- Ethereum treasury companies face valuation stress as mNAV drops below 1.

- Reduced equity issuance capacity hampers ETH accumulation.

- Might trigger asset sales affecting ETH price negatively.

On September 27, 2025, Ethereum treasury firms SharpLink, The Ether Machine, and ETHZilla reported mNAV ratios below 1, amid price weaknesses in ETH, revealing significant valuation stress.

This downturn may trigger forced asset sales, affecting governance token values and potentially impacting ETH’s market price.

Ethereum Treasuries’ mNAV Decline Sparks Financial Stress

The mNAV for major Ethereum treasuries SharpLink, The Ether Machine, and ETHZilla fell below 1, indicating valuation stress. SharpLink holds 838,730 ETH, The Ether Machine holds 495,360 ETH, and ETHZilla holds 102,240 ETH as of September 27. The low mNAV ratio restricts their ability to issue equity at a premium for ETH acquisition, impacting the treasury’s ETH accumulation process.

With mNAV below 1, the regular mechanism to bolster ETH holdings through premium equity issuance is halted. This shift can potentially lead to asset liquidation, negatively affecting the ETH value. Market participants express concern over this negative feedback loop, which might further reduce the secondary market for ETH.

Ethereum stakeholders and the broader community are closely monitoring these developments. As reported on-chain, there is increased governance activity as treasury managers seek restructuring solutions. Key figures like Joe Lubin, linked with SharpLink, highlight the necessity for innovative capital strategies to navigate this downturn.

“Ethereum treasuries must innovate on capital efficiency and staking composition to weather cyclical downturns.” – Joe Lubin, Founder, SharpLink

ETH Market Responses to Ongoing Treasury Liquidation Risks

Did you know? The fall of mNAV below 1 often indicates emerging market distress reminiscent of the 2022 altcoin cycles when various treasuries faced similar liquidation pressures, affecting liquidity and governance token values.

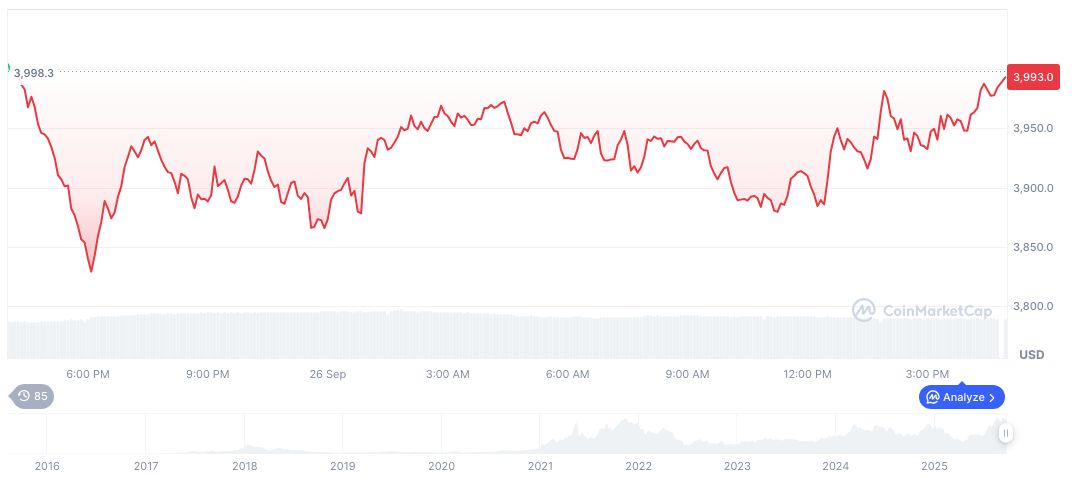

Ethereum (ETH) currently priced at $4,014.97, has a market cap of $484.62 billion and accounts for 12.83% market dominance, according to CoinMarketCap. Its 24-hour trading volume sits at $35.53 billion, reflecting a 38.23% decrease. Price has increased by 3.13% over 24 hours but decreased by 10.12% over the past week.

The Coincu research team highlights potential for increased liquidations and the need for strategic mitigation efforts among ETH treasury managers. Historical treasury market cycles and macro-economic data suggest further repercussions if mNAV distress persists. Regular industry evaluations and governance decisions will remain critical for stakeholders.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/ethereum/ethereum-treasuries-face-valuation-drop/