- Report forecasts rise in asset demand due to global aging.

- Bitcoin and similar assets seen as prime beneficiaries.

- Institutional involvement likely bolstered by regulatory transparency.

According to a report by the Federal Reserve Bank of Kansas City, the aging global population will drive asset demand, including Bitcoin, through 2100, increasing it by 200% of GDP.

This forecast elevates Bitcoin’s status as a global asset, potentially mirroring gold’s safe-haven role and influencing future institutional financial strategies and regulatory frameworks.

Bitcoin Set to Rise 200% in GDP Until 2100

According to the Federal Reserve Bank of Kansas City, the global demand for assets will significantly rise due to aging populations and accompanying wealth growth. This surge is set to impact various asset classes, including Bitcoin, projected to rise by an additional 200% of GDP until 2100.

Bitcoin’s appeal as a store of value akin to gold may increase, particularly as regulations clarify and institutional products emerge. Bitget CEO Gracy Chen and Bitfinex analysts have commented on rising demand, emphasizing Bitcoin’s potential role in diversified portfolios.

“The maturity of crypto regulations being worked on at the moment can play a good role in fueling future demands for the asset class.” – Gracy Chen, CEO, Bitget

Responses to the report reflect increased investor interest, with analysts highlighting the importance of cryptocurrencies in asset diversification. Gracy Chen noted future government backing could bolster crypto’s appeal to older demographics who previously favored traditional investments.

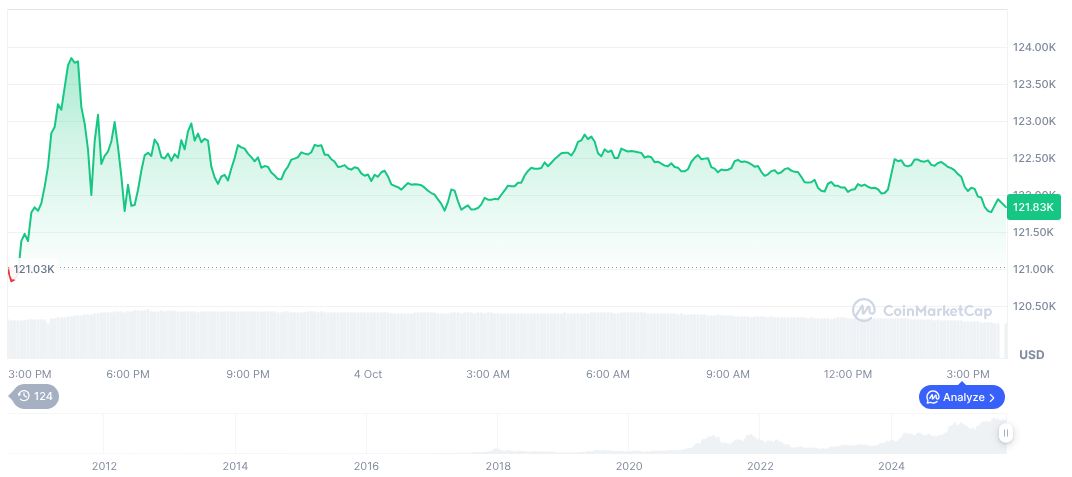

Bitcoin Trading at $123K with Rising Investor Interest

Did you know? In historical parallels, gold received increased demand during wealth upswings, mirroring the potential future trajectory anticipated for Bitcoin as outlined in the Fed’s report.

As per CoinMarketCap, Bitcoin (BTC) currently trades at $123,236.38, holding a market cap of $2.46 trillion and a dominance of 58.31%. The past 24 hours witnessed a price increase of 0.98%, while its 7-day change surged to 12.71%. Despite a 7.18% decrease in trading volume, Bitcoin shows increased investor interest.

The Coincu research team suggests that continued wealth growth and regulatory clarity may support further institutional investment in Bitcoin. Historical data reflects a pattern where clearer regulations have historically bolstered crypto adoption. Enhanced access to crypto ETFs may also transform the investment landscape over the coming years.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/global-asset-demand-boost/