- Asia-Pacific region sees rapid increase in stablecoin activity.

- USDC trading volume reaches $2.4 trillion.

- Singapore and Hong Kong lead this transformative growth.

Circle reports Asia-Pacific’s stablecoin trading volume reached $2.40 trillion in the last year, with Singapore and Hong Kong leading, reflecting significant growth in actual applications.

This surge highlights stablecoins’ growing role in global finance, driven by regulatory support and infrastructure, affecting cross-border transactions and finance.

USDC Trading Hits $2.4 Trillion in Asia-Pacific

USDC issuer Circle reports substantial growth with the Asia-Pacific region emerging as a stablecoin focal point. Led by Singapore and Hong Kong, this geographical rise is accompanied by strategic fintech advancements. The report cites cross-border remittances and supply chain finance as primary application drivers.

Singapore and Hong Kong’s regulatory infrastructures have facilitated a robust stablecoin ecosystem, promoting fast, cost-effective transactions. The Asia-Pacific economic landscape is witnessing notable transformation, fostering innovations in tokenized trade.

Responses from industry leaders and regulators reinforce this trend’s significance. Jeremy Allaire, Circle CEO, acknowledged the region’s pivotal role in stablecoin adoption through a statement on Twitter.

Stablecoin Innovation Driven by Regulatory Support

Did you know? The rise of Singapore and Hong Kong as stablecoin hubs mirrors their earlier ascension as fintech centers post-2017, following Western ICO restrictions.

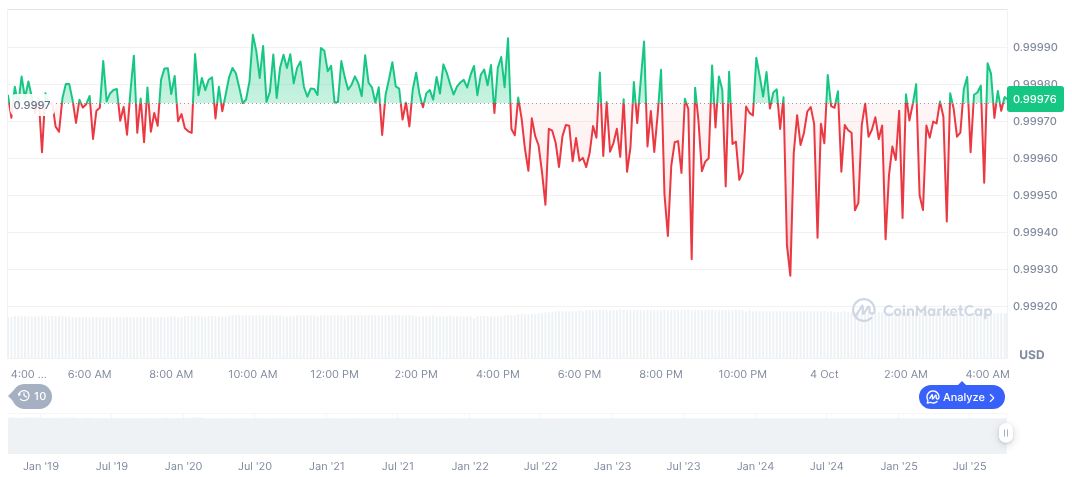

USDC maintains a stable exchange rate of $1.00, with a current market cap of $75.40 billion, constituting 1.80% of the market dominance according to CoinMarketCap. Over the past 24 hours, there has been a trading volume of $20.52 billion, reflecting a 7.22% change in activity.

Coincu research highlights that Singapore and Hong Kong’s supportive regulatory stance is propelling stablecoin innovation. Financial institutions are increasingly integrating digital currencies into their operations, which paves the way for more inclusive financial systems, impacting global economic integration and digital transactions.

“Asia Pacific leads the world in real-world stablecoin adoption for payments, remittance, and trade. Circle’s commitment to Singapore and Hong Kong reflects our vision for regulated, accessible digital dollars.” — Jeremy Allaire, Co-founder & CEO, Circle

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/asia-pacific-stablecoin-boom/