Billionaire hedge fund manager Ray Dalio has touted Bitcoin as “alternative money” as it continues to gain global adoption. This comes as BTC’s profit-taking surges past $3.7 billion amid its new rally past $120,000.

Ray Dalio Labels Bitcoin an “Alternative Money”

In a recent interview, Ray Dalio described Bitcoin as an “alternative money.” He noted that its growing recognition as a store of value makes it impossible to ignore. While he admitted he holds only a small amount of BTC personally, Dalio emphasized that the token meets key features of hard money.

He pointed out that there is a limited supply of the token, with only 21 million coins available. However, Ray Dalio raised concerns about whether central banks would use the token as a reserve currency. He said that the need for clear transaction records and the risk of future regulations could stop official use of the token.

The billionaire had previously made bullish comments about the token before this. In June, Ray Dalio praised BTC for its unique qualities that make it a form of hard currency. He noted that the coin is now entering the elite class of hard money assets, standing alongside precious metals such as gold and silver.

Dalio’s comments are in line with those of seasoned investor Robert Kiyosaki. In order to protect themselves from future financial crises, he has frequently advised investors to hold Bitcoin, silver, and gold.

Investors are shifting to alternative assets as a result of pressure on the global bond markets, particularly from decreased exposure to U.S. treasuries. Both Kiyosaki and Dalio agree that the token’s limited supply gives it an edge over fiat currencies that can be inflated at will.

BTC Profit-Taking Surges Past $3.7B

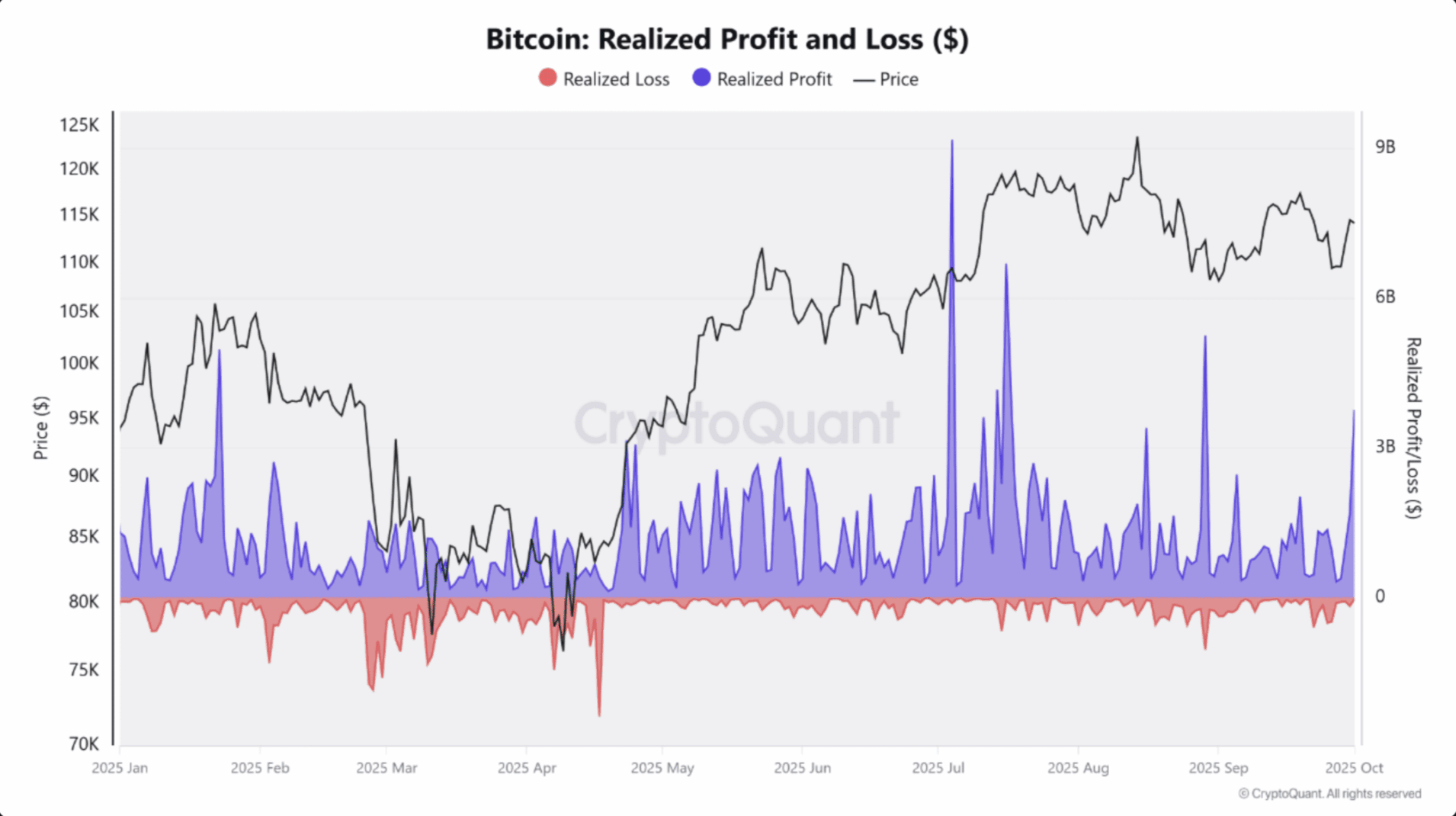

According to CryptoQuant data, over $3.7 billion in realized gains were recorded in just one day. This was the fifth-largest event for taking profits in 2025.

Analyst Caueconomy pointed out that selling activity can show increased selling pressure, but it doesn’t mean short-term investors control the market. Instead, this selling may mean that long-term investors are cashing in their profits, which suggests prices could still go up.

This comes as the Bitcoin price surged past $120,000. This is its highest level since mid-August as traders gear up for a bullish ‘Uptober.’ Over the past five days, the token has shown consistent gains in an attempt to reach its prior highs.

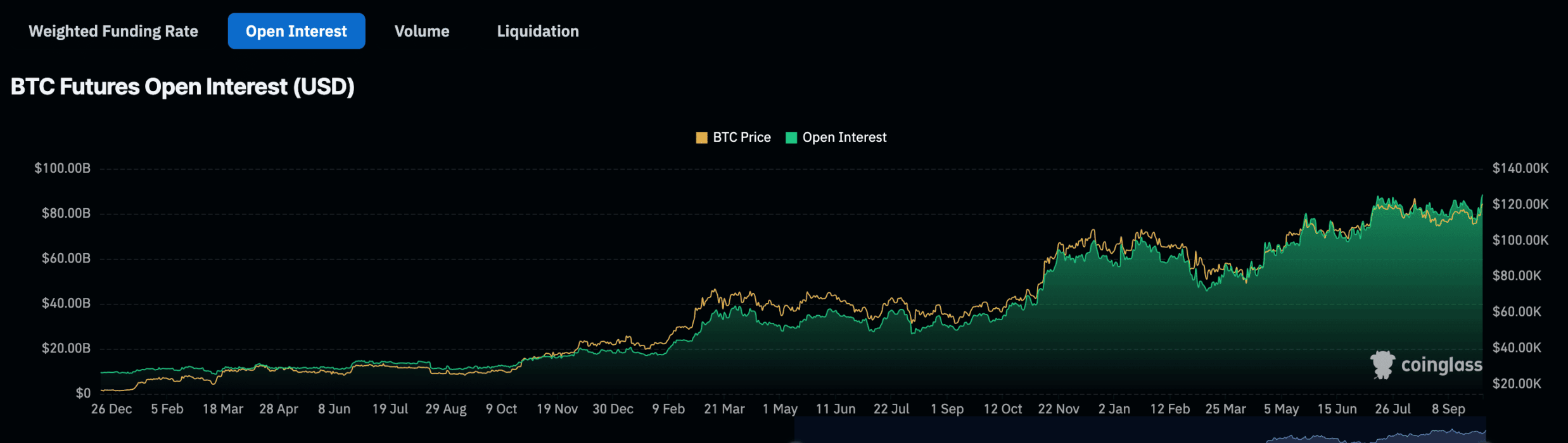

Additionally, open interest in Bitcoin futures has hit a record $88 billion, suggesting that traders are setting up for future gains. Spot ETFs are also seeing significant inflows.

Banking giants are adding to the bullish case. Citigroup forecasted BTC could climb as high as $231,000 within the next 12 months, with base and bear scenarios at $181,000 and $82,000, respectively.

JPMorgan also weighed in on Bitcoin. They stated that the token is undervalued compared to gold and could rise to $165,000. They cited its declining volatility relative to the precious metal as a sign of maturing market stability.