Key Takeaways

How will it work?

Fiserv’s FIUSD platform will power Roughrider Coin, enabling instant, secure transactions and interoperability with other stablecoins.

Why did they name it Roughrider Coin?

U.S. state – North Dakota named it after Theodore Roosevelt’s “Rough Riders” to reflect the state’s pioneering spirit.

North Dakota is making a bold entrance into the DeFi space with the announcement of Roughrider Coin, a U.S. dollar-backed stablecoin set to launch in 2026.

The stablecoin will initially serve banks and credit unions within North Dakota, streamlining money movement across the state’s financial network.

North Dakota’s stablecoin push

North Dakota named the project after Theodore Roosevelt’s famed “Rough Riders.” The coin reflects the state’s pioneering drive toward blockchain-backed finance.

The state follows Wyoming in launching its own state-backed stablecoin and aligns this move with President Donald Trump signing the nation’s first federal stablecoin law.

North Dakota Governor Kelly Armstrong said in the statement,

“As one of the first states to issue our own stablecoin backed by real money, North Dakota is taking a cutting-edge approach to creating a secure and efficient financial ecosystem for our citizens.

He added,

“The new financial frontier is here, and The Bank of North Dakota and Fiserv are helping North Dakota financial institutions embrace new ways of moving money with the Roughrider coin.”

Fiserv acts as a catalyst

Fiserv built Roughrider Coin on its digital asset platform, which handled over 35 billion merchant transactions in 2022, and designed it to interoperate with other stablecoins.

In fact, the FIUSD platform was created to enable interoperability across digital assets.

As a result, Roughrider Coin will work seamlessly with other stablecoins in the future.

Providing further insights, Fiserve COO Takis Georgakopoulos noted,

“We’re entering a new era where payments are instant, interoperable, and borderless. North Dakota’s vision and leadership in launching this initiative show how forward-thinking policy can drive real progress in digital finance.”

Federal-level stablecoin dynamics

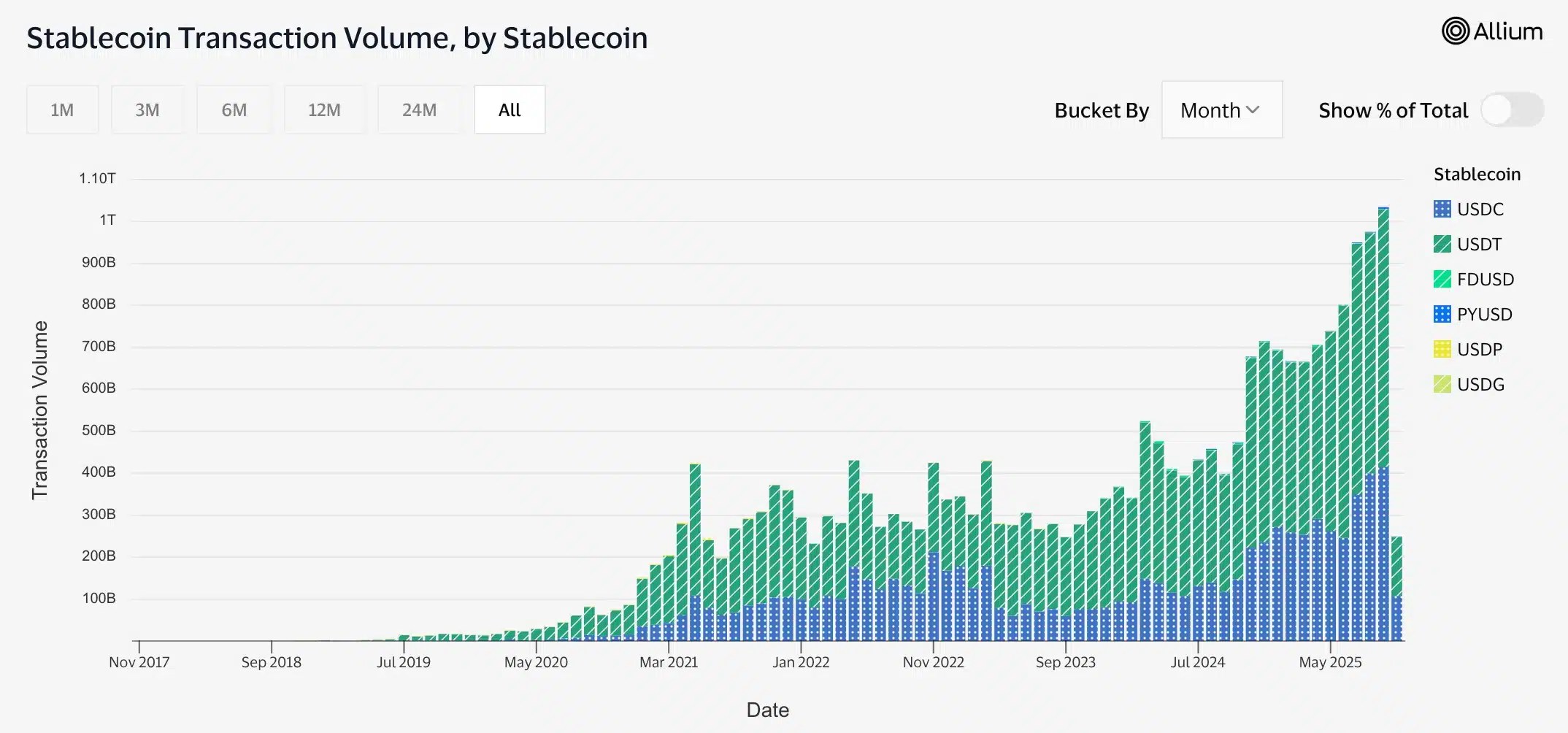

The move comes as stablecoin adoption hits record highs.

Visa’s on-chain analytics showed that total Stablecoin Transaction Volume surpassed $5.8 trillion, with assets like Tether [USDT] and Circle’s USDC dominating on-chain activity.

Source: Visa on-chain analytics

Initiatives such as the GENIUS Act are further driving this momentum, as consumers increasingly choose transparent, high-yield alternatives to conventional banking.

Henceforth, banks will now face mounting pressure to share fairer returns with depositors, intensifying competition between centralized institutions and decentralized finance.

Source: https://ambcrypto.com/north-dakota-unveils-first-state-owned-u-s-stablecoin-details/