- CeFi now leads the market in crypto financing with $23.58 billion.

- New financial tools like ETFs and DAT are growing in influence.

- Regulatory frameworks are expected to adapt to evolving market dynamics.

RootData’s Chief Product Manager Ye Wang unveiled the “2025 Cryptocurrency Development Research Report” at the Silicon Valley 101 x RootData summit, highlighting transformative shifts in crypto financing dynamics.

The report indicates significant financial restructuring with CeFi at the forefront, and new instruments like ETFs reshaping market strategies, influencing investor actions and startup growth trajectories.

CeFi’s $23.58 Billion Leads Crypto Financing Shift

Ye Wang, Chief Product Manager, speaking at the Silicon Valley 101 x RootData summit, introduced major changes in cryptocurrency financing structures. With emerging technologies and methods, CeFi now leads the market. The report outlined shifts in financing priorities, emphasizing how CeFi’s $23.58 billion outpaces other sectors.

Financing structures are transforming, with IPOs, bonds, and M&A tactics from traditional finance entering the space. These strategies push boundaries by driving substantial institutional involvement. New tools like ETFs and DAT continue to attract significant investment interest, reinforcing their impact.

“The crypto market’s financing structure is undergoing major change, with CeFi leading in total financing, while new financial tools are disrupting traditional rounds.” — Ye Wang, Chief Product Manager, RootData

Community responses highlight anticipation, with industry stakeholders focusing on the shift to institutional engagement. While major KOL statements are sparse, analysts await official commentary from global influencers, potentially affecting regulations and market dynamics.

Crypto Market Dynamics and Regulatory Expectations for 2025

Did you know? With the new financing tools like ETFs and DAT, the 2025 expected market shift echoes the post-2020 institutional surge, potentially becoming one of the largest impacts since.

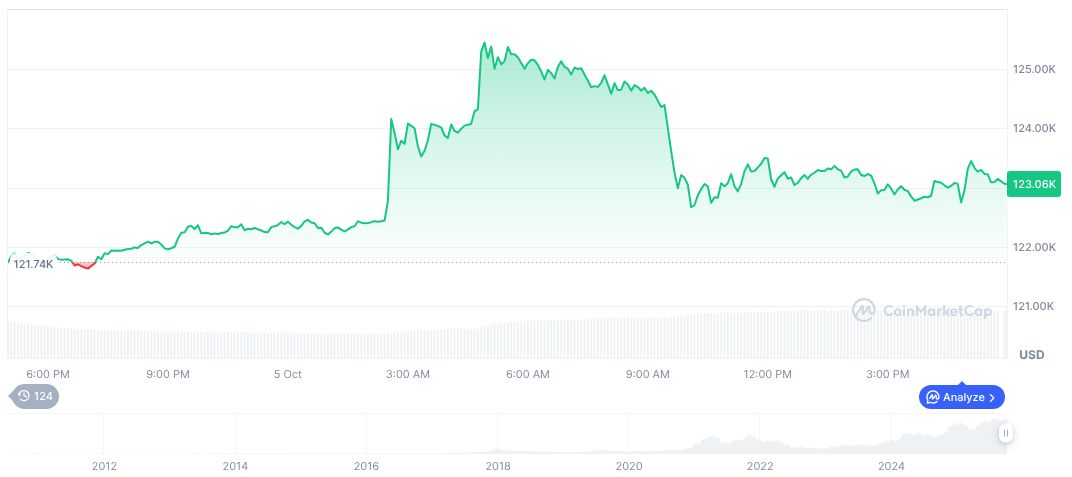

According to CoinMarketCap, Bitcoin’s current price is $123,958.97, exhibiting notable growth with a 24-hour change of 0.27% and a seven-day gain of 10.92%. Its market cap stands at 2.47 trillion, showing robust activity with a 76.47% increase in trading volume. Bitcoin maintains significant market presence with a dominance of 58.51% as of October 6, 2025.

Insights from Coincu research suggest that as institutional financing tools reshape markets, regulatory frameworks may adapt to these changes. The integration of AI in crypto financing could revolutionize investment mechanisms, expanding opportunities for innovation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/rootdatas-report-crypto-financing-trends/