Key Takeaways

Why is Solana looking poised despite recent price underperformance?

Solana’s on-chain activity remains robust, signaling strong network demand and investor interest.

Could BNB’s rally impact SOL?

BNB’s 30-day run and overheated RSI may trigger a rotation back into SOL, reinforced by on-chain activity and Bitwise’s staking ETF update.

This week’s data shows a clear rotation out of Solana [SOL].

Notably, SOL’s market share has dropped to 2.96%, while Binance Coin [BNB] has climbed to a two-year high of 4.43%, suggesting FOMO is chasing BNB for upside potential.

But is this a sign of Solana’s weakening fundamentals driving capital elsewhere, or is it simply Binance Coin’s growth story attracting attention, making this shift more pro-BNB than anti-SOL?

Weekly on-chain trends highlight a multi-polar market

BNB’s been ripping, clocking a 50% jump over the last 30 days.

By contrast, SOL has only managed a 1.5% uptick, making BNB’s rally nearly 33× larger. The result? The SOL/BNB ratio is down to 0.20, as of writing, marking its lowest level since Q4 2023 after four consecutive weekly losses.

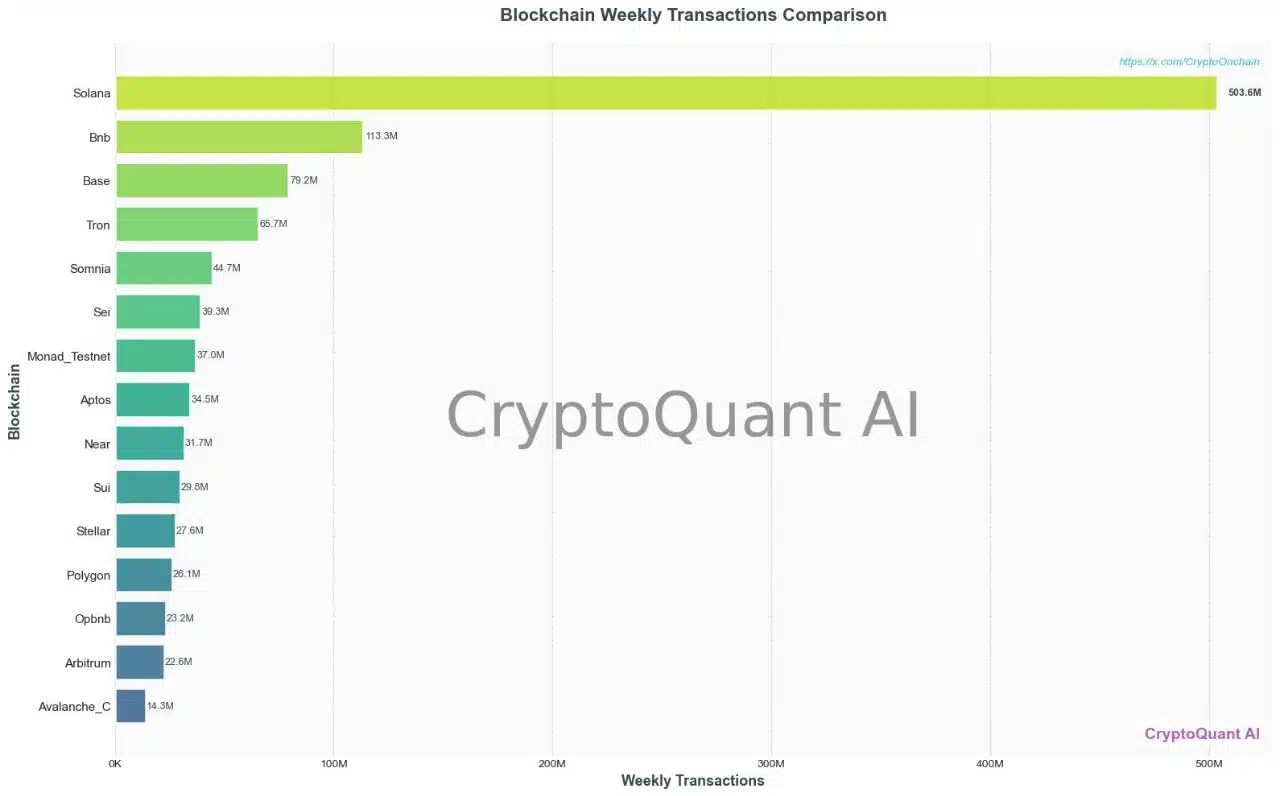

However, on-chain data tells a slightly different story. Solana recorded 503.6 million economic (non-vote) transactions this week, more than 4.4x BSC’s throughput, fueling chatter that SOL might be relatively undervalued.

Source: CryptoQuant

Backing this thesis, Solana’s weekly data looked bullish.

For starters, Solana Exchange Traded Products (ETPs) hauled in $706 million this week, marking a 127% above the prior all-time high, showing serious capital chasing SOL even if the price hasn’t caught up yet.

In short, Solana’s price underperformance reflects a pro-BNB momentum on the macro side, while on-chain and network fundamentals stay rock solid, reinforcing a healthy multi-polar market structure.

What happens to Solana if the market tilts?

As the market went risk-off, SOL slipped below $230 support.

That said, SOL is now in consolidation, moving sideways between $220–$230. And the resilience isn’t random. At press time, Daily Network Volume was at $7 billion+, roughly 24% higher than BNB, showing Solana’s bid support.

Meanwhile, BNB is heating up across timeframes. The 2.2% intraday pullback, paired with an overextended RSI, could signal a local top, setting up a rotation back into Solana, backed by the volume flow.

Source: TradingView (SOL/BNB)

In short, SOL appears undervalued, potentially setting the stage for its next leg higher.

Bitwise’s decision to rebrand its Solana staking ETF with a competitive 0.20% fee, just a week before the SEC hearing, adds fuel to the setup, signaling fresh inflows and possible buying pressure. It’s a textbook FOMO catalyst.

Supporting this outlook, on-chain metrics show continued network strength, suggesting the market isn’t ready to turn bearish on SOL. Combined with BNB’s overextension and Bitwise’s strategic timing, the conditions point to a compelling “buy the dip” opportunity.

Source: https://ambcrypto.com/solana-why-sols-price-levels-might-not-reflect-its-true-value/