- ADA rebounds from $0.75–$0.78, showing resilience amid strong technical support levels.

- Futures open interest surges above $1.5B, reflecting heightened trader participation.

- Persistent net outflows indicate accumulation and reduced selling pressure by investors.

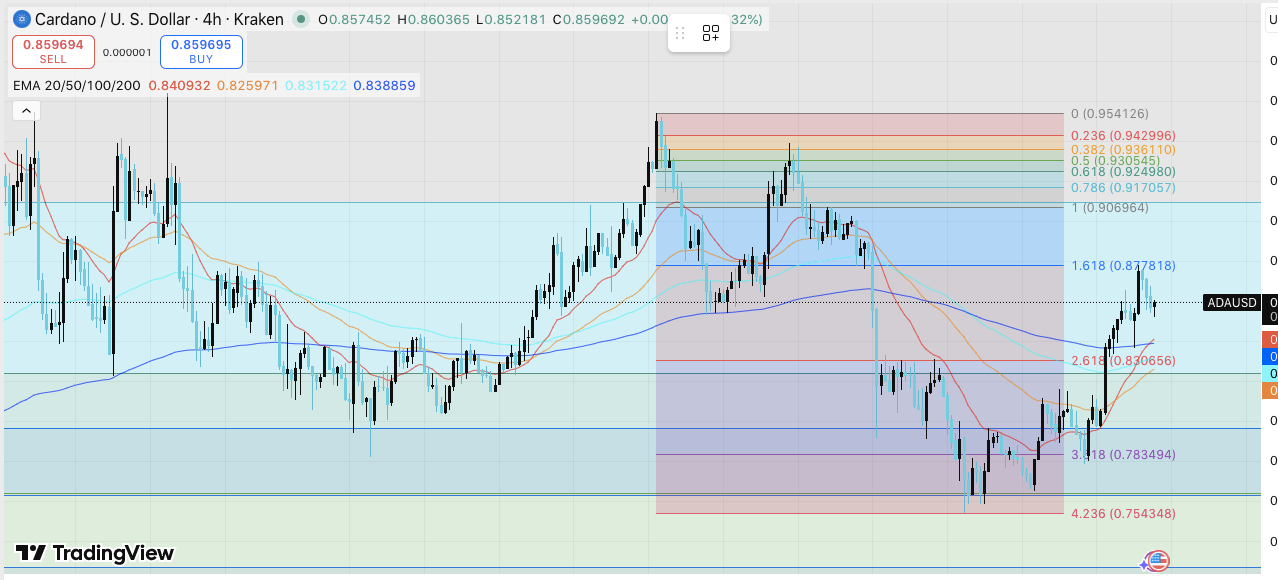

Cardano (ADA) has entered a recovery phase after a sharp pullback, trading around $0.86. The cryptocurrency rebounded strongly from the $0.75–$0.78 support zone, showing resilience.

Buyers recently pushed ADA toward the 1.618 Fibonacci extension at $0.878, where it faced resistance and pulled back slightly. This rebound reflects growing optimism among traders and investors who closely monitor key technical levels.

Key Levels to Watch

On the downside, ADA finds immediate support near $0.83, which aligns with the 20-EMA and the 2.618 Fibonacci level. If this level fails to hold, the $0.78 zone, corresponding with the 3.618 Fibonacci level, offers stronger support. A deeper pullback could test $0.75, where the 4.236 Fibonacci level provides a potential floor.

Upside resistance remains clear. The $0.88 level represents the first hurdle, already tested during the recent bounce. A break above this point could open the door to $0.91, coinciding with the 0.786 Fibonacci retracement, and further toward $0.95, the swing high from the previous rally. EMAs ranging from 20 to 200 are converging, hinting at a potential bullish shift if ADA maintains above $0.83.

Related: Chainlink Price Prediction: LINK Eyes $25 After Strong Recovery

Rising Open Interest Reflects Market Activity

Cardano’s futures market shows heightened trader participation. Open interest, which remained under $300 million early in the year, surged above $1.5 billion by October 3, 2025.

This rise coincided with ADA trading near $0.87, signaling increased speculative activity. Consequently, the sharp expansion in open interest suggests stronger capital inflows into derivatives markets and elevated market engagement.

Exchange Flows Signal Accumulation

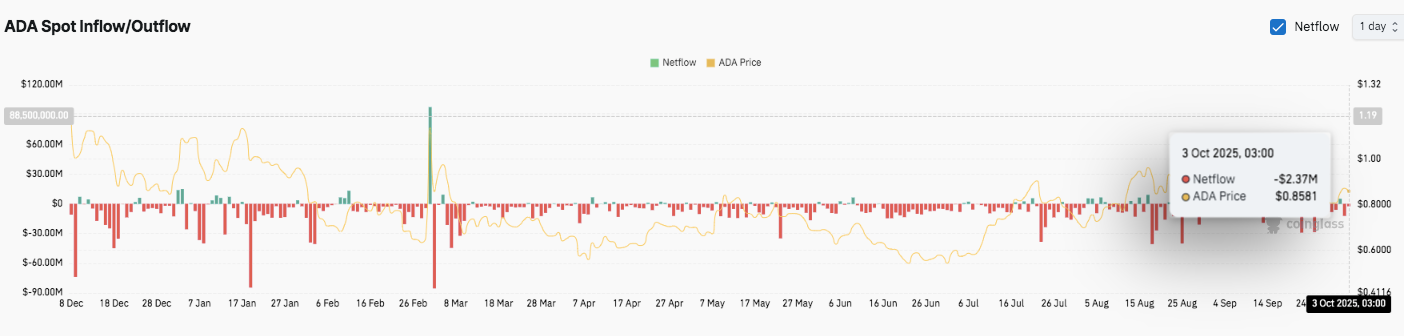

Spot inflows and outflows provide further insight. Recent months show persistent net outflows, indicating that investors are moving ADA off exchanges. On October 3, ADA recorded a net outflow of $2.37 million.

Such consistent outflows often signal accumulation and reduced selling pressure. Additionally, they reflect investor confidence, as fewer coins remain available for immediate trading.

Technical Outlook For Cardano (ADA/USD)

Key levels remain well-defined as Cardano consolidates above critical support heading into October.

Upside levels: $0.88 (1.618 Fib extension) is the first hurdle, followed by $0.91 (0.786 retracement) and $0.95 (recent swing high). A sustained breakout above these levels could extend the rally toward $1.02.

Downside levels: $0.83 (2.618 Fib) aligns with the 20-EMA as the nearest support. Below that, $0.78 (3.618 Fib) serves as a stronger base, with $0.75 (4.236 Fib) as deeper support if selling pressure intensifies.

Resistance ceiling: $0.95 remains the key level to flip for medium-term bullish momentum, as it marks the recent swing rejection.

The technical picture suggests ADA is compressing inside a recovery channel, with converging EMAs signaling a potential directional breakout. Momentum remains sensitive around $0.83 support, where buyers continue to defend the rebound structure.

Related: XRP Price Prediction: XRP Eyes $3.2 Breakout as Derivatives Interest Surges

Will Cardano Go Up?

The ADA price prediction for October hinges on whether bulls can secure a close above $0.88 and sustain it. A successful breakout could open the path toward $0.91–$0.95, with extended upside toward $1.02 if volume supports the move. However, a failure to hold $0.83 increases the likelihood of retests at $0.78 and $0.75.

For now, Cardano sits at a pivotal juncture. Rising futures open interest and consistent exchange outflows hint at accumulation, but conviction must be confirmed by a decisive breakout. October’s narrative points to heightened volatility, leaving ADA’s next leg dependent on buyers’ strength at critical inflection levels.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/cardano-price-prediction-ada-eyes-0-95-amid-strong-support-levels/