- DOGE consolidates near $0.25, balancing buyers and sellers across key EMAs.

- Rising futures open interest and inflows suggest renewed accumulation trends.

- Corporate treasury demand strengthens Dogecoin’s long-term institutional confidence.

Dogecoin (DOGE) is showing signs of renewed activity across both spot and derivatives markets as traders weigh short-term direction. The meme-inspired cryptocurrency, currently trading near $0.25, is consolidating within a narrow range after a strong early-month rally.

Technical indicators suggest price stability above key moving averages, while recent inflows and treasury activity point to strengthening accumulation trends among both retail and institutional players.

Consolidation Defines the Current Setup

On the 4-hour chart, Dogecoin is holding between $0.245 and $0.254. This zone coincides with the 20, 50, and 100-period exponential moving averages (EMAs), indicating balance between buyers and sellers.

The $0.263 level, marked by the 0.5 Fibonacci retracement, serves as the first resistance to watch. A confirmed breakout above this region could lift DOGE toward $0.274 and potentially $0.288 in the short term. However, failure to stay above $0.245 could trigger a corrective slide toward $0.22.

Related: XRP Price Prediction: Institutional Endorsements And S&P’s Crypto Index Boost Confidence

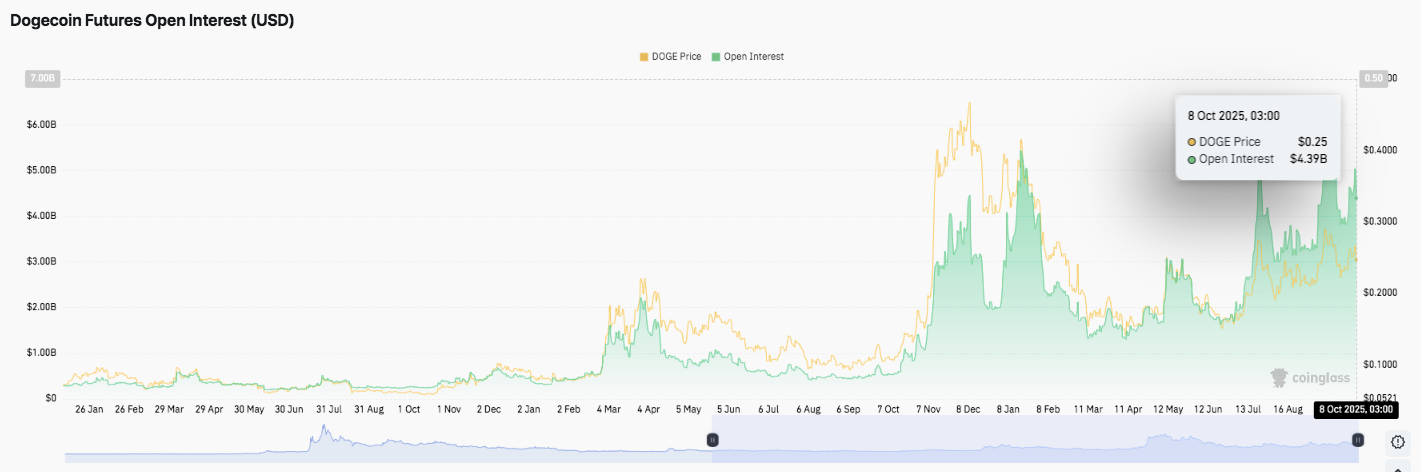

Open Interest Signals Renewed Leverage Exposure

Dogecoin futures open interest has risen sharply to $4.39 billion as of October 8, signaling a build-up of leveraged positions. The increase follows months of muted trading activity earlier in 2025.

Significantly, open interest has expanded alongside steady price gains, suggesting accumulation rather than speculative liquidation. Historically, such patterns often precede major price swings, as traders position ahead of potential volatility.

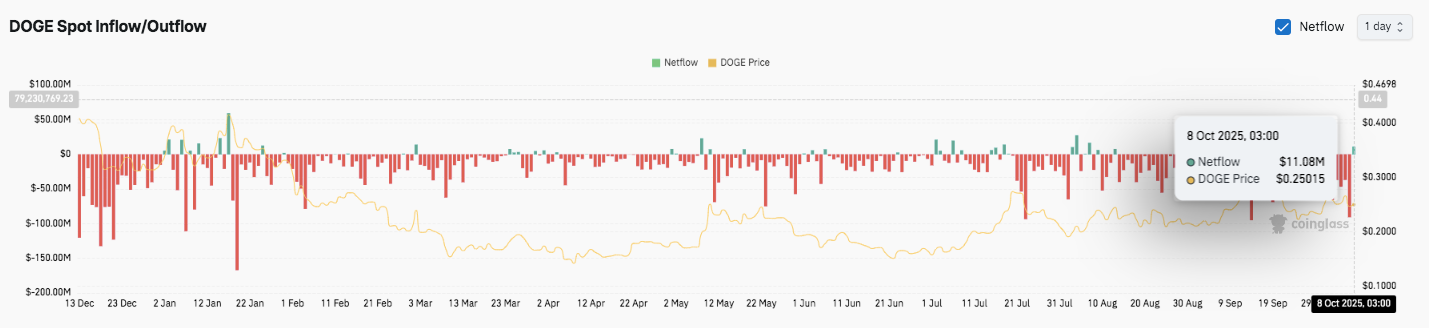

Inflows Point to Accumulation

Besides derivatives activity, on-chain data shows that Dogecoin recorded a net inflow of $11.08 million on October 8. The return of positive inflows marks a notable shift after months of steady outflows.

Sustained inflows above $10 million typically indicate renewed market confidence and accumulation by larger holders. Conversely, a reversal into deep outflows could imply profit-taking or weakening demand.

Corporate Demand Reinforces Long-Term Confidence

Corporate interest continues to provide fundamental support. NYSE-listed CleanCore Solutions recently disclosed that it now holds over 710 million DOGE, worth about $188 million.

The firm aims to expand its treasury to one billion tokens through a structured acquisition strategy supported by Bitstamp and Robinhood. This accumulation underscores growing institutional confidence in Dogecoin’s long-term role as a treasury-grade digital asset.

Related: Cardano Price Prediction: ADA Consolidates as Open Interest Hits $1.57 Billion

Technical Outlook for Dogecoin Price

Dogecoin’s price structure remains tightly coiled heading into mid-October, with key support and resistance levels clearly defined. The token is trading near $0.25, consolidating after its recent rally earlier this month.

- Upside levels: Immediate resistance sits at $0.263, which aligns with the 0.5 Fibonacci retracement. A decisive breakout above this level could trigger a move toward $0.274 and $0.288, where the next Fibonacci extensions lie. A stronger continuation could even retest the $0.30 psychological threshold if bullish volume persists.

- Downside levels: Support rests near $0.246 at the 200 EMA, followed by $0.240 and the $0.220–$0.225 demand zone. A breakdown below $0.238 could expose DOGE to a deeper retracement toward $0.21.

- Resistance ceiling: The $0.263–$0.274 cluster remains the critical resistance zone to flip for medium-term momentum. Sustained closes above this area could validate a bullish continuation toward $0.28 or higher.

The technical setup indicates that Dogecoin is forming a compression range within overlapping EMAs, signaling potential volatility expansion in the coming sessions. Historical data shows that similar consolidations near the 200 EMA often precede strong directional moves.

Will Dogecoin Break Higher?

Dogecoin’s next move depends on whether buyers can maintain control above $0.246 and push past the $0.263–$0.274 resistance band. Rising open interest, improved on-chain inflows, and growing treasury accumulation all hint at renewed investor confidence.

If momentum strengthens, DOGE could test the $0.28 zone and potentially extend to $0.30. However, failure to hold current support could trigger a short-term correction toward $0.22.

Related: Ethereum Price Prediction: Jack Ma’s ETH Reserve Report Boosts Market Sentiment

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/dogecoin-price-prediction-doge-holds-0-25-as-cleancore-buys-710m-coins/