Fresh data from Alphractal highlights how Bitcoin, Litecoin, and Dogecoin continue to experience significant shifts in their Lost Coins metrics, a factor often overlooked in price analysis.

Lost Coins represent assets tied to wallets that have never been moved on-chain, many belonging to early adopters who accumulated in the infancy of each network.

While prices tend to push long-term holders to move dormant funds, the overall metric rarely falls to zero. This is largely because a portion of wallets are permanently inaccessible, locking away coins forever.

Bitcoin’s Lost Coins Plateau

For Bitcoin, the chart reveals a steady rise in Lost Coins throughout its early years, peaking as millions of BTC were permanently locked. In more recent cycles, the metric has flattened, suggesting that most recoverable dormant coins have already been activated. This trend reflects a more mature market, where price rallies no longer trigger as dramatic a decline in Lost Coins as seen in earlier years.

Litecoin shows a different picture, with Lost Coins steadily increasing across its history. Despite strong rallies, the metric has rarely dropped significantly, indicating that many early wallets remain untouched.

This rising dormant supply has coincided with LTC’s price hovering in consolidation ranges, suggesting muted selling pressure from long-term holders.

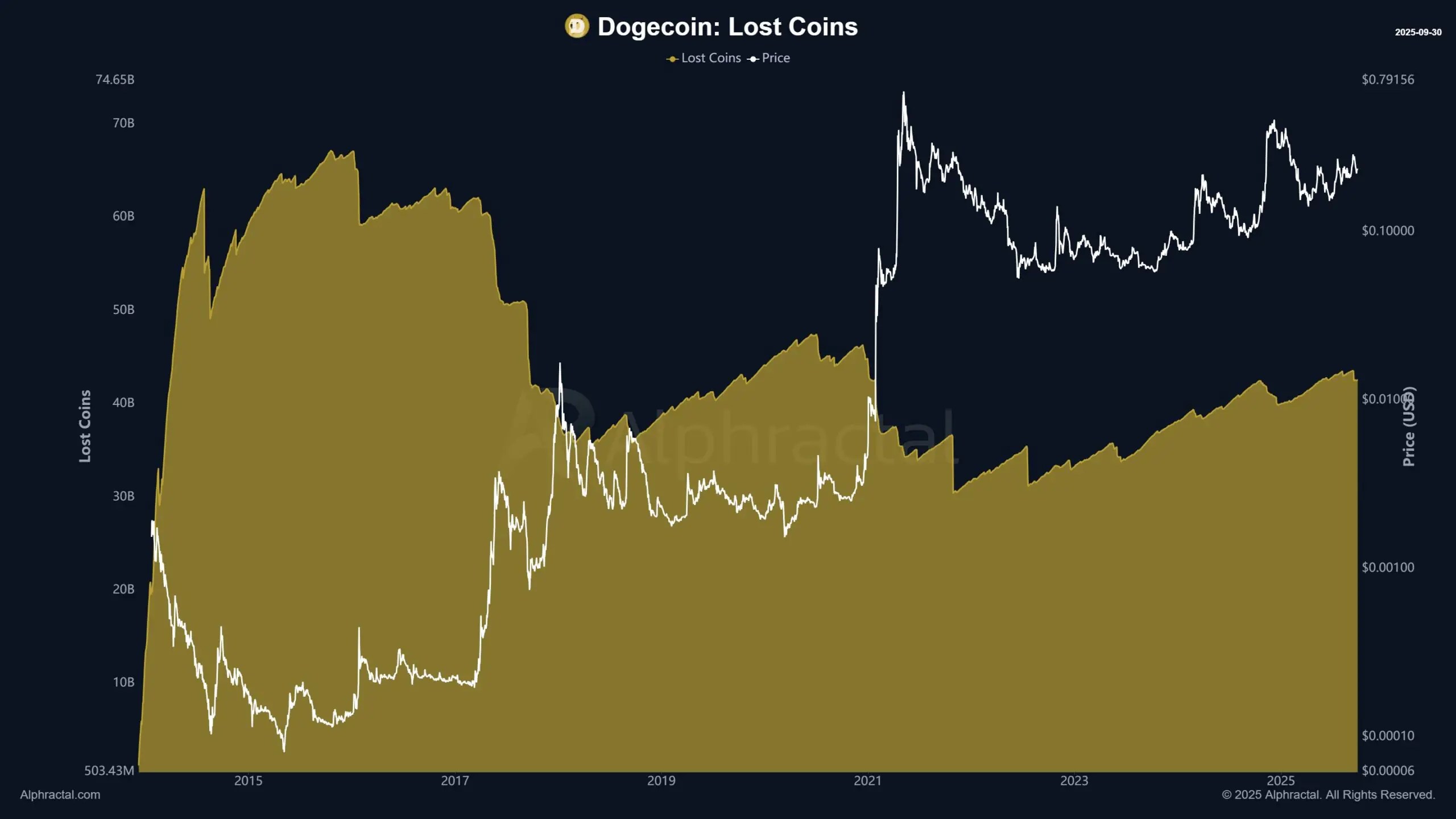

Dogecoin’s Volatility Reflected in Lost Coins

Dogecoin presents the most erratic pattern. The memecoin’s Lost Coins surged in its early years, then saw sharp declines whenever price action turned euphoric. However, the long-term trend still points upward, meaning a growing share of DOGE is sitting idle. Given Dogecoin’s inflationary supply model, permanently lost tokens act as a subtle counterbalance to new issuance.

Market Signals from Lost Coins

Analysts often underestimate the role of Lost Coins in shaping supply dynamics. When the metric is rising, it usually indicates a lack of selling from early wallets, often translating into sideways price action or even signs of bear market conditions. Conversely, during euphoric rallies, some of these coins re-enter circulation, adding liquidity and sometimes intensifying market volatility.

Alphractal’s data underscores how these hidden dynamics continue to influence Bitcoin, Litecoin, and Dogecoin in different ways. While Bitcoin appears to have stabilized in its dormant supply, Litecoin continues to accumulate untouched holdings, and Dogecoin swings more erratically in response to price hype.

In short, Lost Coins remain a quiet but powerful force in the market — shaping supply, sentiment, and long-term price behavior.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

Source: https://coindoo.com/new-data-shows-how-dormant-crypto-wallets-shape-market-trends/