Key Takeaways

What’s fueling Ethereum activity?

Transactions broke 1.6–1.7 million daily and Active Addresses hit 422k, reflecting genuine adoption and DeFi growth.

Will ETH break higher soon?

Weak DMI at 17 and SMI near 33 show bearish bias, keeping price between $4,000 and $4,300 despite whale accumulation.

Ethereum [ETH] has been stuck in a tight range, with price momentum weakening even as its blockchain activity hits new records.

At press time, ETH traded at $4,147, down 1.17% in 24 hours. Yet, while the altcoin’s upside has stalled, transactions, Active Addresses, and whale demand are surging, setting up a clash between weak momentum and strong fundamentals.

Ethereum transactions and addresses climb

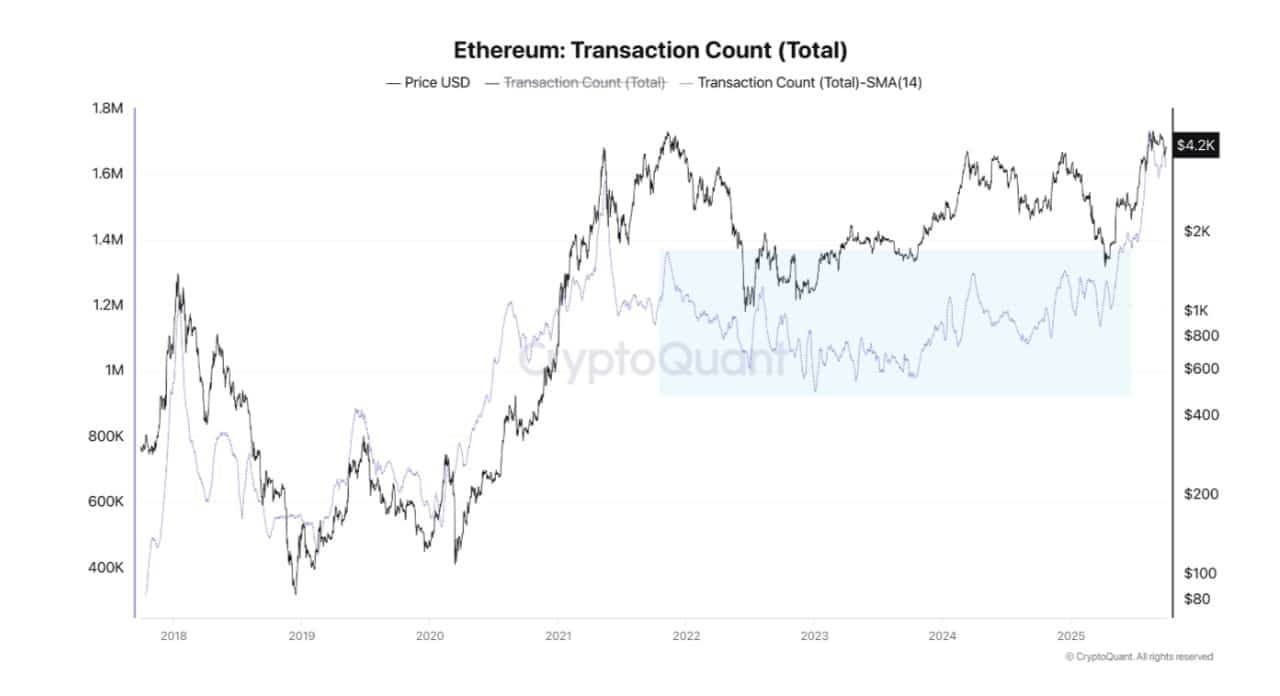

According to CryptoQuant, Ethereum’s daily transactions broke out of a four-year range of 900k–1.2 million.

Source: Cryptoquant

As of writing, the network recorded between 1.6 and 1.7 million transactions, marking the highest levels recorded on Ethereum.

Even more importantly, real users backed these transactions. In fact, the number of Active Addresses has bounced back from the dip below 400k, rising from 342k to 422k.

Source: CryptoQuant

Usually, when Addresses and Transactions rise in tandem, it indicates actual network adoption and demand growth, not mere trading hype.

Whales and derivatives add fuel

In addition to the increasing adoption of blockchain, there has been consistent demand from the open market, especially from large entities.

One such entity is Tom Lee’s Bitmine.

According to Lookonchain, two new wallets belonging to Bitmine received 51,255 ETH worth $213 million. The firm’s holdings climbed to roughly $9 billion, reflecting strong demand from this entity.

Additionally, demand for Ethereum’s Futures positions surged significantly. DefiLlama recorded Ethereum Perpetual Volume at $1.268 billion on 01 October, its highest since July.

Source: DefiLlama

Sustained growth in Perps Volume reflected traders’ increasing exposure on both sides of the market.

Historically, whale accumulation paired with rising futures participation preceded strong buying pressure and upside moves.

Momentum indicators stay weak

According to AMBCrypto’s analysis, Ethereum experienced vigorous network activity backed by a growing DeFi ecosystem. At the same time, demand in the Spot market and Futures remained steady.

Despite network and futures growth, ETH’s price action remained fragile.

At press time, the Directional Movement Index (DMI) fell to 17, while its negative index climbed to 22. The Stochastic Momentum Index (SMI) held at 33, signaling bearish territory.

Source: TradingView

For a trend reversal, DMI must flip its -DI while SMI must break above 40.

Until then, ETH may stay range-bound between $4,000 and $4,300. Even so, strong adoption and whale flows could help ETH retest $4,250, with $4,456 as the next target.

Source: https://ambcrypto.com/ethereum-adoption-breaks-records-so-why-is-eth-below-4-3k/