- Venezuela increasingly uses USDT as currency amid hyperinflation, impacting local businesses.

- Hyperinflation leads Venezuela to adopt USDT, reshaping commerce.

- TRC-20 network USDT adoption highlights currency impact.

In Venezuela, hyperinflation has driven USDT on the TRC-20 network to become the dominant currency for daily business via Binance P2P, replacing the devalued bolívar.

This crypto-dollarization highlights stablecoins’ role in countries facing inflation and restrictive fiscal environments, reshaping Venezuela’s economic landscape and affecting regional crypto adoption trends.

Venezuelan Commerce Shifts to Tether Amid Hyperinflation

Venezuelan businesses and consumers now primarily utilize USDT for transactions, opting for this stablecoin due to low fees and convenience. This shift reflects a broader financial strategy to cope with severe inflation and a reliance on digital currency as the bolívar’s value continues to depreciate.

Economic activities in Venezuela have experienced a profound change with stablecoins accounting for 47% of transactions under $10,000 in 2025. The reliance on USDT aims at stability amid severe fluctuations in the local currency. This reliance on USDT creates a unique form of digital dollarization without direct government intervention.

“Disbursements in tether to private buyers have surpassed cash USD transfers, marking an operational shift in the current exchange regime.” – Asdrúbal Oliveros, Managing Partner, Ecoanalítica

Record USDT Adoption Sets Digital Dollarization Precedent

Did you know? Venezuela’s USDT usage marks the highest economic activity transacted using stablecoins globally amid hyperinflation, setting a precedent for digital dollarization.

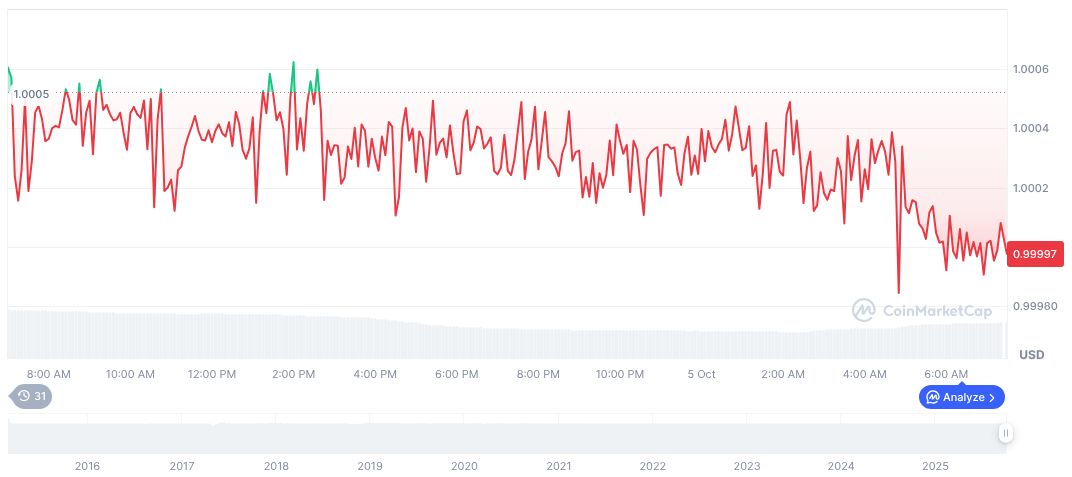

On October 5, 2025, Tether USDt (USDT) reported a consistent value of $1.00 with a market cap of $177.06 billion and a 24-hour trading volume of $146.92 billion. The USDT’s presence remains stable despite a slight decline of 0.00% in price over 24 hours, according to CoinMarketCap.

Financial experts from Coincu Research recognize the potential for sustained USDT usage in regions facing economic crises, encouraging a digital pivot in monetary practices. This trend may prompt reevaluations of regulatory frameworks as countries adjust to decentralized finance demands. Cryptocurrency market shifts like these signify potential global impacts on digital finance structures.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/venezuela-usdt-hyperinflation-trend/