- Dogecoin shows early accumulation signs after rebounding above key $0.241 support.

- Critical resistance at $0.263–$0.288 could trigger a rally toward previous swing highs.

- Inflows suggest shifting sentiment, hinting at potential durable recovery in October.

Dogecoin has entered an important recovery phase, with traders closely watching how the coin reacts to technical levels. After weeks of steady selling pressure, the meme-inspired asset is now showing signs of resilience.

Price action on the 4-hour chart suggests that short-term sentiment has shifted, especially as DOGE trades above several critical moving averages. While inflows and outflows still reflect cautious investor behavior, early signs of accumulation are beginning to emerge.

Key Technical Levels Shaping the Trend

DOGE is currently valued at $0.2564, a move that places it just above the 0.382 Fibonacci retracement level at $0.2534. This zone now serves as immediate support. The recovery began after a sharp rebound from the $0.22 level, which aligned with the 0.236 Fibonacci retracement.

Significantly, the 20, 50, 100, and 200 exponential moving averages have converged near $0.241. This clustering forms a solid base of support, reinforcing the current bullish momentum.

Resistance, however, remains close. The next upside barrier stands at $0.263, with stronger hurdles waiting at $0.274 and $0.288. A decisive break through these levels would likely propel DOGE toward $0.306, the previous swing high. On the downside, failure to hold above $0.241 could push the coin back toward $0.220, erasing much of the recent progress.

Related: Dogecoin Price Prediction: Can Morgan Stanley’s $1.3T Move Push DOGE Toward $0.30?

Market Flows Point to Shifting Sentiment

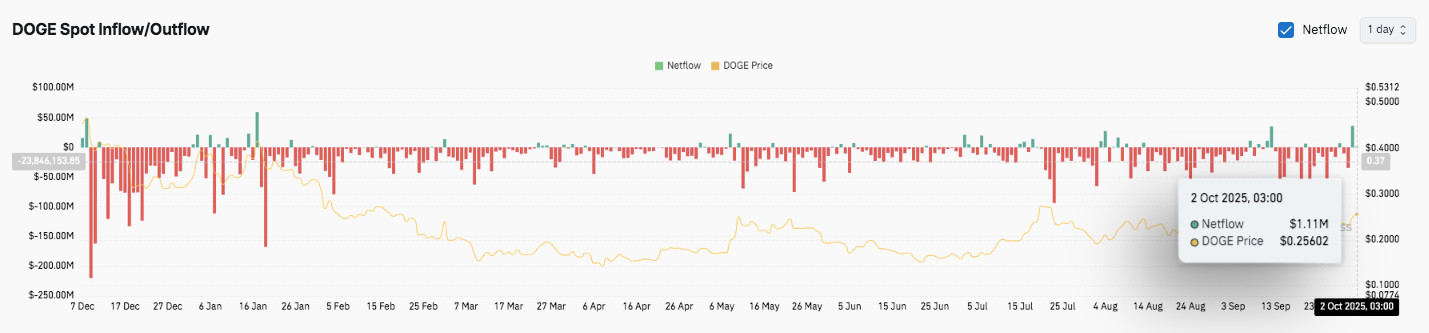

Beyond technical charts, on-chain data provides important context. Spot inflows and outflows have consistently shown heavier outflows over the past year, with several surges above $100 million.

These movements indicate frequent profit-taking and sustained selling pressure from large holders. However, the latest reading on October 2 showed a $1.11 million net inflow as DOGE traded near $0.256.

This shift, though modest, could reflect a gradual change in sentiment. Smaller inflow spikes often act as early signals of renewed accumulation, especially when paired with improving price structure. If this trend continues, it may provide the foundation for a more durable recovery rally.

Technical Outlook for Dogecoin Price

Key levels are well-defined heading into October:

- Upside levels: $0.1520, $0.1585, and $0.1650 as immediate hurdles. A breakout could extend toward $0.1750 and $0.1880.

- Downside levels: $0.1450 trendline support, followed by $0.1390 and $0.1315 as deeper cushions.

- Resistance ceiling: $0.1650 (200-day EMA) is the key level to flip for medium-term bullish confirmation.

The technical setup indicates Dogecoin is consolidating within a broad ascending channel. A decisive move through $0.1650 could trigger volatility expansion and strengthen the case for a higher run.

Related: Related: Dogecoin Retests Triangle as Whales Add 2 Billion DOGE Into Support

Outlook: Will Dogecoin Rally in October?

Dogecoin’s path forward depends on whether buyers can defend the $0.1450–$0.1390 zone long enough to challenge the $0.1585–$0.1650 cluster. Compression suggests a breakout is approaching, and historical October seasonality often coincides with heightened volatility in DOGE. If inflows support momentum, price could target $0.1750 and $0.1880.

Failure to hold $0.1450, however, risks breaking structure and exposing the coin to $0.1390 and $0.1315. For now, Dogecoin remains at a critical juncture, with conviction flows likely to determine the next move.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/dogecoin-price-prediction-doge-price-holds-above-key-fibonacci-level/