- XRP price gap $2.51–$2.73 reveals little on-chain activity in that zone.

- XRP price gap is important as the $2.7 line must hold to avoid sliding back.

- The support level then aligns XRP’s path toward $3.20 breakout.

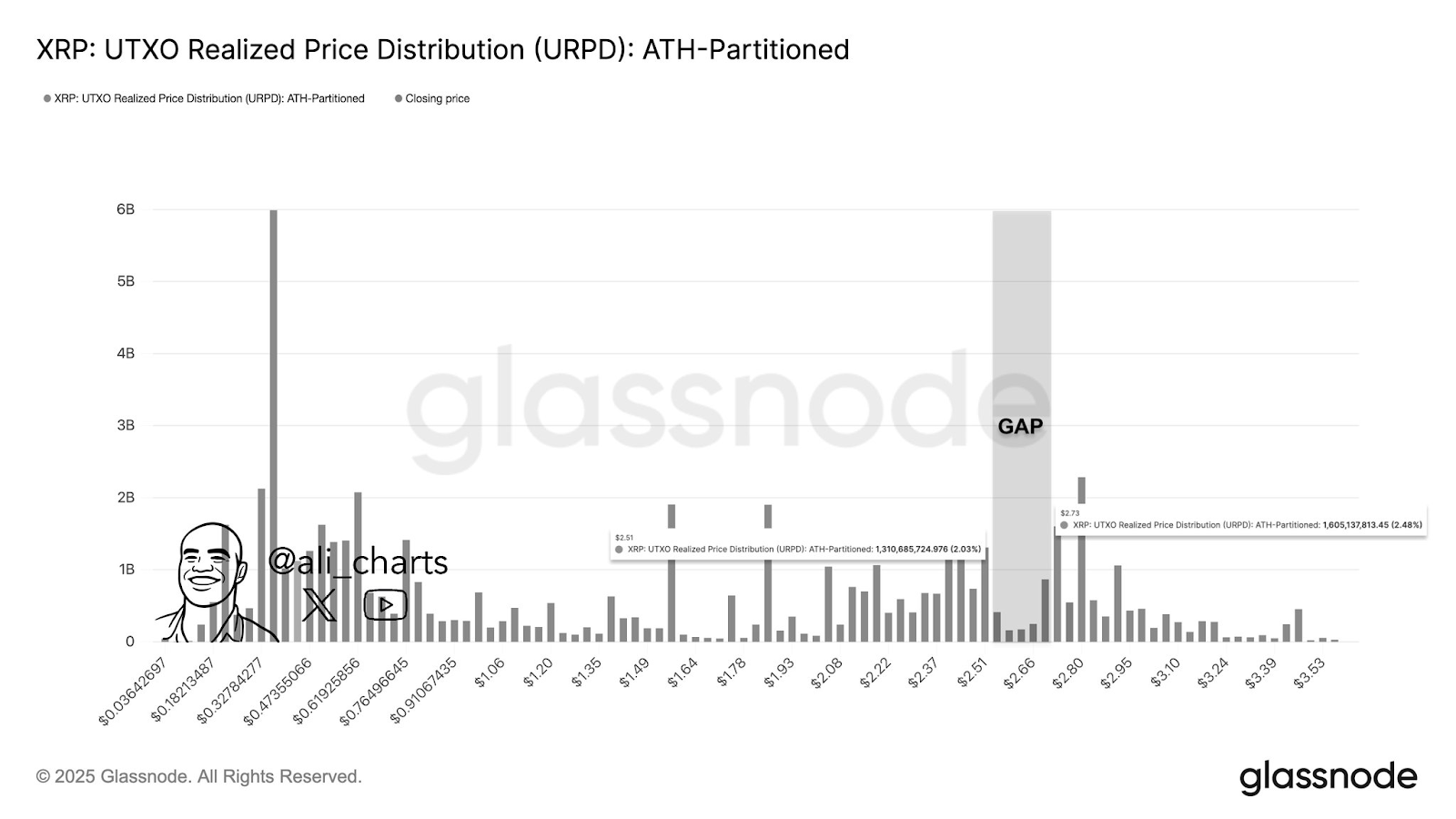

Crypto analyst Ali Martinez brought out an XRP chart showing a conspicuous UTXO Realized Price Distribution (URPD) gap between $2.51 and $2.73, based on Glassnode’s ATH-partitioned realized distribution.

That means very little on-chain coin activity has occurred in that band with fewer prior transactions priced there. This setup can be described as a “crucial price gap” under XRP’s current trading levels.

If XRP’s price is inside or just above this mismatch zone, then it becomes a resistance band as well as an area lacking strong buyer support beneath. Trader risk is that if momentum stalls, the gap may act like a vacuum.

Related: Eric Trump Urges ‘Buy the Dip’ as BTC, ETH, and XRP Recheck Support. Is Now the Chance?

$2.70 Is the Threshold XRP Must Defend

Right now traders are watching the $2.70 area as a critical hold point. If XRP falls back below that mark, it could slide toward $2.50 or further, because few buyers have historically transacted in that intervening gap.

So in a way, defending $2.71 in recent days may be essential to holding the breakout narrative.

What Does XRP Chart Analysis Show?

In the four-hour timeframe, the XRP price has formed an ascending symmetrical triangle. Following the correction during the past 2 weeks, the XRP price has been retesting the base for the triangular pattern during the past few days.

If XRP price is to regain its prior bullish momentum, the buyers must help it rally above the four-hour 100 Moving Average Simple (SMA), which currently hovers around $2.97. This is followed by supply zones around $3.14 and $3.20, levels that XRP must reclaim to revive bullish momentum.

XRP’s Climb to $3.20 Remains Contingent

For XRP to realistically push toward $3.20, it must first close above the gap zone and reclaim $3.00-$3.14. That will require real volume, not just fleeting wicks. Spot XRP ETF demand could help as regulatory clarity improves, inflows might give the extra push.

Spot XRP ETF Approvals Bodes Well for XRP’s Bullish Outlook

Earlier this month, the United States Securities and Exchange Commission (SEC) approved generic listing standards for crypto assets. Notably, the U.S. SEC has until mid next month to make its final decisions on over a dozen spot XRP ETF applications. On Friday, Cyber Hornet filed with the U.S. SEC for an S&P 500 and XRP ETF.

But even with XRP’s positive momentum from ETF approval, risk remains. If $2.70 fails, XRP could revisit $2.50 or weaker. The gap acts like an invisible pit; once you fall in, it’s harder to climb out.

Related: XRP Price Holds $2.67 Support as Traders Track Fed Catalysts and ETF Drivers for October

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/xrp-support-2-7-gap-must-hold-for-path-to-3-20/