Key Takeaways

Why is Solana seeing record stablecoin inflows?

Legal clarity from the GENIUS Act spurred a $3 billion rise, boosting supply to $15 billion.

Will this impact SOL’s price trend?

If SOL breaks its $222 EMA resistance, the token could reclaim $235 in near-term trading.

With crypto usage reaching record levels, stablecoins have seen strong inflows.

Their combined market cap climbed 1.44% to $303.18 billion over the past week and 6.05% over the last 30 days, rising from $285.7 billion, according to DefiLlama.

Source: DefiLlama

Amid this stablecoin market growth, supply on the Solana chain has outpaced all other blockchains.

Solana outpaces peers in stablecoin growth

While Solana [SOL] remained the third-largest chain by stablecoin supply, it has recorded the fastest growth over the last months.

This surge in stablecoin supply is primarily driven by the GENIUS Act, which was passed three months ago, as per Danny Nelson.

With the Genesis Act offering legal clarity over stablecoin issuance and distributions, their usage has surged, with the Solana blockchain leading the way.

When the Act was signed on the 18th of July, Solana’s stablecoin supply stood at $10 billion, a 50% rise in just three months since then.

Source: Artemis

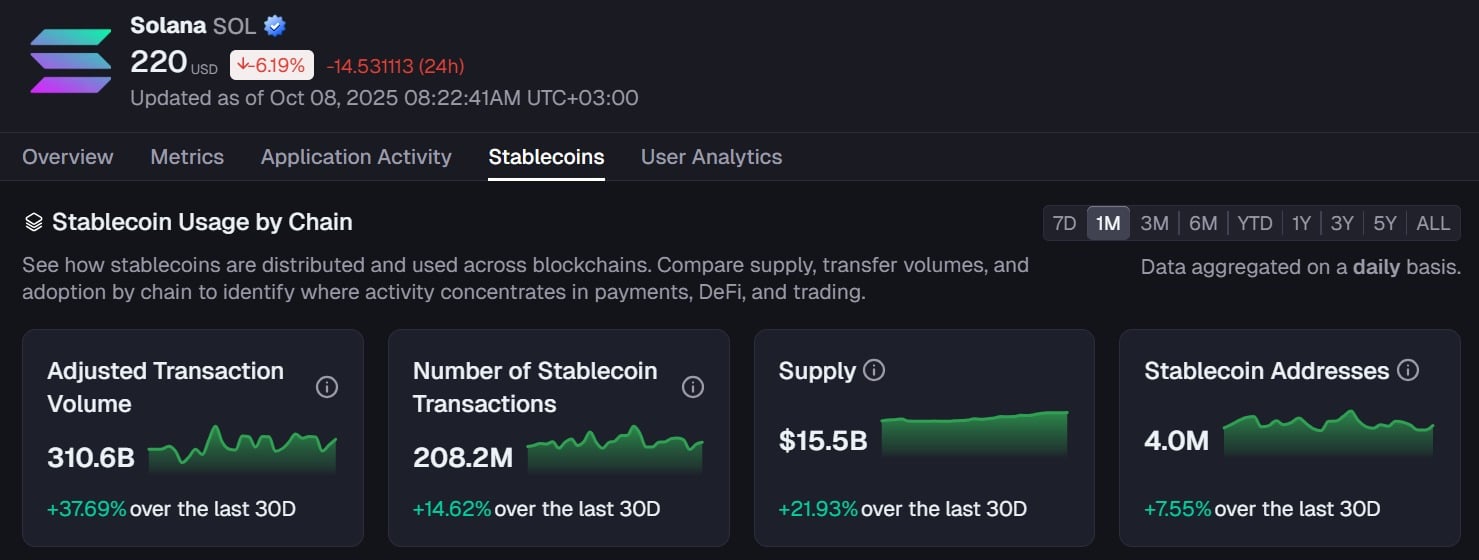

Solana’s stablecoin adoption strengthened further as stablecoin addresses increased 7.55% to 4 million, while transaction count rose 14.6% to 208 million in thirty days.

Its Adjusted Transaction Volume also spiked 37.69% to $310.6 billion, signaling a rising network utility.

Competitors still hold an upper hand

While Solana’s Stablecoin Supply experienced explosive growth, Ethereum [ETH] remained way ahead.

Ethereum maintains its lead, holding 53.67% of the global stablecoin supply ($172 billion), while TRON [TRX] follows with 25.79% or $77 billion.

Source: Defillama

Solana ranks third at 4.99%, but its growth rate now outpaces both.

SOL price reacts to rising network activity

AMBCrypto observed that the surge in stablecoin supply coincided with significant gains on SOL.

The token climbed from $173 to $253 before cooling near $219 at press time, according to TradingView.

Source: TradingView

SOL traded above its long-term moving averages, maintaining a bullish setup. However, short-term resistance looms at the 20-day EMA of $222.

A breakout above could see SOL retest $235, while sustained losses may pull it back toward the 50-day EMA of $213.

Source: https://ambcrypto.com/solanas-stablecoin-supply-soars-50-in-3-months-heres-how/