- XRP bounced from $2.70 support, but on-chain data shows weak demand and rising exchange reserves.

- Whale transfers of 50M XRP spark debate, while misinformation on X clouded the narrative.

- October SEC rulings on six XRP ETFs may define the next major move in XRP’s price.

XRP pulled back from its $2.70 support zone as the week started, sparking a rebound now trading 2.90 that has traders testing the line between relief and conviction. The move comes at a moment when speculation over an October spot ETF decision is already pushing sentiment higher, yet the underlying data on demand tells a more complicated story.

Misinformation Fuels Confusion Around Whale Activity

A surge of posts on X claimed that XRP whales were buying at record pace. The narrative spread quickly, drawing more than 180,000 views in a single day. But on inspection, the claim falls apart.

The data cited came not from new XRP flows, but from an older analysis of Bitcoin whale activity. The mix-up illustrates how easily the XRP community’s enthusiasm can be redirected by recycled charts, and how fragile the current bullish narrative remains.

On-Chain Data Signals Weak Demand

Fresh numbers from CryptoQuant show XRP reserves on exchanges have risen to more than 3.5 billion tokens. That matters because rising reserves usually indicate weaker demand; more supply being left on exchanges rather than moved off for custody.

For example, between July 20 and September 2, 2025, the exchanges’ reserves for XRP surged from 2.98 billion to about 3.54 billion, while the asset declined in value from $3.55 to $2.86.

At the same time, withdrawals from exchanges have collapsed, dropping from a peak of 2.2 million transactions last year to fewer than 500 as of latest.

That collapse in outflows reflects the same reality that buying appetite has cooled, leaving more XRP in liquid supply and less in long-term hands.

Whales Still Move, But Signals Are Mixed

During the past 24 hours, a whale transfer of 17.5 million XRP from Kraken to an unknown address was recorded. Last week, whales accumulated over 50 million XRP, valued at over $150 million, amid the ongoing market correction.

The demand for XRP is expected to grow rapidly in the coming months, especially after the approval of several spot ETF products in the United States. Meanwhile, the REX-Osprey XRP ETF has grown to over $66 million in assets under management since its inception on September 18, 2025.

Midterm Expectations for XRP Price

XRP ETF Launch Provides a New Backdrop

According to historical data, XRP has recorded more bearish results for October since 2013 than bullish. Although the approval of the spot XRP ETF in October may change the XRP’s performance, crypto analyst Benjamin Cowen has warned that the altcoin market could bleed to Bitcoin before their ultimate parabolic rally in November and December.

What Does the XRP Chart Reveal?

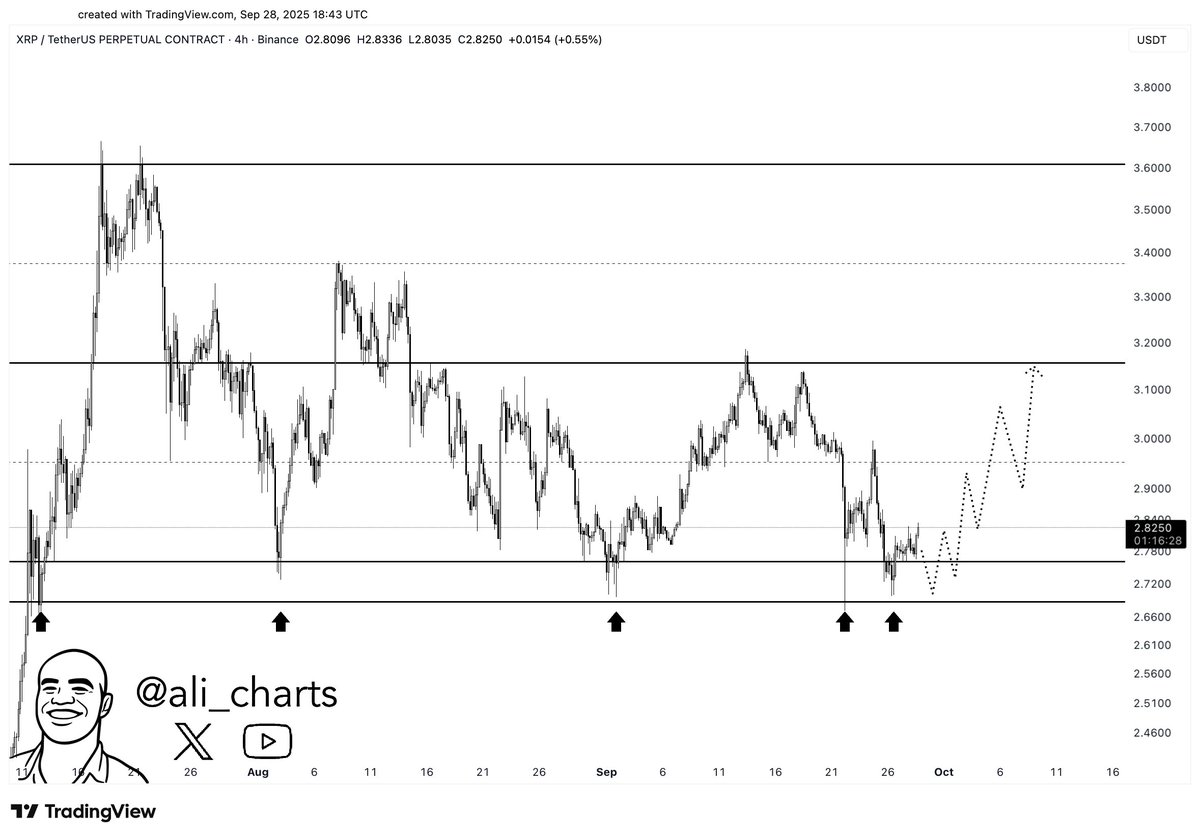

Chart structure is still defined by a descending triangle that has boxed XRP in since July’s all-time high above $3.65.

Following the recent crypto drop, which was triggered by the 25 Fed rate cut, the XRP price has dropped towards the lower border of the triangular consolidation.

As such, crypto analyst Ali Martinez has noted that the XRP price is well-positioned to rally towards $3.2 in the near future if the support level of around $2.7 holds.

Related: XRP Liquid Staking Expands While Critics Warn of Yield Risks

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/xrp-rebounds-from-2-70-support-as-october-etf-rulings-near/