- Bitcoin price today trades near $109,700, holding above $109,000 support but capped below the $111K–$113.5K EMA cluster.

- BlackRock’s $66M Bitcoin purchase for its Global Allocation Fund signals growing institutional adoption.

- Net inflows of $58.49M show renewed accumulation, though futures open interest slips to $78.1B on cautious leverage.

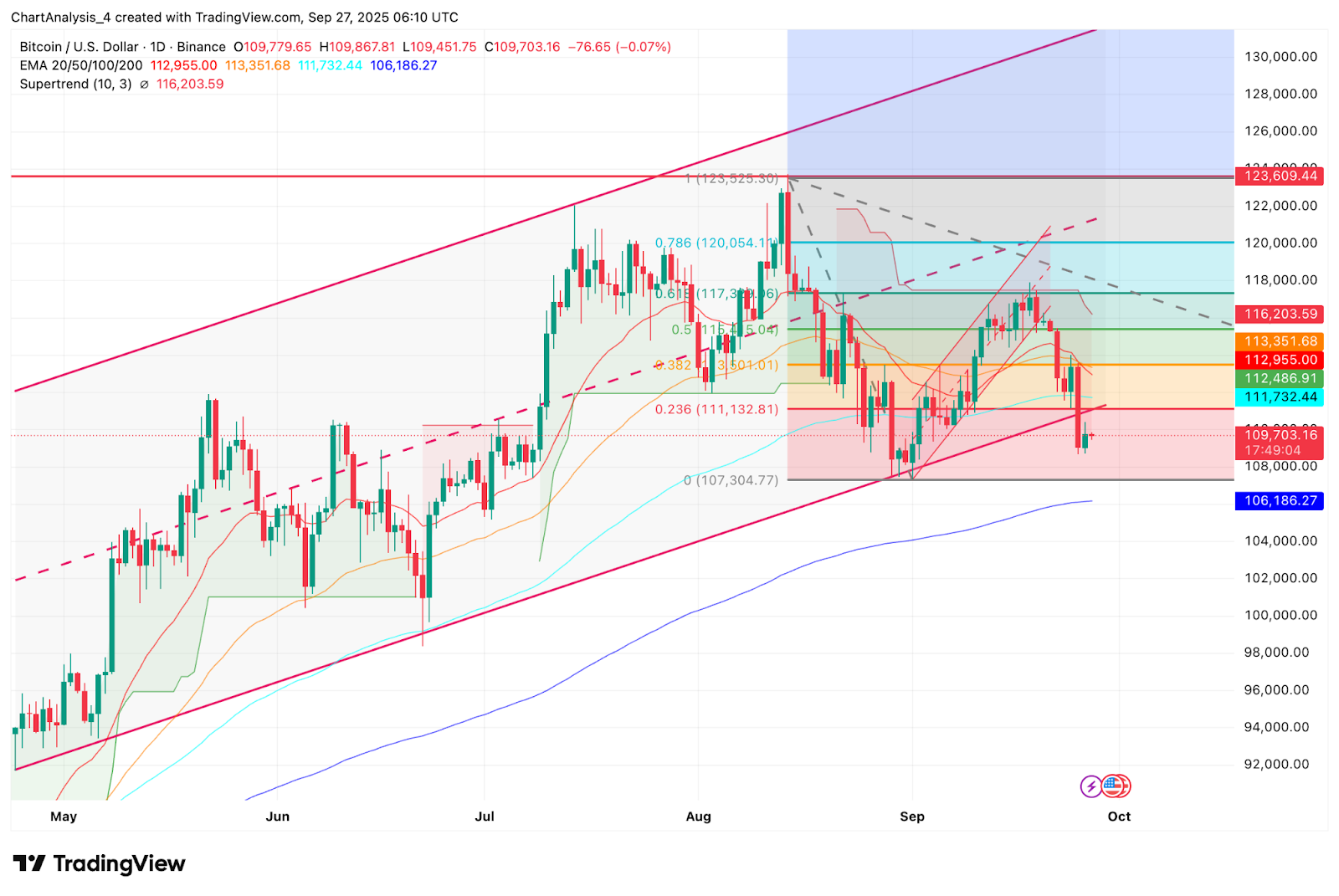

Bitcoin price today is trading near $109,700, struggling below the $111,000–$113,500 resistance cluster. Buyers are defending the $109,000 zone, but momentum has weakened after repeated failures to reclaim the EMA cluster. The market now weighs institutional inflows against fragile technicals.

Bitcoin Price Holds Key Support But Struggles With EMAs

The daily chart shows Bitcoin hovering around $109,700, with the 20-day EMA at $112,955 and the 50-day EMA at $113,351 forming a ceiling. Immediate support lies at $109,000, while deeper demand rests near $107,300, marked by the 0.236 Fibonacci retracement.

RSI signals remain neutral, highlighting a lack of conviction from either side. The Supertrend indicator continues to flash resistance at $116,200, aligning with the 0.5 Fibonacci level near $115,000. Unless buyers can reclaim $113,500, the broader setup risks sliding into a lower consolidation channel.

BlackRock Purchase Adds Institutional Tailwind

Market sentiment received a major boost after BlackRock purchased $66 million worth of Bitcoin for its Global Allocation Fund. This development underscores growing institutional adoption and adds credibility to the long-term bullish thesis.

Traders are watching whether BlackRock’s move will trigger copycat flows from other large asset managers. If sustained, such allocations could absorb supply faster than miner issuance, reinforcing the case for Bitcoin’s next breakout.

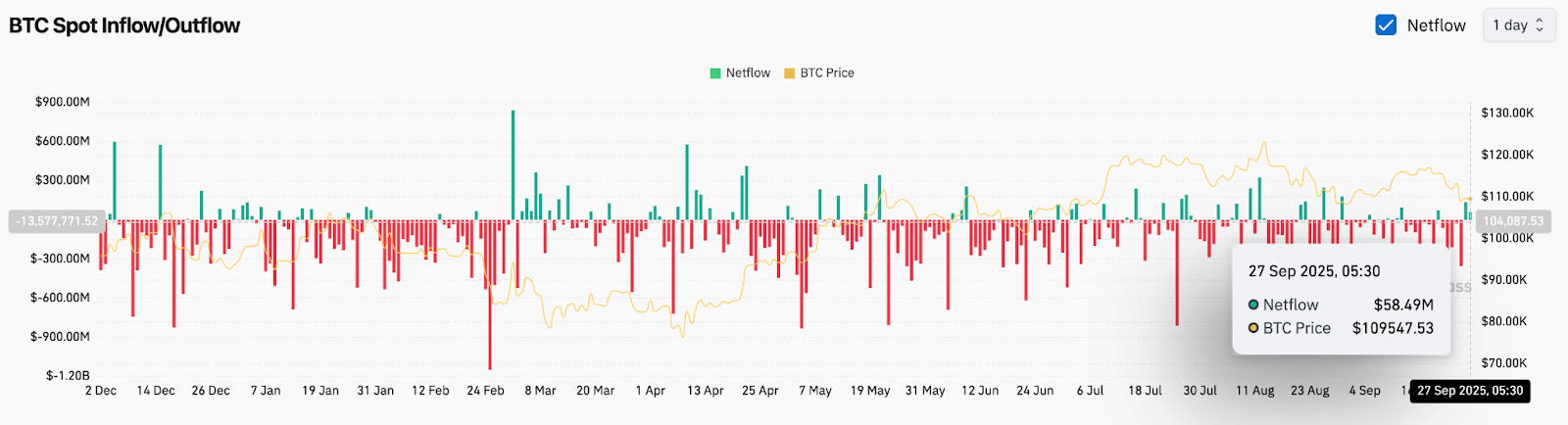

On-Chain Data Shows Positive Net Flows

Exchange data shows a $58.49 million net inflow on September 27, signaling renewed accumulation at spot levels. While weekly flows remain volatile, the pickup in deposits highlights improving demand after weeks of mixed activity.

Historically, inflows above $50 million often precede stronger upward pressure, provided they are sustained. However, analysts caution that a single-day spike is not enough to reverse the broader cooling trend unless accompanied by rising active addresses and consistent accumulation.

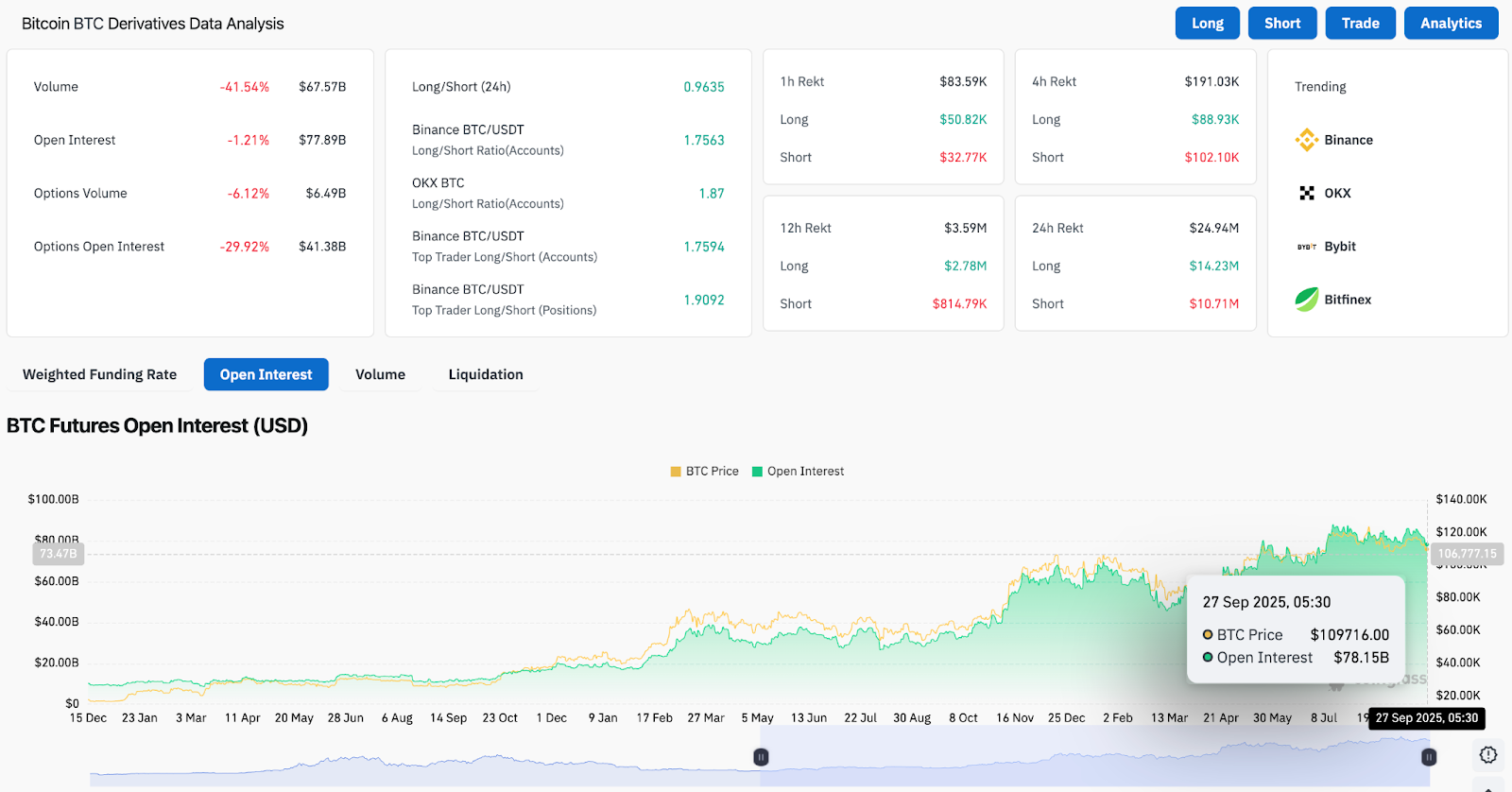

Futures Open Interest Reflects Cautious Leverage

Derivatives data highlights a soft backdrop. Bitcoin open interest has slipped to $78.1 billion, down 1.2% on the day. Options open interest also dropped nearly 30%, reflecting reduced speculative appetite.

Despite this, long/short ratios show a tilt toward bullish positioning, with Binance’s top trader accounts holding more longs than shorts. This suggests that while leverage is being pared back, conviction among large accounts remains intact.

Technical Outlook For Bitcoin Price

Bitcoin price prediction for the short term hinges on the $109,000–$107,300 support band. A clean defense here would allow buyers to regroup for another attempt at the $111,700–$113,500 EMA cluster.

- Upside levels: $113,500, $116,200, and $120,000 if momentum strengthens.

- Downside levels: $109,000 and $107,300, with deeper risks toward $106,000 if selling pressure builds.

Outlook: Will Bitcoin Go Up?

The outlook for Bitcoin remains finely balanced. Institutional buying from BlackRock provides a strong long-term narrative, but technical momentum is still capped by the EMA cluster. On-chain flows show early signs of recovery, though derivatives data reflects cautious leverage.

As long as Bitcoin holds above $109,000, analysts see room for another recovery attempt toward $116,000. A decisive close above $113,500 would validate this scenario, while losing $107,300 could shift focus back toward $106,000 and delay the next leg higher.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.