Global central bank liquidity is beginning to show signs of contraction, a trend that analysts say could turn out to be favorable for the cryptocurrency market.

Market strategist Joao Wedson pointed out that the decline, which comes just weeks after highlighting its importance for digital assets, could be a major tailwind for Bitcoin and altcoins.

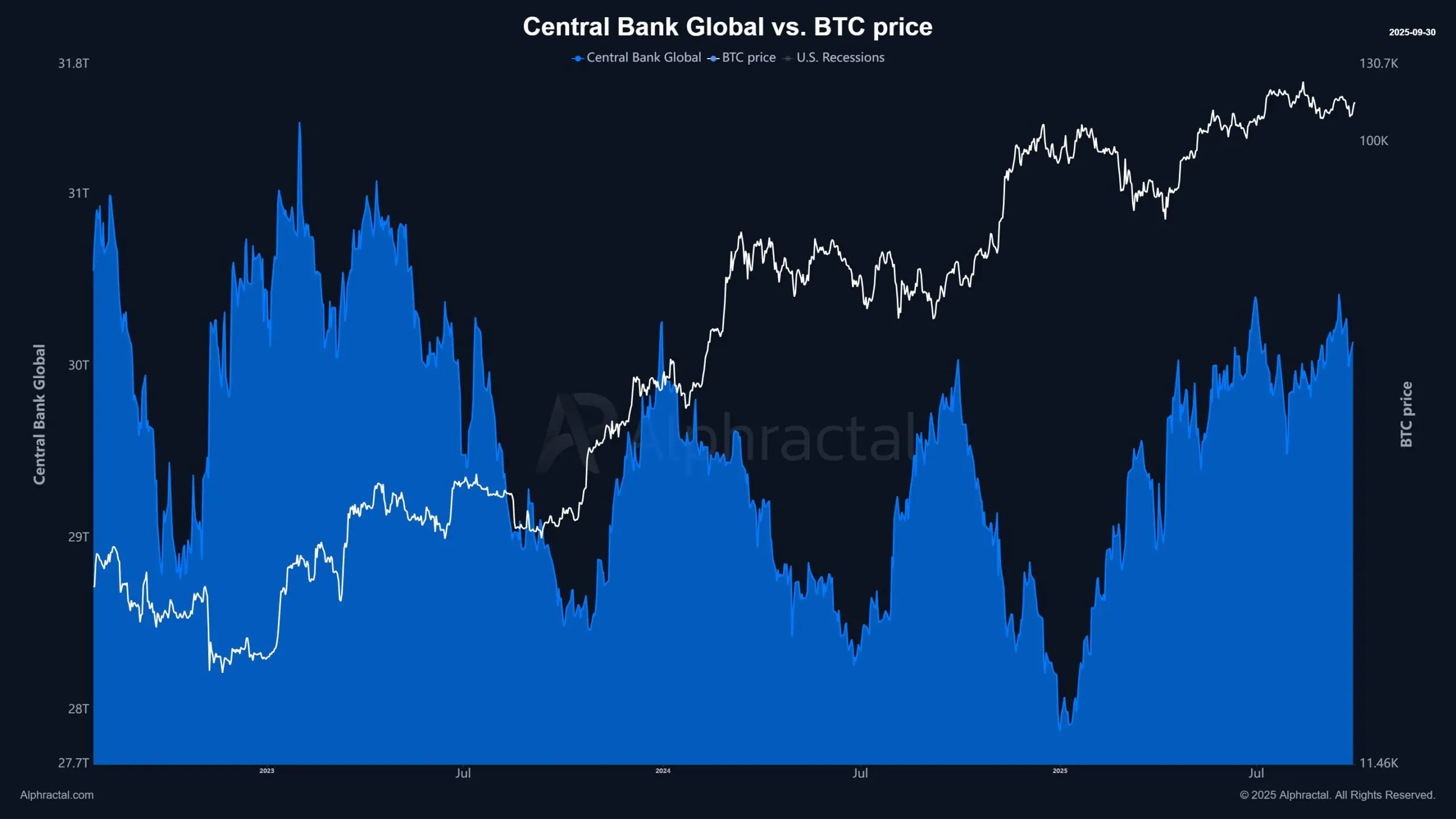

A chart shared by research platform Alphractal illustrates the relationship between central bank liquidity levels and Bitcoin’s price performance.

Historically, dips in liquidity have coincided with stronger upward momentum in crypto markets, suggesting that the latest downturn may once again create conditions that favor risk assets.

Bitcoin has been trading near record levels, and many observers believe the shift in liquidity dynamics could provide additional support for its next leg higher. Altcoins, which often follow Bitcoin’s trajectory but with amplified moves, may also benefit if the trend continues.

Wedson emphasized that while tightening liquidity can pose challenges for traditional markets, the crypto sector tends to thrive in such periods, reflecting its unique positioning as a hedge against central bank policies.

With liquidity now showing clear signs of retreat, attention is turning to whether this setup could accelerate a new phase of bullish momentum across the digital asset landscape.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

Source: https://coindoo.com/global-liquidity-drop-seen-as-bullish-signal-for-bitcoin-and-altcoins/