- U.S. government shutdown starting October 1 affects general operations.

- Cryptocurrency impact remains unclear with no immediate disruption.

- No major official crypto statements from U.S. or industry leaders.

The U.S. government shutdown commenced on October 1, 2025, as Congress failed to pass the appropriations bill, reportedly affecting various federal operations according to Jinshi through PANews.

While previous shutdowns showed limited crypto market impact, potential regulatory implications remain a concern for digital asset stakeholders.

U.S. Shutdown Focuses on Budget, Leaves Crypto Unscathed

As of October 1, 2025, the U.S. government commenced a shutdown due to Congress’s inability to progress with an appropriations bill. This process has affected general federal operations, with a focus on non-essential services. Discussions have centered around Medicaid and ACA subsidies, with no crypto-specific references from Congress or the administration.

In the financial realm, crypto markets remain steady, as no direct grants or federal blockchain pilot projects have been impacted. The focus of the shutdown is on traditional budgetary concerns rather than digital assets, limiting immediate crypto repercussions. Historical parallels suggest that unless coupled with regulatory shifts, such events rarely disturb the crypto landscape significantly.

Vitalik Buterin, Co-founder, Ethereum, “While the government faces shutdown challenges, the Ethereum community is focused on ensuring our development continues uninterrupted.” Source

Current Crypto Stability Mirrors Past Shutdowns

Did you know? Previous U.S. government shutdowns in 2013 and 2018–2019 had little direct impact on cryptocurrency, only influencing markets when paired with major regulatory changes.

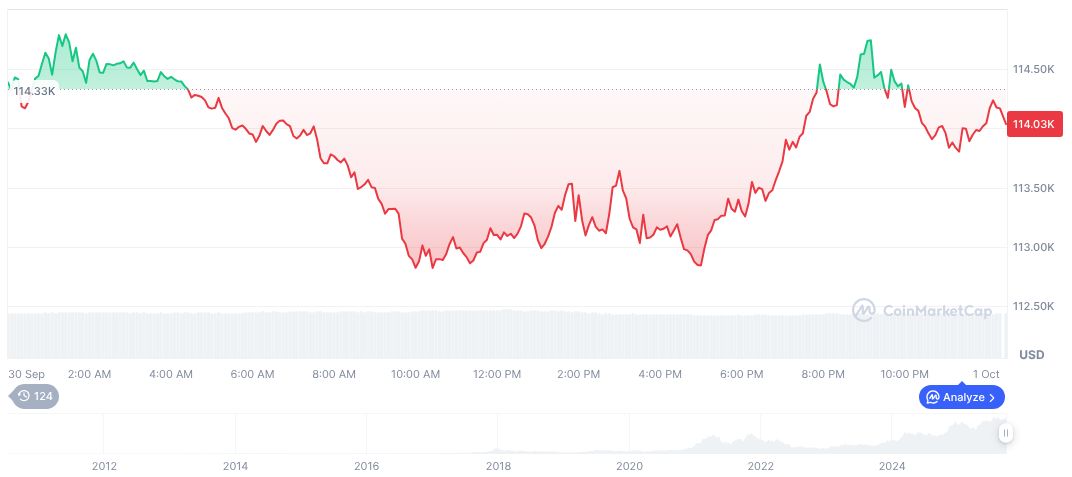

As of October 1, 2025, Bitcoin (BTC) trades at $114,423.68, maintaining a market cap of 2,280,258,297,923.73 with a dominance of 58.36% in the market, according to CoinMarketCap. Recent data reflects a 7.24% rise in the past 24 hours. With a circulating supply of 19,928,203 BTC, the price has exhibited resilience, marked by a 6.50% uptick over the last 30 days while on-chain activities remain consistent.

Coincu Research Team highlights possible outcomes that center around broader macroeconomic stability unless regulatory measures are heightened. Bitcoin and other cryptocurrencies may benefit from the perception of being safe havens. Currently, there is no indication of major price disruptions or protocol changes instigated by the shutdown. Meanwhile, for further insights into how crypto markets have reacted to regulatory and macroeconomic changes, you can explore our analysis on the Federal Reserve rate cut impact.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/us-government-shutdown-crypto-impact-2/