- Stellar’s price stability near $0.40 shows balanced market momentum and hesitation.

- Rising open interest above $300M signals growing trader participation and confidence.

- Sustained inflows near $0.40 could spark Stellar’s rebound toward the $0.42 resistance.

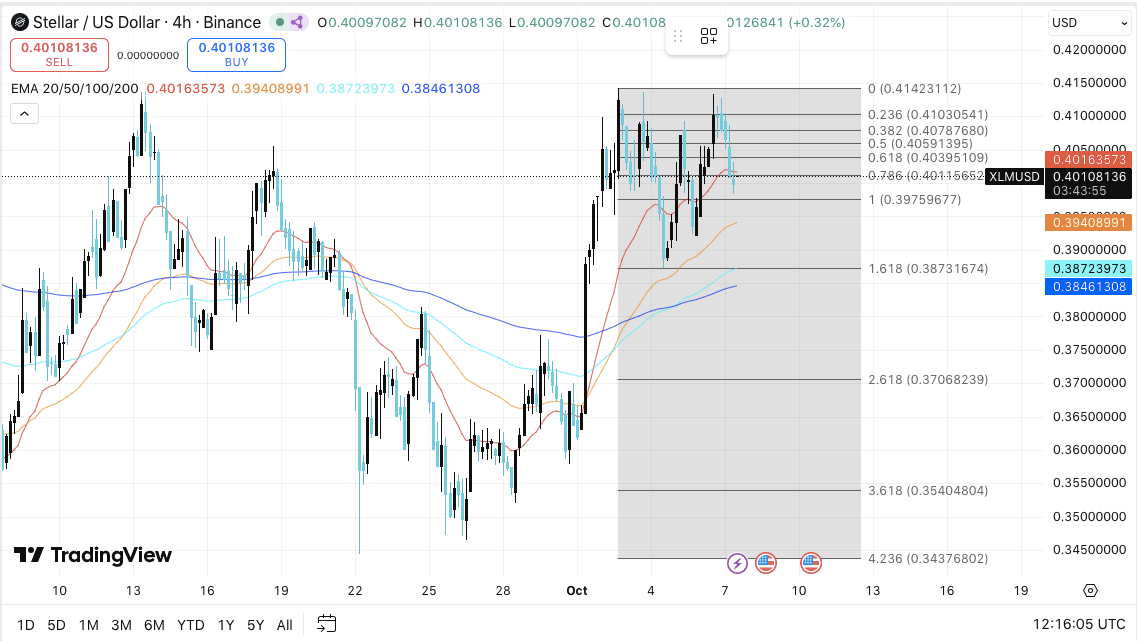

Stellar (XLM) is currently consolidating near the $0.40 region, with traders closely watching for signs of a breakout or breakdown. The cryptocurrency has been oscillating within a narrow range, showing both resilience and hesitation after its late-September rebound.

The 4-hour chart reflects tight trading activity between $0.397 and $0.414, suggesting that buyers and sellers are evenly matched. The market’s direction now depends on whether bulls can defend the psychological $0.40 mark long enough to trigger renewed upward momentum.

Technical Setup Points to Balanced Momentum

XLM/USD pair remains in a short-term consolidation phase, with clear Fibonacci levels shaping key reaction zones. Price has repeatedly failed to break above $0.414, forming a temporary ceiling, while $0.397 continues to serve as immediate support.

The 50-EMA at $0.394 and the 100-EMA near $0.387 show that short-term trend strength remains intact. However, any close below these averages could tilt the balance toward the bears.

Immediate resistance is located at $0.405 and $0.410, which correspond to the 0.5–0.382 Fibonacci retracement zone. A successful breakout above these levels could open a path toward $0.420, while failure to sustain above $0.397 might expose the $0.387 and $0.370 levels.

Related: Cronos (CRO) Price Prediction: Traders Eye Breakout as Open Interest Surges

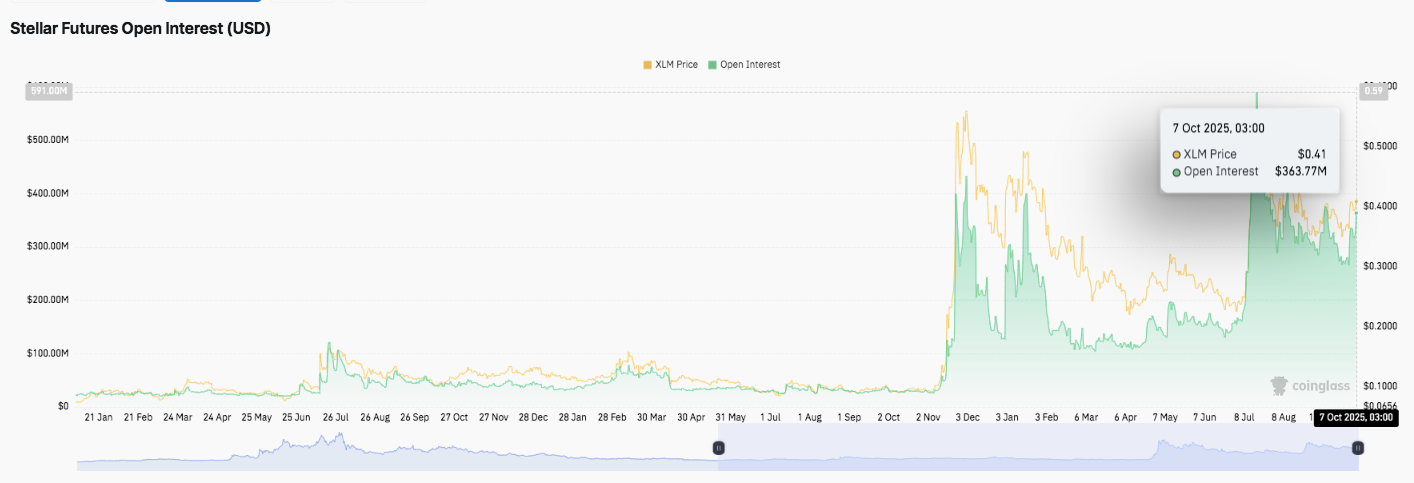

Rising Open Interest Reflects Market Engagement

Besides price consolidation, the futures market shows strong activity. Open interest for Stellar has risen sharply in 2025, climbing from under $100 million at the start of the year to above $360 million by early October. This surge indicates growing participation from both retail and institutional traders.

The alignment between price gains and open interest growth suggests that speculative positioning favors a potential continuation of the bullish trend. Sustained open interest above $300 million could strengthen market confidence, while sharp declines may point to profit-taking or reduced leverage exposure.

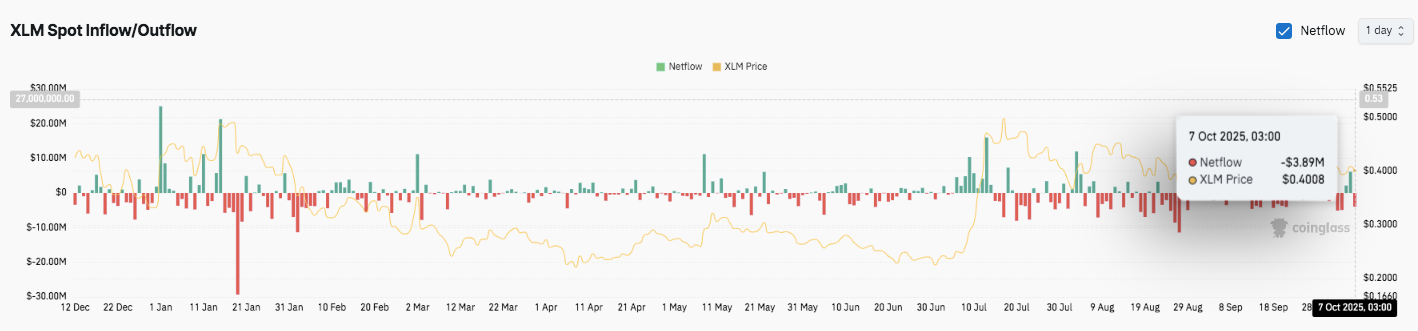

Inflows and Outflows Reveal Mixed Sentiment

Additionally, spot netflow data reveals alternating inflows and outflows throughout the year, mirroring shifts in sentiment. On October 7, Stellar recorded a net outflow of $3.89 million, implying short-term selling pressure as traders locked in profits around $0.4008.

Historically, similar outflows have preceded minor pullbacks, while strong inflows often triggered recovery phases. Consequently, market participants are watching for renewed inflows as a signal of fresh accumulation. If sustained buying returns near $0.40, Stellar could resume its upward trajectory toward $0.42 in the coming sessions.

Related: Ethereum Price Prediction: Samsung Staking And BitMine Treasury Fuel Demand

Technical Outlook for Stellar (XLM) Price

Key levels for Stellar (XLM) remain well-defined as consolidation continues around the $0.40 region heading into mid-October.

- Upside levels: $0.405 and $0.410 are immediate hurdles, aligning with the Fibonacci 0.5–0.382 zone. A breakout above $0.410 could extend the move toward $0.414 and $0.420, where recent highs and prior supply converge.

- Downside levels: Immediate support sits at $0.397, followed by $0.387 and $0.384, which coincide with the 100-EMA and 200-EMA confluence zone. A decisive close below $0.397 could open the path to $0.370, marking the lower boundary of the current consolidation structure.

- Resistance ceiling: The $0.414 zone remains a key level to flip for medium-term bullish continuation, representing the latest rejection point on the 4-hour chart.

The broader technical setup suggests that XLM is compressing inside a symmetrical range, where volatility contraction often precedes expansion. The market’s next move depends on how price reacts around the $0.40 psychological level.

Will Stellar Price Rebound?

Stellar’s price outlook for October depends on whether bulls can defend the $0.397–$0.400 support range. Sustained strength above this level may trigger momentum toward $0.420, supported by rising open interest and improving market participation.

Related: SUI Price Prediction: Mainnet Upgrade Boosts Momentum

Conversely, failure to hold above $0.397 could attract selling pressure, exposing the lower supports near $0.387 and $0.370. Historical seasonality and recent outflow patterns hint at short-term caution, but a rebound remains plausible if inflows strengthen.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.