The Ethereum price and BMNR stock have recorded modest gains thanks to BitMine’s recent $1 billion ETH purchase. Additionally, a crypto analyst has shared that the token’s chart has never been more bullish amid its growing fundamentals.

Ethereum, BMNR Surges After BitMine’s $1 Billion Buy

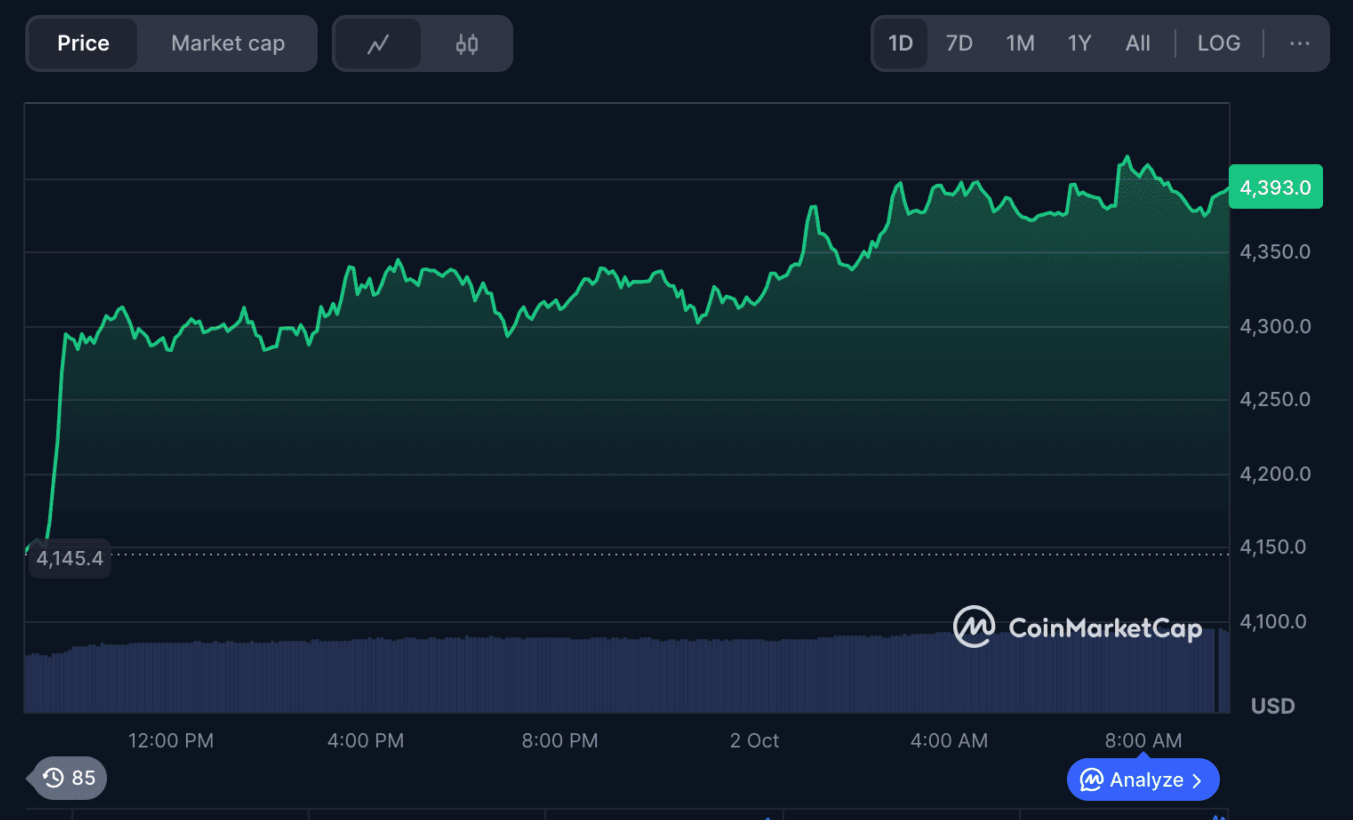

Ethereum has gained momentum in the market, rising 5.39% to trade at $4,389. This outpaced Bitcoin’s 3.7% increase and the broader cryptocurrency market’s 3.68% rise. The asset broke past the $4,400 threshold, a psychological level that traders had been watching closely.

One of the biggest drivers of this rally came from BitMine. The company confirmed a nearly $1 billion purchase of the altcoin, equivalent to 234,846 ETH. The move brought the company’s total holdings to 2.65 million tokens, valued at around $11 billion.

The company now holds the most extensive Ethereum treasury globally. Its position dwarfs rivals such as Joe Lubin’s SharpLink, which has about 838,730 tokens, and The Ether Machine, with 495,360 tokens.

Additionally, BitMine has also become the second-largest public crypto treasury overall. They are trailing only Michael Saylor’s Strategy, which made a BTC purchase earlier this week.

BMNR stock also climbed by 3.46% in pre-market trading to $54.10. The company’s market capitalization is estimated at $9.36 billion, underscoring the dual momentum of its equity performance and growing ETH holdings.

The huge purchase comes after its ETH purchase last week. BitMine acquired approximately $84 million in ETH. The tokens were purchased from Galaxy Digital through a series of over-the-counter transactions.

Analyst Declares “Most Bullish Chart Setup Yet”

Prominent analyst CryptoGoos described the current charts as “the most bullish Ethereum chart yet” he has ever seen. This further reinforces the token’s positive Sentiment.

Ted Pillows also pointed to the token’s reclaiming of the $4,250 support. He projected targets at $4,500 and $4,750 before testing a new all-time high.

$ETH has reclaimed the $4,250 support level.

The next 2 major levels are $4,500 and $4,750 before a new ATH.

If Ethereum breaks below the $4,250 support level, it’ll drop towards $4,000. pic.twitter.com/I0Y38M69lW

— Ted (@TedPillows) October 2, 2025

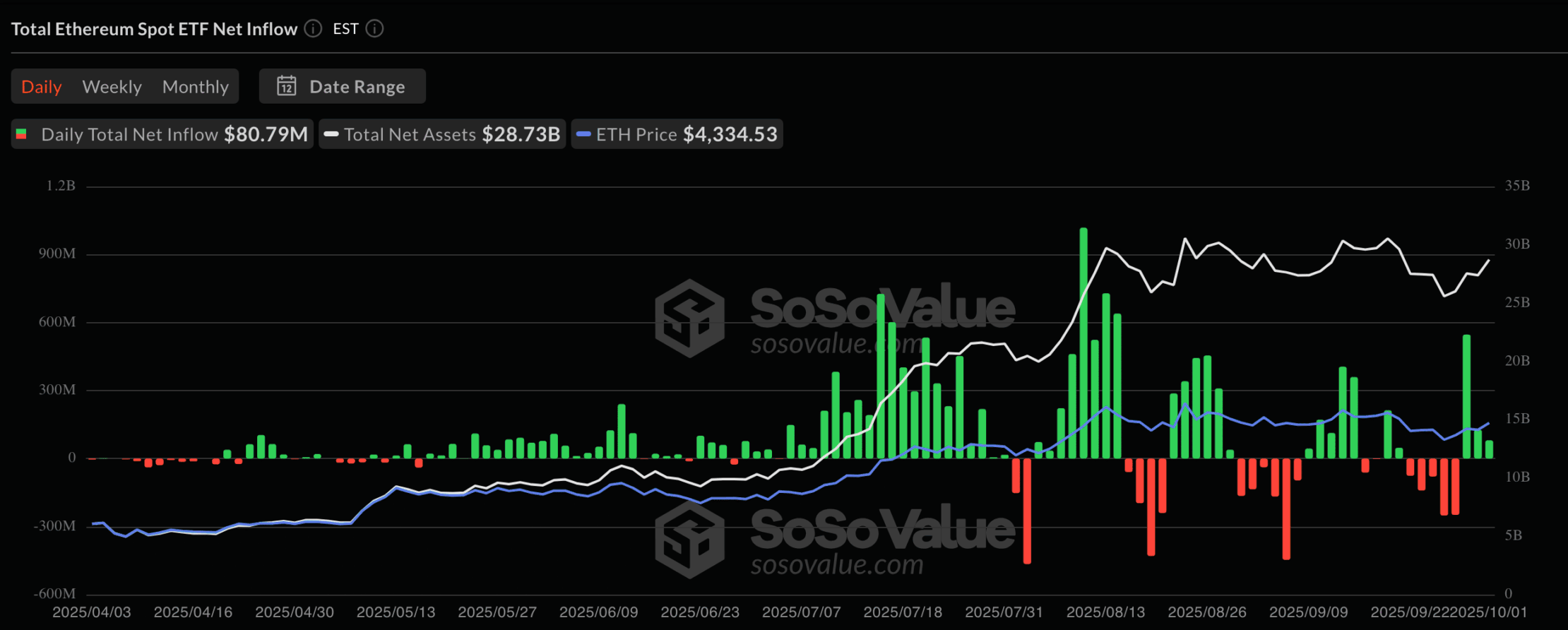

Furthermore, on October 1, U.S. spot ETFs also saw significant inflows, with Bitcoin funds recording $676 million and Ethereum ETFs attracting $80.79 million. Both asset classes posted three consecutive days of positive flows, according to SoSoValue data.

This outlook is consistent with a series of bullish forecasts for the token. Tom Lee set a bold ETH target, predicting the token could rally to $12,000 by the end of 2025. The growing fundamentals around the token have set the stage for what many believe could be a march toward new all-time highs.