- Main event, leadership changes, market impact, financial shifts, or expert insights.

- Potential permanent federal layoff plans have emerged.

- U.S. shutdown risks affecting cryptocurrency volatility.

On September 30, U.S. President Trump announced that a government shutdown could lead to permanent layoffs for federal workers, departing from temporary measures typically expected during such scenarios.

This escalation adds economic uncertainty, potentially increasing market volatility, especially within the cryptocurrency sector.

Trump Proposes Permanent Layoffs Amid Shutdown Threat

U.S. President Trump announced the possibility of permanent layoffs for federal employees if a government shutdown occurs. This marks a departure from previous practices where temporary furloughs were standard, and employees received back pay. Russell Vought, Director of the OMB, conveyed the administration’s intention to use this period to review and potentially downsize government staff. In response to this unprecedented measure, federal unions have criticized the administration, accusing it of leveraging worker livelihoods for political gains. The White House memo also warned of “Reduction-in-Force” notices, signaling permanent job losses and deep fiscal measures. Volatility in major assets like BTC and ETH often spikes amid U.S. fiscal uncertainty, with previous shutdowns impacting markets.

However, as of the latest reports, there have been no direct reactions from high-profile cryptocurrency leaders or government officials regarding this specific shutdown threat.

Donald Trump, President of the United States, “Federal agencies might cut a lot of the people that … we’re able to cut on a permanent basis. I would rather not do that, but we will act if no deal is reached.”

Cryptocurrency Markets Brace for Shutdown-Induced Volatility

Did you know? During previous U.S. government shutdowns, increased volatility in BTC was noted as investors weighed risks amid economic uncertainty, showcasing a recurring pattern of crypto market fluctuations in response to U.S. fiscal challenges.

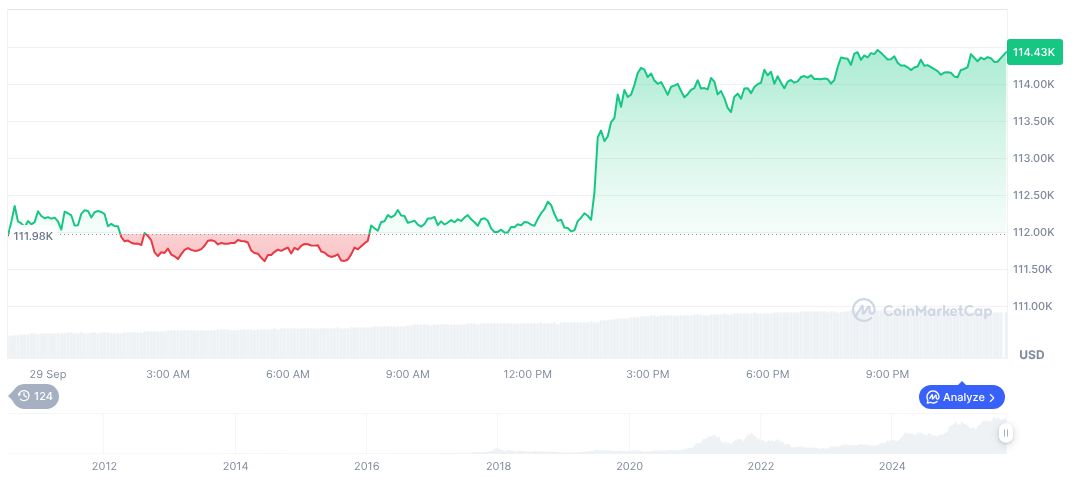

According to CoinMarketCap, Bitcoin (BTC) is currently priced at $113,194.60, with a market cap of $2.26 trillion. In the past 24 hours, trading volume reached $63.03 billion, reflecting a 34.73% increase. Bitcoin holds a market dominance of 58.09% and has experienced price changes over various intervals, notably a 1.05% increase in the past 24 hours. The insights from Coincu research suggest the potential for heightened volatility due to the economic uncertainties from government shutdowns, affecting both traditional and digital markets. As investors look to navigate these potential impacts, Bitcoin may face further market shifts depending on future developments.

However, as of the latest reports, there have been no direct reactions from high-profile cryptocurrency leaders or government officials regarding this specific shutdown threat.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/us-government-shutdown-permanent-layoffs/