- Sui’s 1.57.2 upgrade boosts network speed, developer tools, and ecosystem stability.

- SUI price consolidates near $3.57, holding above key EMAs amid cautious optimism.

- Immediate resistance at $3.63, with potential short-term targets of $3.84–$3.90.

Sui’s latest mainnet upgrade to version 1.57.2 and protocol version 96 has renewed market interest in the project. The update enhances network efficiency and fixes key bugs affecting developer tools, signaling continued progress for the blockchain’s ecosystem.

Meanwhile, the SUI price is showing consolidation signs near $3.57 after a notable rebound from September lows. Despite this brief pause, technical indicators suggest that bullish sentiment remains intact if the asset maintains support levels above its key moving averages.

Network Enhancements Strengthen Ecosystem Stability

The recent upgrade introduces several improvements that could strengthen Sui’s long-term scalability. Mysticeti v2, also known as Mysticeti fastpath, is now live on the mainnet, enabling faster transaction processing. Additionally, validator and full nodes now feature CheckpointArtifacts digest in summaries, boosting synchronization accuracy.

Developers also benefit from new API integrations, including CoinRegistry support through gRPC, JSON-RPC, and GraphQL interfaces. This unified structure simplifies access to token metadata and total supply data. Moreover, bug fixes within the command-line interface eliminate early termination issues caused by protocol mismatches between CLI binaries and network versions.

Related: XRP Price Prediction: Trump’s Crypto Endorsement Sparks Ripple Momentum

These changes reflect the Sui team’s ongoing effort to enhance developer experience and transaction efficiency, both essential for network growth. Consequently, these updates may improve investor sentiment by ensuring a more stable environment for decentralized applications.

SUI Price Holds Above Key Support Levels

On the technical front, SUI continues to trade within a narrow range after reclaiming critical exponential moving averages. The 4-hour chart shows the price hovering between $3.52 and $3.59, levels corresponding to the 50-day and 20-day EMAs. This range serves as short-term support as traders await confirmation of the next directional move.

Immediate resistance sits near $3.63, aligning with a Fibonacci extension that has capped recent upward attempts. If buying pressure returns, subsequent targets lie between $3.84 and $3.90, marking potential profit-taking zones. However, a decisive drop below $3.48 could invalidate the bullish setup and open the path toward deeper supports around $3.20.

Related: Bitcoin Price Prediction: Strategy’s $3.9B Gain Boosts Sentiment

Momentum indicators remain steady, suggesting mild cooling after the strong recovery from $3.07. Holding above the $3.48–$3.52 region keeps bulls in control, with a potential breakout above $3.63 likely to trigger a renewed advance toward higher resistance bands.

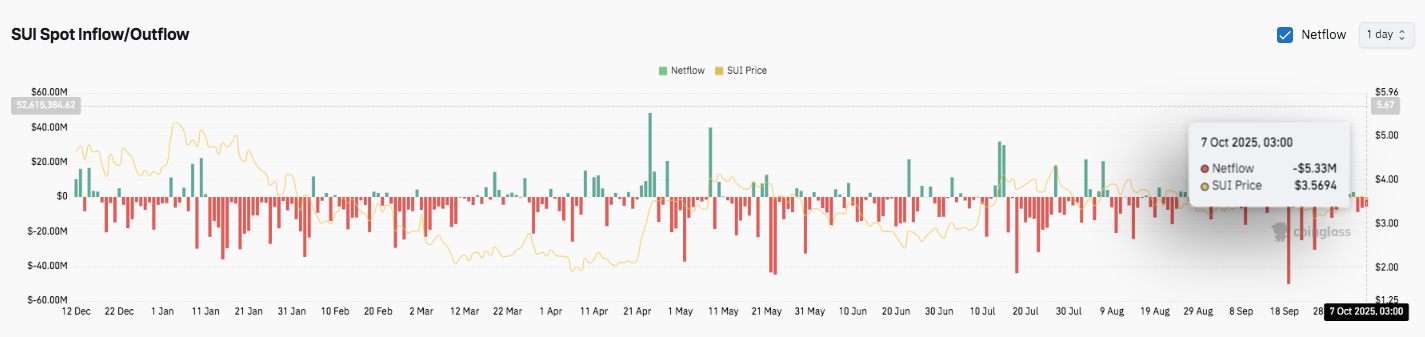

Exchange Outflows Reflect Cautious Optimism

Data from the SUI spot inflow/outflow chart reveals consistent outflows since mid-September, reflecting a cautious yet optimistic market stance. On October 7, a net outflow of $5.33 million was recorded as the token traded near $3.57. This pattern indicates that investors are moving assets off exchanges, possibly preparing for long-term staking or anticipating price recovery.

While sustained outflows often suggest reduced selling pressure, the lack of strong inflows shows that traders remain conservative. Hence, the market’s cautious tone aligns with the current consolidation phase, where price stability near the $3.5 zone precedes potential volatility.

Technical Outlook for SUI Price

Key levels remain tightly defined as SUI consolidates above its short-term supports.

- Upside levels: $3.63 (immediate hurdle), followed by $3.84 and $3.90. A breakout above these could target $4.10 and $4.36.

- Downside levels: $3.52 (50 EMA) remains critical, with deeper supports at $3.41 and $3.20 if momentum weakens.

- Resistance ceiling: $3.92–$3.97 marks the zone to reclaim for medium-term bullish continuation.

The technical setup shows SUI compressing within a narrow consolidation band, where declining volatility often precedes a strong directional breakout. The 4-hour structure remains constructive as long as price holds above $3.48, with EMAs forming a potential bullish cross.

Related: Pi Price Prediction: Bearish Channel Persists as Pi Struggles Near $0.26

Will SUI Continue Its Recovery?

The SUI price outlook for October depends on whether buyers can maintain support near the $3.48–$3.52 range and break decisively above $3.63. Sustained strength could open the path toward $3.84 and $3.90 in the short term. However, a failure to defend $3.48 might trigger a correction toward $3.20.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/sui-price-prediction-mainnet-upgrade-boosts-momentum/