- Citigroup projects Bitcoin at $133K, Ethereum at $4.3K–$4.5K by 2025.

- Investor demand drives positive price forecasting.

- Citi views Bitcoin with stronger bullish potential than Ethereum.

Citibank’s recent report revises its 2025 projections, pricing Bitcoin at $133,000 and Ethereum between $4,300 and $4,500, influenced by investor demand and network activity.

These adjustments underscore the increasing institutional traction for Bitcoin over Ethereum, highlighting potential market shifts and influencing investor strategies in digital assets leveraging current market dynamics.

Bitcoin’s Bullish Potential Drives Market Forecasts

Citigroup’s latest report outlines new price targets for Bitcoin and Ethereum, setting Bitcoin’s value at $133,000 by the end of 2025. For Ethereum, the projection remains within a range of $4,300 to $4,500, citing network activity and investor demand as key factors. Analyst sentiments show more bullish confidence for Bitcoin, attributing its strength to its “digital gold” narrative, while Ethereum’s outlook is influenced by ongoing network activity without direct price correlation.

Potential market shifts due to these projections include increased investor interest and strategic allocations, especially towards Bitcoin. The report sees Bitcoin retaining greater interest due to its dominant market share and institutional appeal, while Ethereum’s activity aligns more with ecosystem and DeFi growth narratives.

Bitcoin is projected to end 2025 at $133,000, while Ethereum is anticipated to range between $4,300 and $4,500, driven by robust network activity and sustained investor demand.

Notable reactions have been limited to ongoing discussions across social media platforms. No direct statements have come from leadership in Citigroup or significant cryptocurrency industry figures in response to these forecasts. Nevertheless, the general sentiment echoes a cautious optimism for Bitcoin’s role in future portfolios.

Price Data and Expert Analysis on Crypto Forecasts

Did you know? Historical forecasts of major banks often correlate with subsequent asset interest and potential volatility, as observed in past cycles, where institutional forecasts preceded significant market actions.

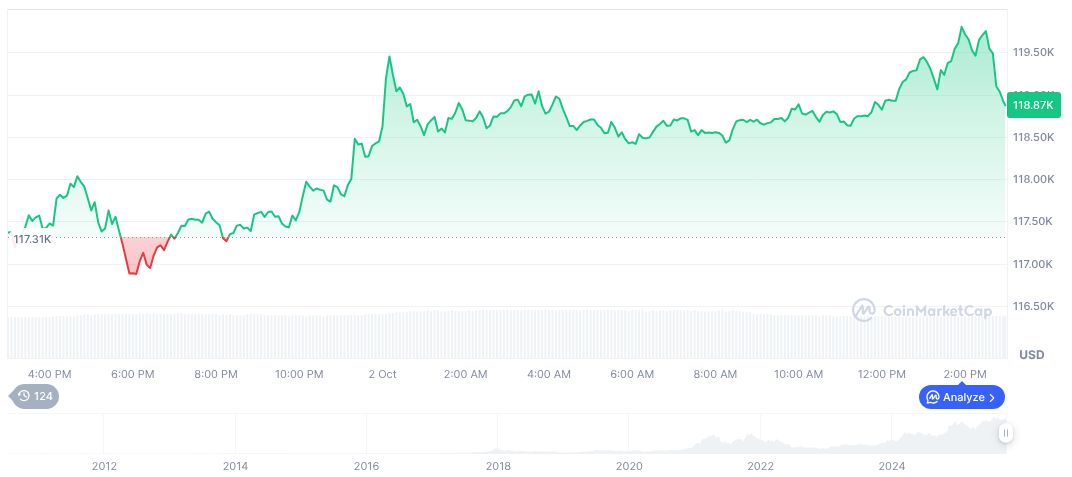

Bitcoin (BTC) is priced at $120,148.23 with a market cap of $2.39 trillion, maintaining a 57.93% dominance. Trading volume over 24-hours fell by 14.62%, totaling $66.11 billion. BTC prices increased 9.57% in the past week and 11.13% over three months, according to CoinMarketCap.

Research insights suggest that Bitcoin will continue as a preferred asset among investors, with Citigroup’s projections potentially impacting allocations. Ethereum may see slower value growth unless Layer 2 and staking gains translate into higher on-chain activity, aligning with existing market trends.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/citigroup-bitcoin-ethereum-2025-target/