- Bitcoin’s market regains balance as ETF funds return.

- Price faces resistance at $114,000-$118,000 cluster.

- Glassnode cites long-term holder moderation stabilizing demand.

Glassnode’s October 2 report reveals Bitcoin’s market entering consolidation, highlighting short-term holder cost basis’s stabilizing role since May 2025 amidst strong ETF activity.

Amid record ETF inflows, Bitcoin’s market shows stabilization signs, pivotal for maintaining momentum, countering short-term volatility, and signaling potential directional shifts.

Market Stabilization Amid ETF Inflow and Holder Strategies

Glassnode released a viewpoint analysis on the Bitcoin market, pointing out the ongoing influence of short-term holder cost basis. This metric has provided dependable support since May 2025. ETF funds have begun to return, indicating demand is stabilizing. The dynamic is crucial, especially given the dense supply challenges Bitcoin faces between $114,000 and $118,000. Glassnode emphasizes, “The short-term holder cost basis above $110,000 remains reliable support.”

Glassnode highlights long-term holders moderating distribution and continued ETF inflows contribute to a more stable demand environment. The analysis suggests a shifting market trend towards consolidation over capitulation. Consequently, volatility has slightly subsided, with the market resetting to a more neutral stance.

Market sentiment, gauged by RVT and the Fear & Greed Index, is cooling off. The options market recorded a noteworthy expiry reset, triggering open interest re-entry into Q4. Institutional demand, reflected through ETF AUM surpassing $100 billion, backs this stabilization narrative.

Bitcoin Price and Market Metrics Highlight Stable Growth

Did you know? Despite a cooling-off period, Bitcoin’s ongoing stabilization and historical behavior in October—a month known for strong returns—set a curious precedent for potential rallies.

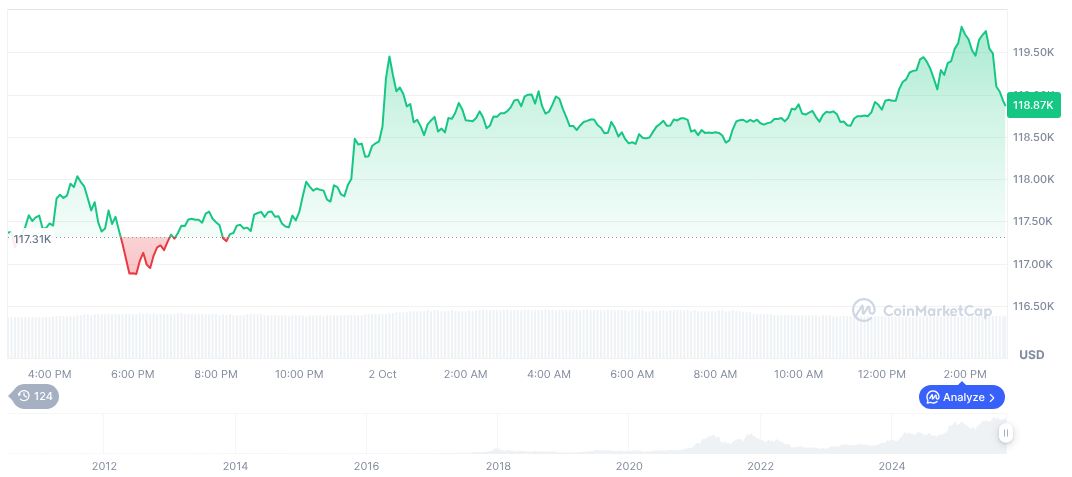

Bitcoin’s current price stands at $119,892.17, with a market cap of $2.39 trillion, representing 58.07% market dominance. The 24-hour trading volume is $69.16 billion. According to CoinMarketCap, the cryptocurrency has exhibited price gains of 1.80% over the past 24 hours and 11.41% over a 90-day period. Insights from DaanCrypto’s analysis further explore these trends and predictions.

Experts indicate that a strategic approach by long-term holders and the options market dynamics contribute to Bitcoin’s positive spread state. Ongoing ETF activities and spot demand continue to underpin the sustainability of Bitcoin’s market rally, according to Glassnode’s analysis.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/bitcoin-stabilization-etf-fund-resurgence/