- Ethereum price today trades near $4,202, holding above $4,120 support while facing resistance at the $4,262 EMA.

- BlackRock’s $205M ETH sale adds selling pressure, even as exchange outflows hit $35.8M on September 30.

- Over $10B in short positions cluster above $4,359, raising risk of a liquidation-driven squeeze toward $4,600.

Ethereum price today is trading at $4,202, recovering from last week’s dip into the $4,120–$4,150 support band. Sellers failed to push price below the 200-day EMA at $3,874, while buyers are now testing resistance at the 20-day EMA near $4,263. The key question is whether ETH can reclaim higher ground and trigger a short squeeze above $4,359.

Ethereum Price Holds Support But Faces Compression

The daily chart shows ETH caught inside a descending structure since July, capped by lower highs near $4,600. Support has been established around $4,120, where the 100-day EMA converges with a high-volume demand zone. The 200-day EMA at $3,874 remains the deeper defense line.

Momentum signals are stabilizing. The RSI has bounced from oversold territory back toward neutral levels, while MACD is flattening after weeks of downside pressure. Price remains below the Supertrend barrier at $4,515, but compression between $4,120 support and $4,262 resistance suggests a breakout is approaching.

On-Chain Flows Show Renewed Selling

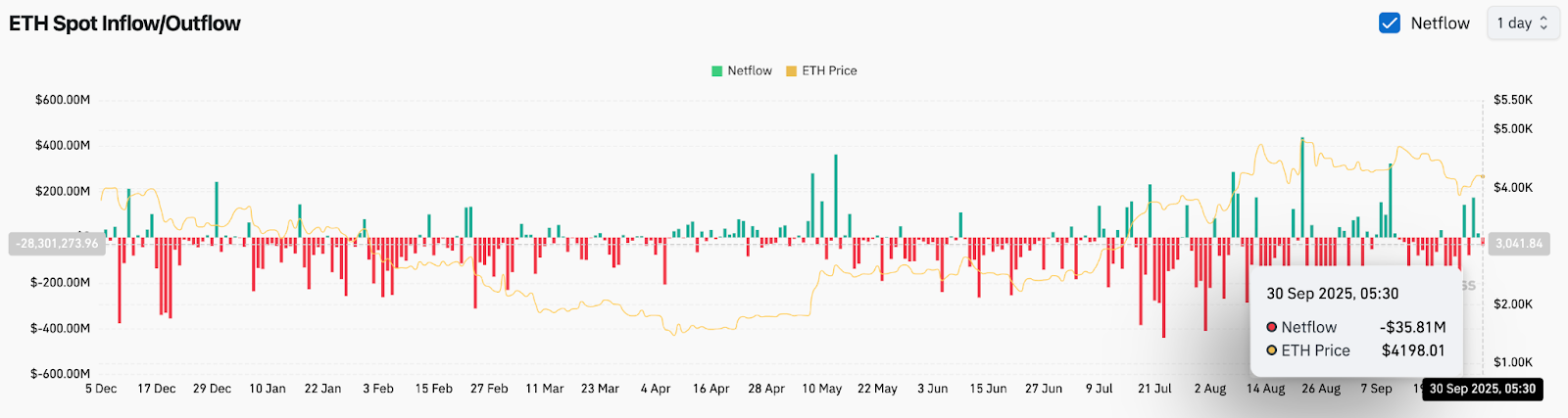

Spot exchange data recorded $35.8 million in net outflows on September 30, extending the streak of volatile flows through September. While outflows typically suggest accumulation, the lack of sustained conviction mirrors the back-and-forth seen in futures positioning.

BlackRock’s reported sale of $205 million in ETH on Coinbase Prime added to selling pressure, offsetting some of the short-term accumulation from retail and smaller institutions. Analysts warn that without consistent inflows, Ethereum price action may struggle to sustain rallies toward higher resistance zones.

Short Squeeze Risk Builds Above $4,359

Market analysts note that over $10 billion in ETH short positions remain open across major exchanges. Liquidity maps show concentrated short liquidation clusters just above $4,359, meaning a decisive move through this level could trigger a cascade of forced buybacks.

As one trader highlighted, “If Ethereum pops to $4,359, one massive squeeze and all those bears get wrecked.” This aligns with liquidation heatmaps showing exponential liquidation risk between $4,360 and $4,450. A squeeze scenario could rapidly fuel upside momentum if buyers reclaim the 20-day EMA and force shorts to cover.

Technical Outlook For Ethereum Price

For October 1, key levels remain well-defined. On the upside, reclaiming $4,262 opens the path to $4,359, with further extension possible toward $4,515 and $4,600 if a short squeeze is triggered. On the downside, losing $4,120 would expose the $3,874–$3,850 cluster, with deeper risk down to $3,427.

Ethereum price prediction short-term levels:

- Upside: $4,262, $4,359, $4,515, $4,600

- Downside: $4,120, $3,874, $3,427

Outlook: Will Ethereum Go Up?

Ethereum price today is holding the $4,120 floor, but the battle now lies at the $4,262–$4,359 resistance cluster. A decisive breakout could ignite one of the largest short squeezes of the quarter, accelerating price toward $4,600.

Failure to reclaim momentum would keep ETH locked in compression, leaving $4,120 and $3,874 as the key defensive levels. Analysts remain cautiously bullish as long as ETH trades above $4,120, but the reaction at $4,359 will determine whether October begins with a breakout or another period of consolidation.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.