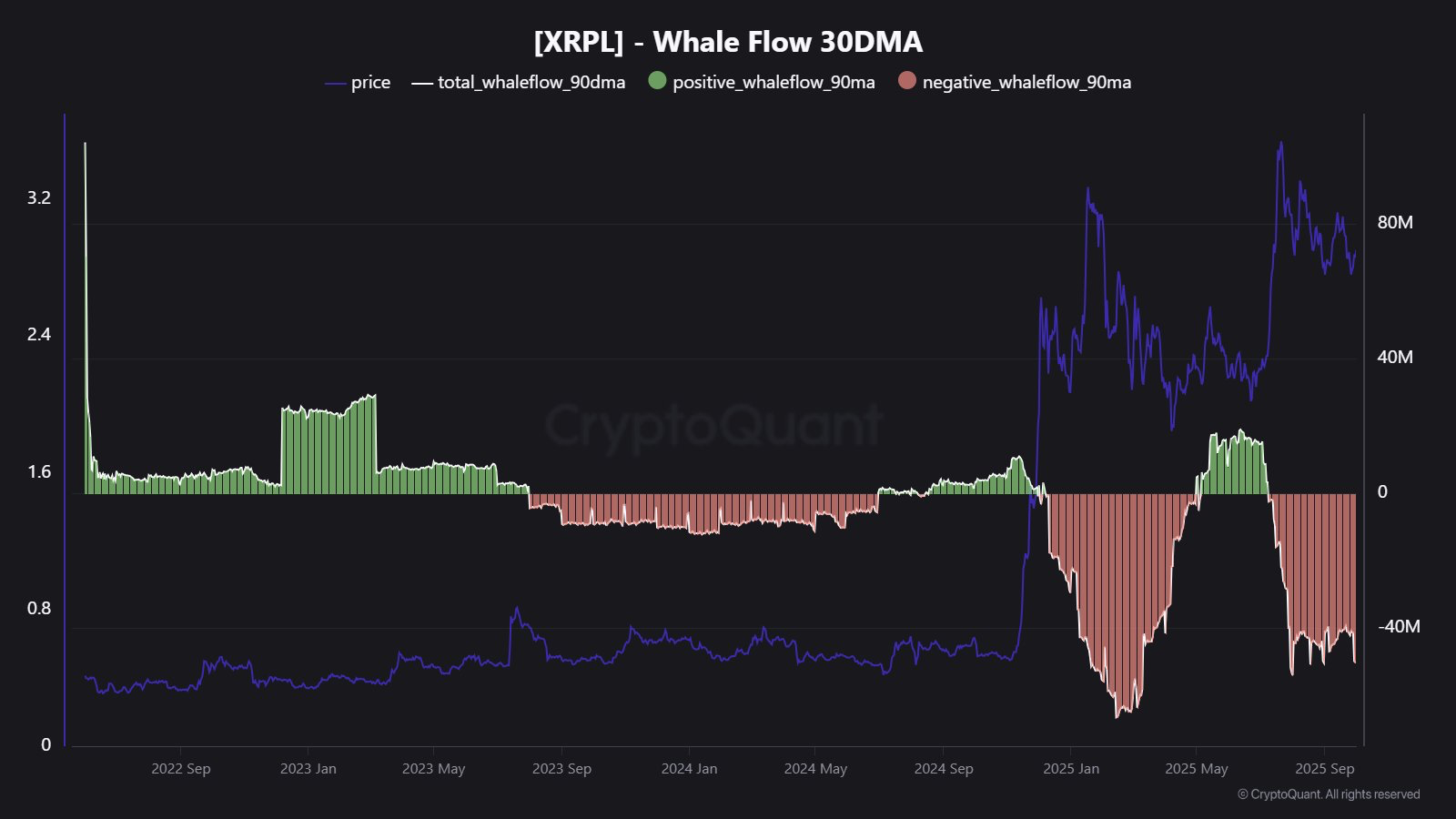

CryptoQuant reports a 30-day average whale outflow of about $50 million per day, a steady negative trend since mid-July 2025.

This sustained outflow signals deliberate distribution rather than short-term profit-taking and has kept sentiment subdued around the altcoin sector.

Historical data on CryptoQuant’s 90DMA whale flow show that extended negative readings often precede soft price action within two weeks. Order-book depth analysis from TradingView’s XRP/USDT chart confirms thin liquidity near the $3.30 resistance zone, leaving price vulnerable to volatility spikes if sell pressure persists.

Why are Whale Investors Offloading XRP?

Regulatory Uncertainty Keeps U.S. Whales Cautious

The U.S. government shutdown and stalled bipartisan crypto bill have made XRP a harder bet for institutions seeking clarity.

The stalling of bipartisan market structure in the U.S. Senate has made XRP less desirable compared to other crypto assets, especially in the BNB ecosystem. Meanwhile, Ripple has been advancing its regulatory compliance in the European market in accordance with the Markets in Crypto-Assets (MiCA) regulations.

Crypto Capital Rotation Ahead of Anticipated ETF Approval

The overall demand for XRP by whale investors has significantly declined in the past few months. The impressive performance of the BNB chain, Bitcoin (BTC), and Gold has weighed down on XRP in the recent past.

Moreover, the anticipated approval of spot XRP ETFs in the United States, potentially before the end of this year, will likely turn into a sell-the-news event. Furthermore, XRP price has been trapped in a multi-month consolidation year-to-date below a resistance level of around $3.3.

Experts’ Insights on XRP Price Midterm Targets

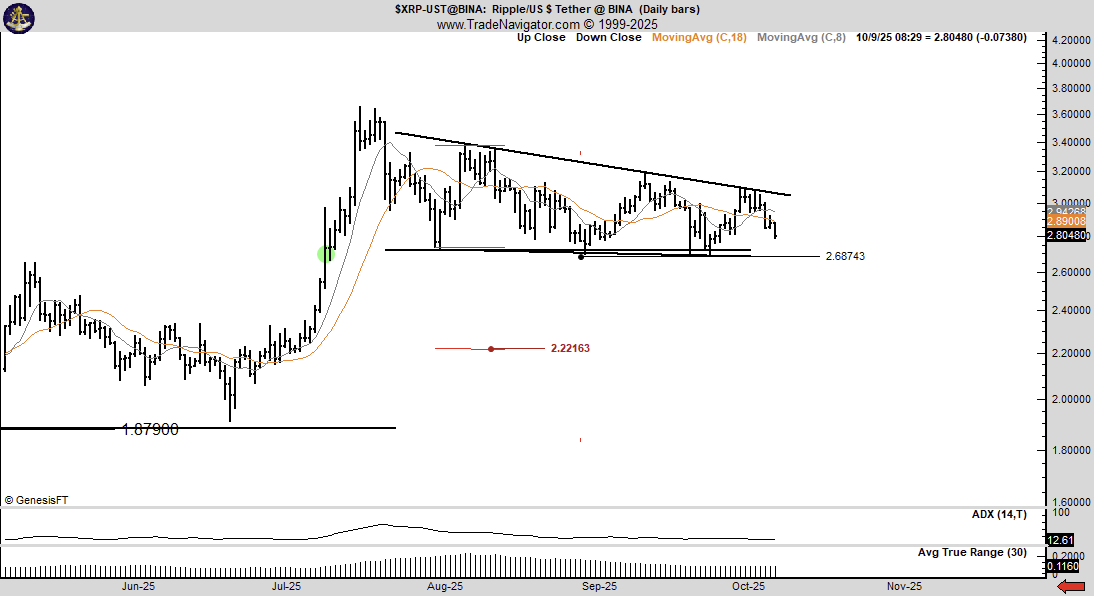

The ongoing XRP selloff by whale investors has weighed down its macro bullish outlook. According to crypto analyst Ali Martinez, the XRP price must rebound from the support level of around $2.73 to validate midterm bullish sentiment.

Peter Brandt, a professional market trader, noted that the XRP price has been approaching the apex of a descending triangle pattern in the daily timeframe. As such, Brandt highlighted that the XRP price must not fall below $2.68 since a drop to $2.22 will be inevitable.

Bigger Picture

The large-cap altcoin, with a fully diluted valuation of about $280 billion, has heavily benefited from the business development of Ripple Labs. The official closure of the Ripple vs SEC case resulted in several fund managers filing for spot XRP ETFs in the United States.

Meanwhile, several companies have been implementing XRP treasury as a hedge against inflation. Earlier this week, Reliance Group Global, a NASDAQ-listed insurance broker, reportedly added $17 million worth of XRP to its treasury management.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.