Key Highlights

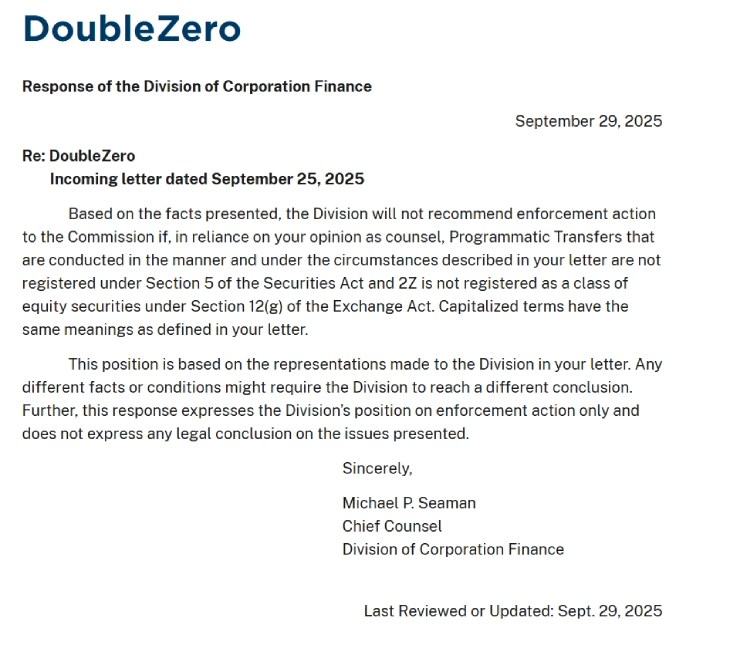

- U.S. SEC has issued a “No-Action Letter” to DoubleZero for its token ‘2Z’

- The letter means that the SEC will not go for enforcement action, and the project does not have to register as a class of “equity securities.”

- This decision shows a positive U.S. regulatory environment that could encourage more infrastructure and utility-based

The Securities and Exchange Commission (SEC), a major U.S. financial regulator, has given a major project a green light, declaring that its digital token is not a security.

(Source: sec.gov)

The project, called DoubleZero, received a “No-Action Letter” from the Securities and Exchange Commission (SEC). This letter is a big achievement for the project.

In a thread on X, DoubleZero explained that, “A No-Action Letter means that the @SECGov’s Division of Corporation Finance has reviewed how the programmatic distributions of the 2Z token work and concluded that: Based on the facts presented, the Division will not recommend enforcement action to the Commission.”

Proud to share that the @SECGov has issued @DoubleZero a No-Action Letter for 2Z. 🦅🇺🇸

The first-of-its-kind No-Action Letter gives us confidence that 2Z does not have to register as a class of “equity securities” and that programmatic flows of 2Z on the DoubleZero network are… pic.twitter.com/gSgiN6tpQj

— DoubleZero IBRL/acc (@doublezero) September 29, 2025

This green signal can provide much-needed clarity and could open the door for a new wave of utility-based crypto projects.

This decision is a big deal because for years, crypto companies have operated in a gray area with uncertainty, never sure if their tokens would be considered illegal securities by the SEC. This ruling provides a clear example of what a legal, utility-focused token looks like.

What is DoubleZero?

DoubleZero is a project designed to enhance blockchain communication efficiency by establishing a global network that uses underutilized subsea and terrestrial fiber optic cables.

Its token, called 2Z, is the fuel for this network. It functions as a utility mechanism within this ecosystem. It is used by network participants, known as validators, to access bandwidth and receive staking rewards for their services.

In its letter to the SEC, DoubleZero successfully argued that people use 2Z for its function, not because they expect the company’s managers to make them rich.

SEC Adopts Flexible Approach to Deal With Crypto Sector

This decision is another major win for the entire cryptocurrency market after Ripple’s legal battle with the SEC. It builds directly on a famous legal battle from 2020 between the SEC and a company called Ripple Labs.

Back then, the SEC sued Ripple, claiming its XRP token was an unregistered security. After a long court fight, a federal judge made a crucial distinction. She ruled that when Ripple sold XRP directly to big investors, it was like a security. But when regular people traded XRP on public exchanges, it was not a security.

This was a landmark moment in cryptocurrency history. It indirectly established that a token itself is not inherently a security. Also, this defines these tokens’ category based on how it is sold and used. The DoubleZero ruling takes this idea one step ahead, which gives a project upfront approval before it even launches its network.

The SEC’s letter to DoubleZero is a signal. It shows that U.S. regulators are beginning to distinguish between tokens that are purely for speculation and those that have a real, functional job to do.

This clarity is exactly what big investors and tech builders have been asking for. It reduces the legal risk of launching new projects in the United States. This will ultimately encourage innovation to stay in the country rather than move overseas.

“Today’s SEC No-Action Letter is a monumental milestone, not just for @DoubleZero, but for the entire crypto industry. It’s time to celebrate 2Z’s model, and that compliant innovation can thrive in the U.S. And for contributors, it means they can participate with confidence, relieved from regulatory uncertainty,” stated in a post on X.

The decision comes amid a bigger push in Washington for clear crypto rules. A proposed law called the CLARITY Act is currently being debated in the Senate. This new rule is expected to write these kinds of distinctions into permanent law.

This comes amid the ongoing legislative efforts to establish a clear regulatory framework for the cryptocurrency market under U.S. President Donald Trump’s pro-crypto administration. SEC and CFTC are jointly working together to bring clarity to the digital asset sector and attract innovations. Today, SEC Chairman Paul Atkins said that crypto is his “number one” priority right now.

Source: https://www.cryptonewsz.com/doublezero-no-action-letter-2z-token-sec/