- Arthur Hayes predicts capital flight from France and advises Bitcoin investment.

- Eurozone faces possible large-scale money printing.

- ECB’s response may affect EU fiscal control.

Arthur Hayes, Maelstrom CIO, forewarned of a severe capital flight from France during his keynote at Token 2049 Singapore, emphasizing potential impacts on the Eurozone’s financial stability.

This financial shift underscores growing concerns over fiscal policies in the EU, driving increased interest in Bitcoin and gold as alternative investment options.

Arthur Hayes Highlights France’s -38% GDP Net Investment Position

Arthur Hayes, co-founder of BitMEX, warned that France is experiencing significant capital outflows. According to the European Central Bank’s target balance data, France has had the largest outflow in the Eurozone since 2021, driven by the public moving funds to countries like Germany. Hayes noted that France’s net investment position stands at -38% of GDP.

Should France implement capital controls, the ECB might require printing 5 trillion euros to support the banking system. Hayes emphasizes a shift to Bitcoin and gold as hedges against potential fiat debasement. His analysis reflects a need for responses to impending challenges within the Eurozone.

“The only rational response for the investor class is a robust allocation to Bitcoin and gold as fiat debasement in the EU becomes inevitable.”

Hayes’s statements have sparked significant debate. While Bitcoin enthusiasts responded positively, the Eurozone’s political leadership has not issued official reactions. On social media, Hayes reiterated his bearish view on the Eurozone, emphasizing his preference for digital and hard asset investments.

Bitcoin Price Surges Amid Eurozone Economic Concerns

Did you know? Since the 2011 EU debt crisis, several Eurozone countries have faced similar challenges, requiring ECB intervention and liquidity support.

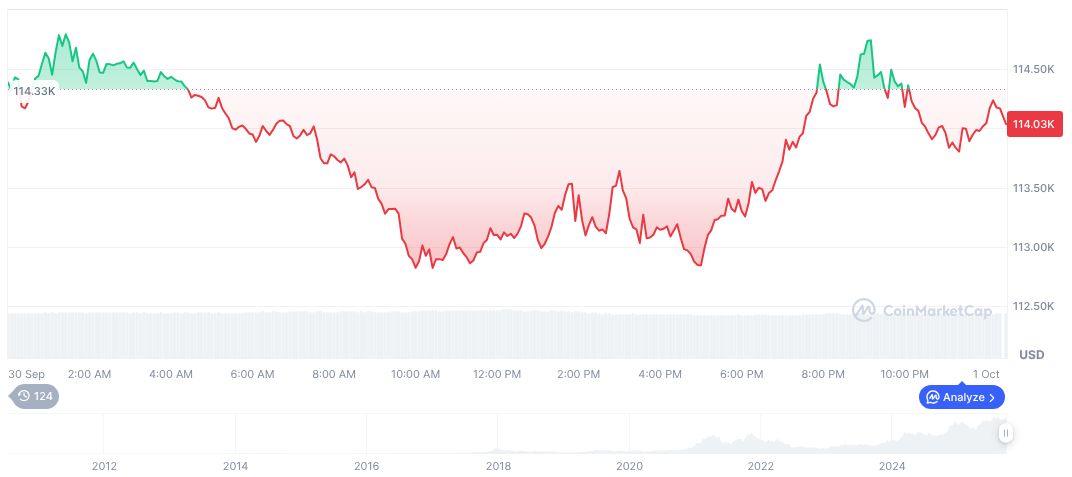

Bitcoin (BTC) maintains a strong presence as it trades at $114,622.77, showing a 0.46% rise in the last 24 hours. According to CoinMarketCap, its market cap is approximately $2.28 trillion, with a dominance of 58.35% amid a 7-day growth of 1.98%. The circulating supply has reached 19.92 million coins.

The Coincu research team suggests that the reliance on external financing poses long-term risks for France. If the ECB undertakes substantial monetary easing, it could potentially strain fiscal policies across the EU. Economic experts urge cautious observation of these developments for future stability.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/hayes-warns-france-capital-crisis/