Key Takeaways

What sparked PancakeSwap’s recent price surge?

The launch of fee-earning limit orders triggered strong retail and whale accumulation, driving CAKE’s rally.

Can CAKE maintain its bullish momentum?

If accumulation continues, CAKE could test $4, but profit-taking may lead to a pullback toward $3.

PancakeSwap’s [CAKE] surged 28.55%, reaching a 2025 high of $3.46 before slightly retracing to $3.22, at press time.

Over the same period, its volume surged 528% to $410 million while market cap reached a yearly high of $1.2 billion, signaling steady capital flows.

But what triggered this uptick?

Why is CAKE up today?

AMBCrypto observed that the recent launch of fee-limit earning orders kick-started CAKE’s rally and soaring retail and whale demand.

Three days ago, PancakeSwap launched fee-earning limit orders, allowing traders to generate fees upon order execution.

This connects trading precision with passive income, thus reinforcing CAKE’s position in DeFi while connecting DEX and CEX functionalities.

The system offers users a 0.1% trading fee reward per order, delivering earnings directly to users’ wallets.

Retail demand skyrockets

Significantly, after the launch of the above program, retail buyers flowed into the market to accumulate CAKE.

In fact, the altcoin recorded a positive Buy Sell Delta for three consecutive days. According to Coinalyze, the altcoin saw 17 million tokens in cumulative Buy Volume compared to 14 million in Sell Volume.

Source: Coinalyze

As a result, the altcoin recorded a positive delta of 3 million tokens, signaling higher buying activity.

Historically, buyer dominance has preceded an intense upward pressure on an asset, often a precursor to higher prices.

Whale activity soars too

Notably, PancakeSwap has recorded massive demand from whales over the past week.

Average Order Size data from CryptoQuant showed Big Whale Orders dominating the market for seven consecutive days.

When the market records big whale orders, it signals increased participation from large entities on either demand or supply.

Source: CryptoQuant

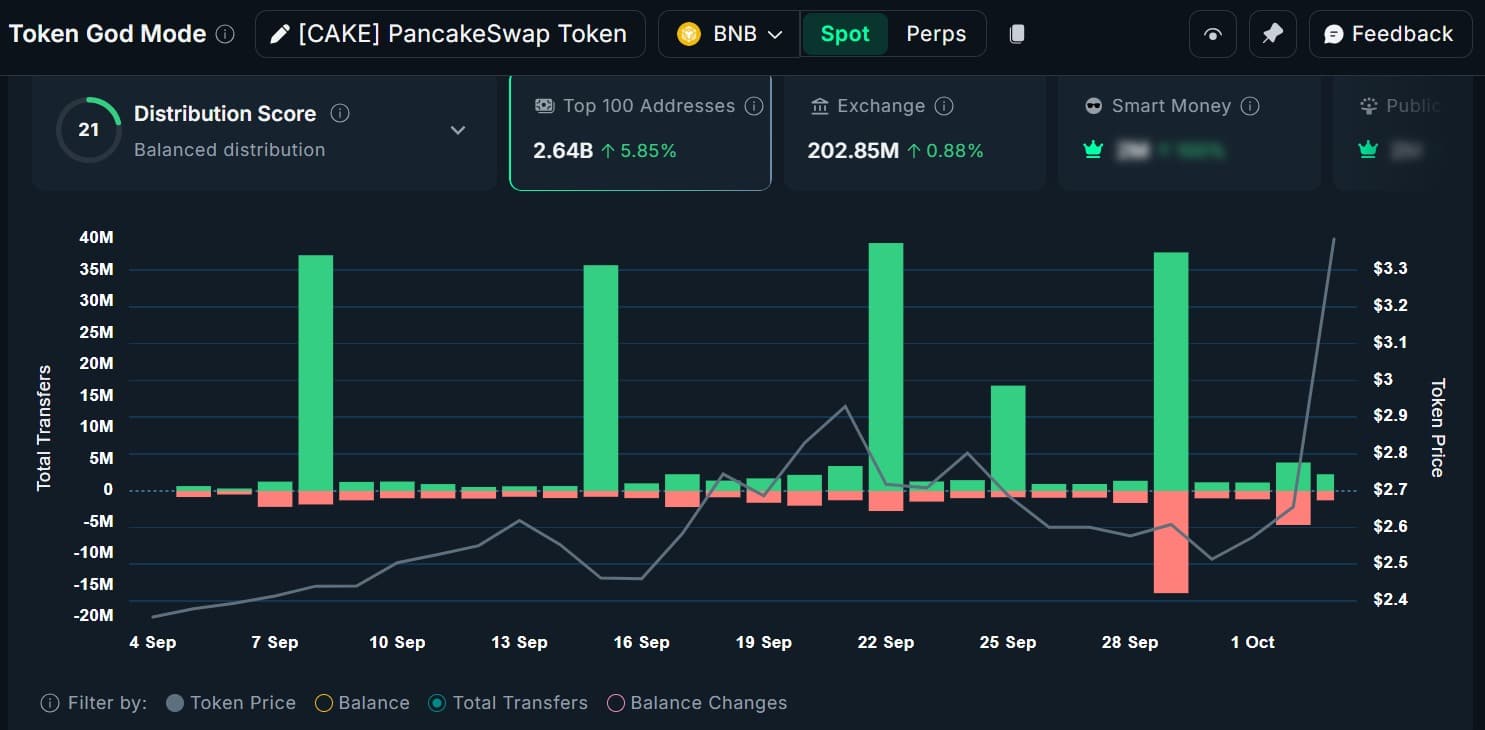

AMBCrypto’s analysis reveals that whales have been actively accumulating CAKE. Nansen data shows net inflows on four of the last five days, indicating consistent buying pressure.

In the past 24 hours alone, large holders boosted their holdings by 5.8% to 2.64 billion tokens, adding 7.6 million CAKE. This led to a sharp balance change of +740k, a notable reversal from the previous day’s -873k outflow.

Source: Nansen

Typically, a higher buying pressure from whales indicates firm conviction with the market, a clear bullish sign.

Profit takers are not left behind

As expected, as the market rebounded, investors who had been underwater rushed into the market to cash out.

According to CoinGlass, CAKE recorded a positive Spot Netflow for three consecutive days. At press time, Netflow was $2.89 million, a dip from $3.38 million the previous day.

Source: CoinGlass

Typically, when netflow is positive, it signals higher inflow, a clear sign of aggressive selling. Increased selling could potentially impact price action negatively, leading to a price decline.

Can CAKE hold momentum?

According to AMBCrypto’s analysis, Pancakeswap rallied, driven by a fee-earning limit order initiative backed by actual demand from retail and whales.

As a result, the altcoin’s Relative Strength Index (RSI) surged to 69, as of writing, edging into the bullish zone. At the same time, its Stochastic RSI jumped to 59, confirming the buyer’s presence.

Source: TradingView

Typically, when these momentum indicators reach a bullish zone, it signals strengthening upward momentum and its continuation potential.

That said, if the current market conditions hold, with whales and retail accumulating, CAKE will test $4 resistance level. Conversely, if profiteers overpower the market, we could see a correction to $3.0.

Source: https://ambcrypto.com/pancakeswap-surges-28-to-2025-high-can-cake-reach-4/