- BitMine accelerates Ethereum buying amid market downturn with 232,520 ETH purchase.

- Tom Lee’s leadership propels strategy mirroring MicroStrategy’s BTC approach.

- Potential for increased market volatility prompted by rapid ETH acquisition.

BitMine, chaired by Tom Lee, acquired approximately 232,520 ETH valued over $900 million during recent market declines through OTC and trading platforms like Coinbase and FalconX.

This massive ETH acquisition can influence Ethereum’s liquidity, volatility, and corporate treasury adoption strategies akin to MicroStrategy’s Bitcoin approach.

BitMine’s Strategic Shift: A $900 Million Ethereum Acquisition

BitMine’s accelerated Ethereum purchases, revealed by Arkham monitoring data, involve 232,520 ETH acquired through platforms like Coinbase and FalconX. Tom Lee leads BitMine’s strategic shift towards becoming an Ethereum treasury powerhouse, supported by institutional investors, including ARK Invest and DCG.

Market volatility has increased following BitMine’s intensified buying spree, causing total value locked (TVL) spikes and liquidity shifts. The purchases aim to strengthen BitMine’s holdings, signaling confidence in Ethereum amid declining prices.

Industry reactions have echoed optimism, with Cathie Wood’s ARK Invest backing BitMine’s strategy. Discussions on digital platforms reflect the community’s positive outlook, though concerns about transparency and future integrations remain prominent.

Ethereum is very unique because it is a smart contract platform and it’s censorship resistant and super resilient. … To build a treasury business on Ethereum means you can have a very positive influence … just like MicroStrategy, noted Tom Lee, Chairman of BitMine and Founder of Fundstrat.

Ethereum’s Market Analysis and Lessons from BitMine’s Strategy

Did you know? In September 2025, BitMine’s Ethereum holdings targeted 5% of all circulating ETH, a strategy historically seen with MicroStrategy’s Bitcoin, marking a significant step for corporate crypto treasury adoption.

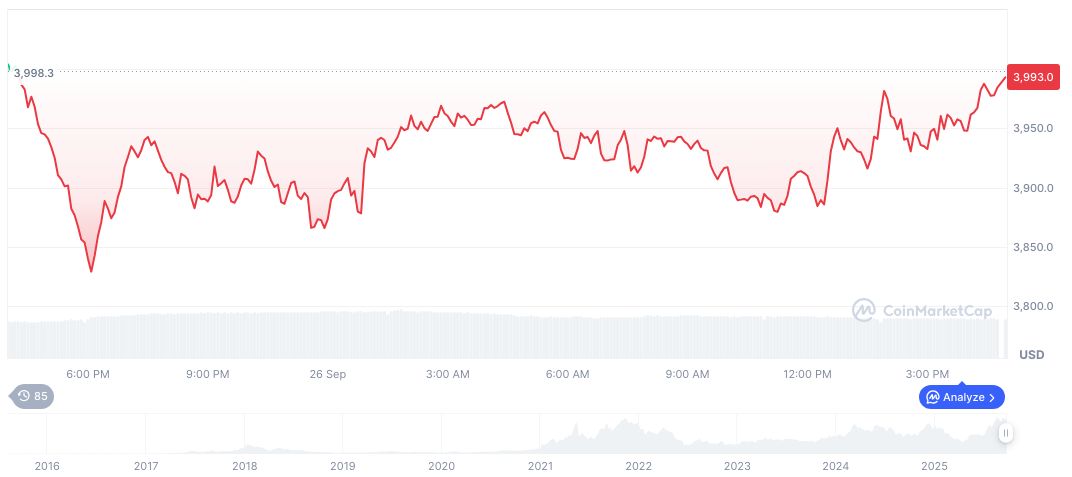

As reported by CoinMarketCap, Ethereum (ETH) trades at $4,011.63 with a market cap of 484.22 billion. The 24-hour volume is at 35.96 billion, reflecting a 41.81% decrease. ETH’s 90-day price shows a 63.33% increase, despite recent seven-day declines.

The Coincu research team suggests that BitMine’s Ethereum accumulation may encourage other firms to adopt similar treasury strategies, potentially prompting regulatory scrutiny. Expert insights highlight Ethereum’s growing appeal as a resilient, smart contract platform, although volatility remains a concern.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/bitmine-ethereum-purchase-2025-market/