- XRP price today trades at $2.78, consolidating between $2.70 support and $2.91–$2.93 EMA resistance.

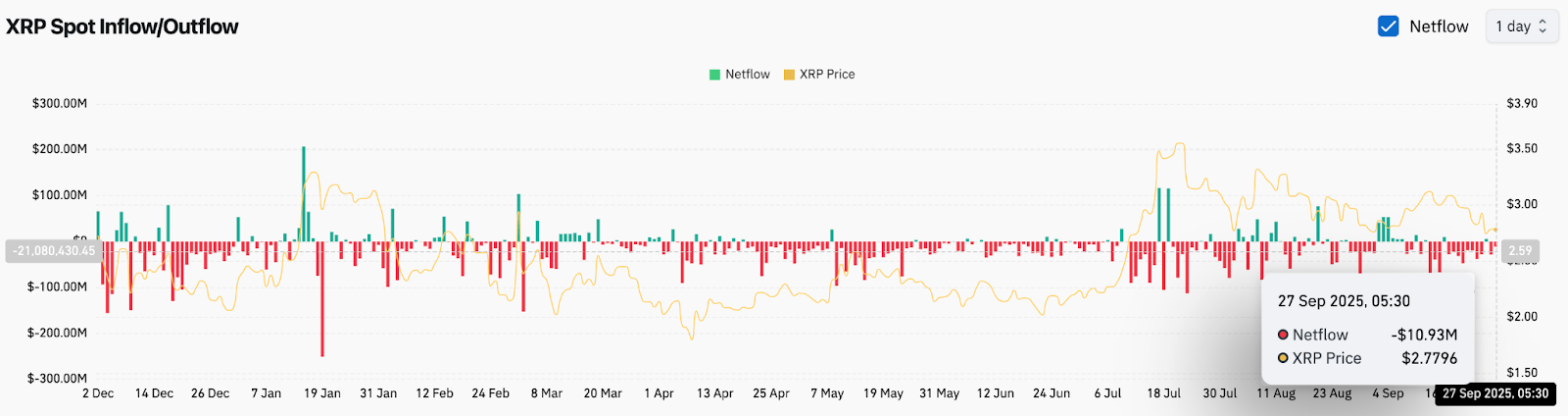

- $10.93M in net outflows highlight weak accumulation, with inflows above $25M needed to shift sentiment.

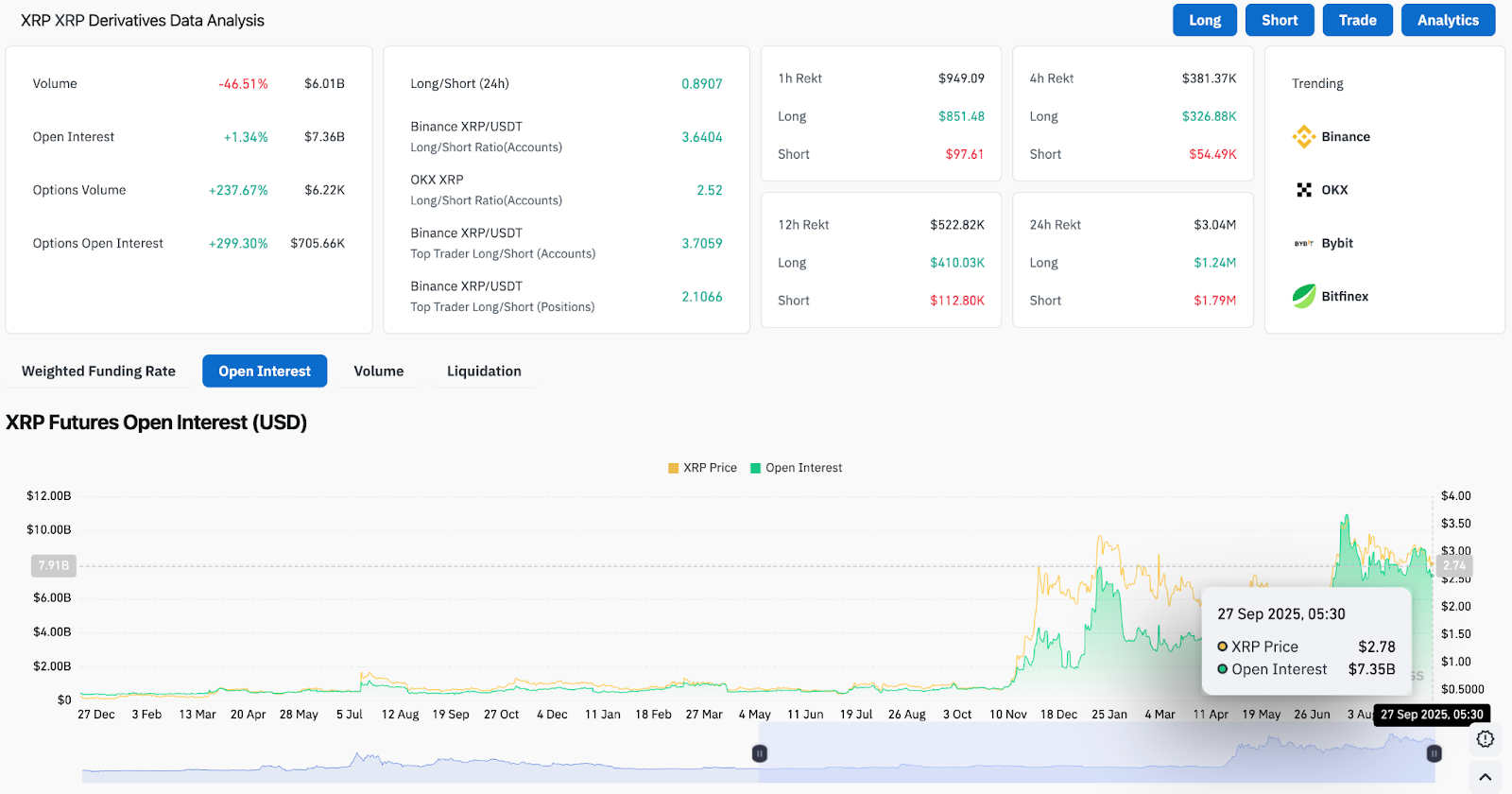

- Futures open interest rises to $7.36B, while options volume jumps 237%, signaling active but cautious positioning.

XRP price today is trading at $2.78, holding above a key support base after facing rejection at the $2.91–$2.93 resistance band. Sellers remain active near the 20-day EMA, yet buyers are attempting to anchor the market above the $2.70 floor. The immediate focus is whether XRP can reclaim the $2.91 level to reestablish momentum toward higher Fibonacci retracement zones.

XRP Price Stays Near Key Support

The daily chart shows XRP moving in a broader descending structure since July, with repeated failures around the $3.09–$3.20 Fibonacci cluster. Current price action is consolidating between the $2.70 support base and the $2.91 resistance zone.

The 20-day EMA at $2.91 remains the near-term barrier, while the 50-day EMA at $2.92 adds further weight to resistance. The 100-day EMA at $2.83 is being retested as short-term support. A loss of this level would increase downside pressure toward the 200-day EMA at $2.60.

Momentum indicators show limited conviction. The Parabolic SAR remains bearish, while RSI is hovering near 42, reflecting weak momentum without reaching oversold territory.

On-Chain Flows Show Persistent Outflows

Spot flows highlight ongoing selling pressure. On September 27, XRP recorded $10.93 million in net outflows, extending a multi-day streak of negative flows. These outflows point to traders moving tokens onto exchanges, typically signaling sell-side positioning.

The lack of strong inflows shows limited accumulation interest at current levels, despite XRP price holding the $2.70 zone. Analysts note that sustained inflows above $25–$30 million would be required to shift sentiment.

Derivatives Market Signals Cautious Positioning

Futures data reveals a mixed setup. XRP open interest rose 1.34% to $7.36 billion, showing that traders are keeping positions active even as spot volumes fell sharply by 46%. Options activity has surged, with a 237% jump in options volume and nearly 300% rise in open interest, reflecting hedging demand around current levels.

The long/short ratios on major exchanges remain above 2.0, with Binance accounts showing stronger bullish bias. However, liquidation data indicates that shorts are still exerting pressure in intraday sessions, keeping price capped below the $2.91 resistance.

Technical Outlook For XRP Price

The technical roadmap for XRP price shows clear levels:

- Upside targets: Reclaiming $2.91 would open the path toward $3.09 (Fibonacci 0.382) and $3.19 (Fibonacci 0.5). A breakout above $3.20 would shift focus toward $3.30 and $3.46.

- Downside risks: Failure to defend $2.70 could expose $2.60 at the 200-day EMA. A deeper breakdown would bring $2.50 and $2.36 back into play.

Outlook: Will XRP Go Up?

XRP remains at a pivotal point. On-chain flows show persistent selling pressure, while derivatives positioning reflects cautious but active participation. Technical charts highlight $2.70 as the key support floor and $2.91 as the breakout barrier.

Analysts suggest that as long as XRP holds above $2.70, the market bias remains neutral to slightly bullish. A decisive close above $2.91 would attract momentum buyers, potentially driving price back toward $3.19–$3.30. Conversely, losing $2.70 would risk deeper retracement toward the 200-day EMA.

For now, XRP price prediction hinges on whether inflows return to support a move above $2.91, or if persistent outflows push price into a new consolidation range near $2.60.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/xrp-price-prediction-xrp-holds-2-78-support-as-futures-open-interest-climbs/