Strategy, the largest corporate holder of Bitcoin globally, announced $3.9B in fair value gains from its Bitcoin holdings during Q3.

Widely known as the largest corporate holder of Bitcoin, Strategy holds roughly 640K $BTC, as per its Q4 records. The average purchase cost per coin is about $73,983. At today’s price of $124,500, the total value of those holdings amounts to roughly $80B with unrealized gains of about $31-$32B.

While the reported $3.9B in fair value gains for the last quarter is a paper gain, it still highlights the significant increase in their $BTC holdings in Q3. The company also notes that for every $10K change in $BTC price, it generates about $6B in unrealized gains, reflecting how the company’s value is strongly tied to the $BTC price.

The firm also recently overtook crypto heavyweight Coinbase, securing its spot as the 106th largest publicly traded company in the US.

Michael Saylor confirmed the pause on X, stating, ”There will be no new orange dots this week, just a $9 billion reminder of why we HODL’.

As the Bitcoin giant sets the tone, investors are exploring emerging opportunities like Bitcoin Hyper ($HYPER), a hot presale riding the momentum of Bitcoin’s rally.

Strategy’s Market Momentum and Bitcoin’s Expanding Institutional Wave

Despite hitting pause on its Bitcoin purchases this week, Strategy’s stocks have climbed by 2.29% in the past 24 hours to around $359, bringing the company’s year-to-date gains to about 20%. The climb in the company’s stock suggests that investor confidence remains high even during these brief accumulation pauses.

With roughly 640K $BTC on its balance sheet, Strategy’s valuation moves almost in sync with Bitcoin, gaining nearly $6B in unrealized profit for every $10K rise in BTC’s price. This illustrates the significant connection between Strategy’s business and $BTC’s performance.

But what exactly is Strategy aiming to build with such a massive $BTC reserve?

Michael Saylor’s long-term vision positions Strategy as a trillion-dollar Bitcoin balance-sheet company, leveraging Bitcoin to transform global credit markets. Saylor’s thesis centers on using Bitcoin as productive collateral to issue Bitcoin-backed credit with higher yields than fiat debt, thereby creating a compounding system of expanding collateral and credit growth.

The goal is to position Strategy as the leading Bitcoin treasury firm, serving as a fundamental pillar of a new financial architecture that powers high-yield savings, Bitcoin-based money markets, and institutional-grade insurance systems.

Furthermore, analysts are projecting even higher Bitcoin targets, expecting the flagship coin to push toward $150K in its next leg, a rally driven by institutional inflows and continued macroeconomic tailwinds.

All of this is creating a fertile terrain for Bitcoin-based projects, such as Bitcoin Hyper ($HYPER).

Bitcoin Hyper: A Layer-2 solution Delivering Fast, Cheap, Scalable Bitcoin

While Bitcoin ranks #1 as the most trusted cryptocurrency, with a market share of over 58%, its blockchain suffers from issues such as poor speed, high transaction fees, limited scalability, and energy-intensive operations.

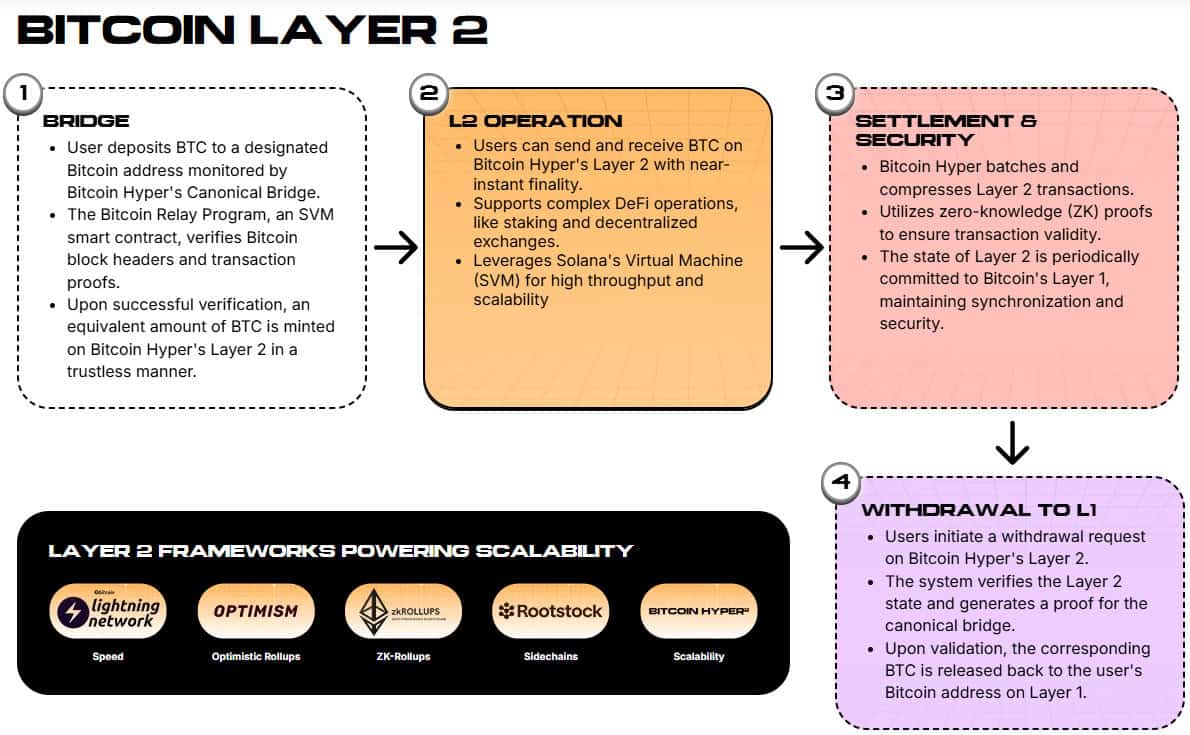

By bridging $BTC into the Bitcoin Hyper Layer-2, you can send, stake, trade, and utilize DeFi tools instantly with sub-cent transaction fees. Each transaction is verified with zero-knowledge (ZK) proofs and settled back on Bitcoin’s main chain, ensuring trustless security and full transparency.

At the center of this ecosystem is the $HYPER token, fueling everything from transactions and staking to governance and token launches.

$HYPER is a meme coin with a ton of utility, from providing access to airdrops to staking rewards, DAO voting rights, and launchpad privileges.

Having raised $22.1M so far, $HYPER is already making waves. Whales are already piling in, with a $HYPER purchase worth $267,799 just yesterday, reflecting strong conviction in the project.

With staking yields set to drop as more users join the pool and the next price jump tomorrow, early backers stand to lock in the highest rewards.

Secure $HYPER at its current bargain presale price today.

Disclaimer: This content has been supplied by a third party contributor. Brave New Coin does not endorse or promote any products or services mentioned herein. Readers are encouraged to conduct independent research before making any financial decisions. The information provided is for informational and educational purposes only and should not be interpreted as investment advice.

Source: https://bravenewcoin.com/partner/strategy-bitcoin-gains-q3-bullish-outlook-hyper-presale