- Shiba Inu price today trades at $0.00001182, holding trendline support at $0.00001180 while capped by EMA resistance.

- Exchange flows show mild $638K inflow, but analysts say consistent multi-million inflows are needed for sustained rallies.

- October narrative resurfaces as traders recall SHIB’s 2021 parabolic run, fueling speculation on a repeat breakout.

Shiba Inu price today is trading at $0.00001182, slipping slightly after losing the $0.000012 support band. Sellers remain active below the 20-day EMA at $0.00001238, while buyers are holding the ascending trendline near $0.00001180. Market focus is now on whether SHIB can reclaim $0.00001264–$0.00001286 to re-test the broader descending channel ceiling.

Shiba Inu Price Holds Critical Support

The daily chart shows SHIB caught between a tightening triangle pattern, with trendline support at $0.00001180 and descending resistance near $0.00001360. Price has repeatedly bounced from this base since mid-September, suggesting accumulation is taking place.

EMA clusters remain key. The 20-day EMA at $0.00001238 and the 50-day EMA at $0.00001264 are immediate barriers. The 100-day EMA at $0.00001286 marks the next resistance, while the 200-day EMA higher at $0.00001364 aligns with the descending trendline. Clearing this zone would confirm a breakout toward $0.00001472 (Fib 0.618) and potentially $0.00001600 (Fib 0.786).

Related: Cardano Price Prediction: ETF Approval Odds Hit 91%, Analysts Weigh Impact

On the downside, losing $0.00001180 risks a deeper test of $0.00001100 and $0.00000999, which remain key liquidity areas.

The Parabolic SAR remains above current levels, underscoring bearish control, but a flip could accelerate momentum if price clears the EMA cluster.

On-Chain Flows Show Mild Accumulation

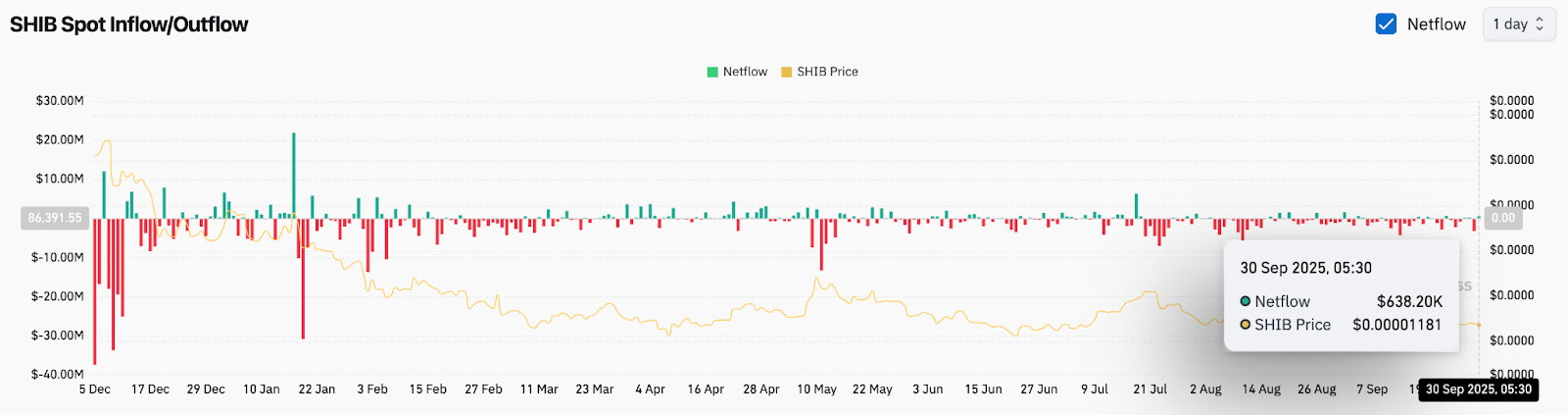

Exchange netflow data shows SHIB recorded a modest $638,000 inflow on September 30, reversing weeks of steady outflows. While not large enough to signal broad conviction, it indicates that some investors are positioning ahead of October’s historical volatility.

In past cycles, strong inflows have preceded sharp upside moves, but the current flows remain cautious. Analysts note that for Shiba Inu price action to sustain a rally, consistent multi-million inflows will be required, similar to the buildup seen during its 2021 surge.

October Narrative Resurfaces

Market commentators are once again drawing parallels to SHIB’s historic October 2021 rally, when the token gained exponentially in just weeks. Back then, U.S. Q4 inflows, peak social media hype, and new exchange listings converged to fuel one of crypto’s most memorable parabolic moves.

This year, traders highlight October as another pivotal month, with broader risk sentiment improving and meme tokens regaining speculative attention. While conditions are different, the memory of SHIB’s October breakout adds psychological weight, keeping investors alert for repeat patterns.

Technical Outlook For Shiba Inu Price

Key levels remain well-defined heading into October:

- Upside levels: $0.00001238, $0.00001264, and $0.00001286 as immediate hurdles. A breakout could extend toward $0.00001472 and $0.00001600.

- Downside levels: $0.00001180 trendline support, followed by $0.00001100 and $0.00000999.

- Resistance ceiling: $0.00001364 (200-day EMA) is the key level to flip for medium-term bullish momentum.

The technical picture suggests SHIB is compressing inside a descending wedge, where a decisive breakout could trigger volatility expansion in either direction.

Outlook: Will Shiba Inu Go Up?

Shiba Inu price prediction for October hinges on whether buyers can defend $0.00001180 long enough to mount a challenge on the $0.00001264–$0.00001286 cluster. Technical compression and historical seasonality both point toward heightened volatility ahead.

Related: Ethereum Price Prediction: Analysts Watch $4,359 Level As Short Squeeze Threatens Bears

If bullish momentum builds with stronger inflows, SHIB could retest $0.00001472 and even $0.00001600. Failure to hold $0.00001180, however, risks breaking the accumulation base and exposing SHIB to $0.00001100 and lower.

For now, SHIB remains in a pivotal zone. The October narrative continues to fuel optimism, but conviction flows and technical confirmation will be the deciding factors for the next leg.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.