- Ethereum price today trades near $3,992 after breaking below $4,035–$4,080 support, testing the 50-day EMA.

- $248M in ETF outflows, including $200M from BlackRock, highlight institutional selling pressure on ETH.

- Analysts see $3,850–$3,900 as a key support cluster, with RSI near oversold suggesting a possible cycle floor.

Ethereum price today stands at $3,992 after breaking below the $4,035–$4,080 support zone. Selling pressure has intensified since ETH failed to maintain footing above the $4,285 resistance, with momentum weighed down further by significant ETF outflows. The immediate test now lies at the $3,850–$3,900 support area, which will determine whether buyers can re-establish control or if the correction deepens.

Ethereum Price Holds At Critical Support

The daily chart shows ETH breaking down from its consolidation triangle and testing the 50-day EMA near $3,990. Immediate resistance lies at $4,080, followed by stronger supply at $4,216 and $4,285. A close above these levels would be required to revive bullish momentum.

The 100-day EMA at $3,854 is now the critical defense line. A loss of this level could open deeper retracements toward $3,500 and the 200-day EMA at $3,403. Momentum indicators highlight pressure, with RSI at 37 showing oversold tendencies but not yet triggering a strong bounce.

ETF Outflows Add To Selling Pressure

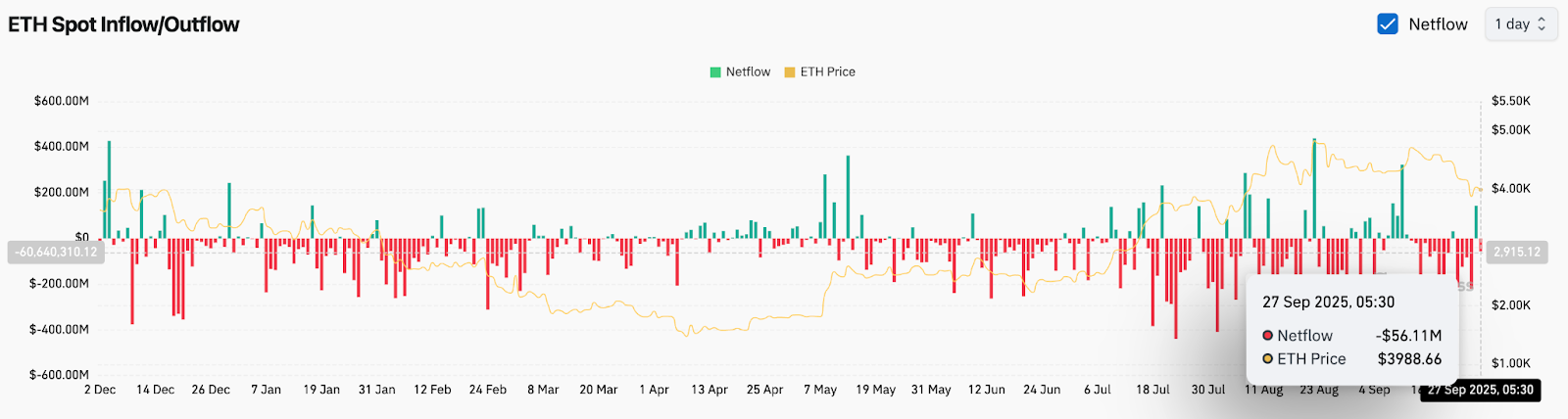

Flows data highlights the bearish tilt. On September 27, Ethereum recorded $56.1 million in net outflows across exchanges, signaling sustained selling activity. More notably, ETF products saw $248 million in outflows, with BlackRock alone unloading nearly $200 million in ETH holdings.

Such large-scale withdrawals undermine market confidence, suggesting institutions are reducing exposure rather than accumulating dips. Analysts caution that persistent outflows could extend the consolidation phase, especially if spot ETF redemptions continue.

Traders Highlight Cycle Lows

Despite the negative flows, some traders argue ETH may be nearing a cyclical floor. Popular analyst Jake Wujastyk pointed out similarities between current RSI patterns and previous bottom formations, suggesting ETH may be testing a key accumulation zone.

Historically, ETH has bounced after approaching the 100-day EMA in prolonged uptrends. If buyers defend the $3,850–$3,900 support, short-term recovery toward $4,200 remains possible. Still, conviction requires stronger inflows to offset ETF-related pressure.

On-Chain Data Shows Weak Participation

Exchange data further supports cautious sentiment. Netflows have leaned negative for weeks, with only brief inflow spikes quickly reversing. Open interest has also cooled, reflecting traders’ reluctance to commit aggressively.

This lack of sustained participation highlights the gap between retail enthusiasm and institutional positioning. Without clear evidence of inflows, ETH price action today remains vulnerable to further volatility.

Technical Outlook For Ethereum Price

Ethereum price prediction in the short term depends on whether the $3,850–$3,900 region holds.

- Upside levels: $4,080, $4,216, and $4,285 if momentum returns.

- Downside levels: $3,854, $3,500, and $3,403 as critical defense lines.

- Momentum: RSI near oversold but requiring confirmation through higher inflows.

Outlook: Will Ethereum Go Up?

Ethereum faces a tough balancing act between bearish ETF outflows and technical support levels. If buyers can hold above $3,850, a relief bounce toward $4,200–$4,285 remains in play. Losing that zone, however, risks a deeper correction toward $3,500.

For now, Ethereum price today reflects fragile sentiment. Institutional outflows dominate the narrative, while technical levels suggest a possible floor. Traders are watching closely to see if ETH can stabilize before sellers force another leg lower.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.