- XRP price today trades at $2.77, consolidating after dipping toward $2.74 with $2.60 as the critical defense.

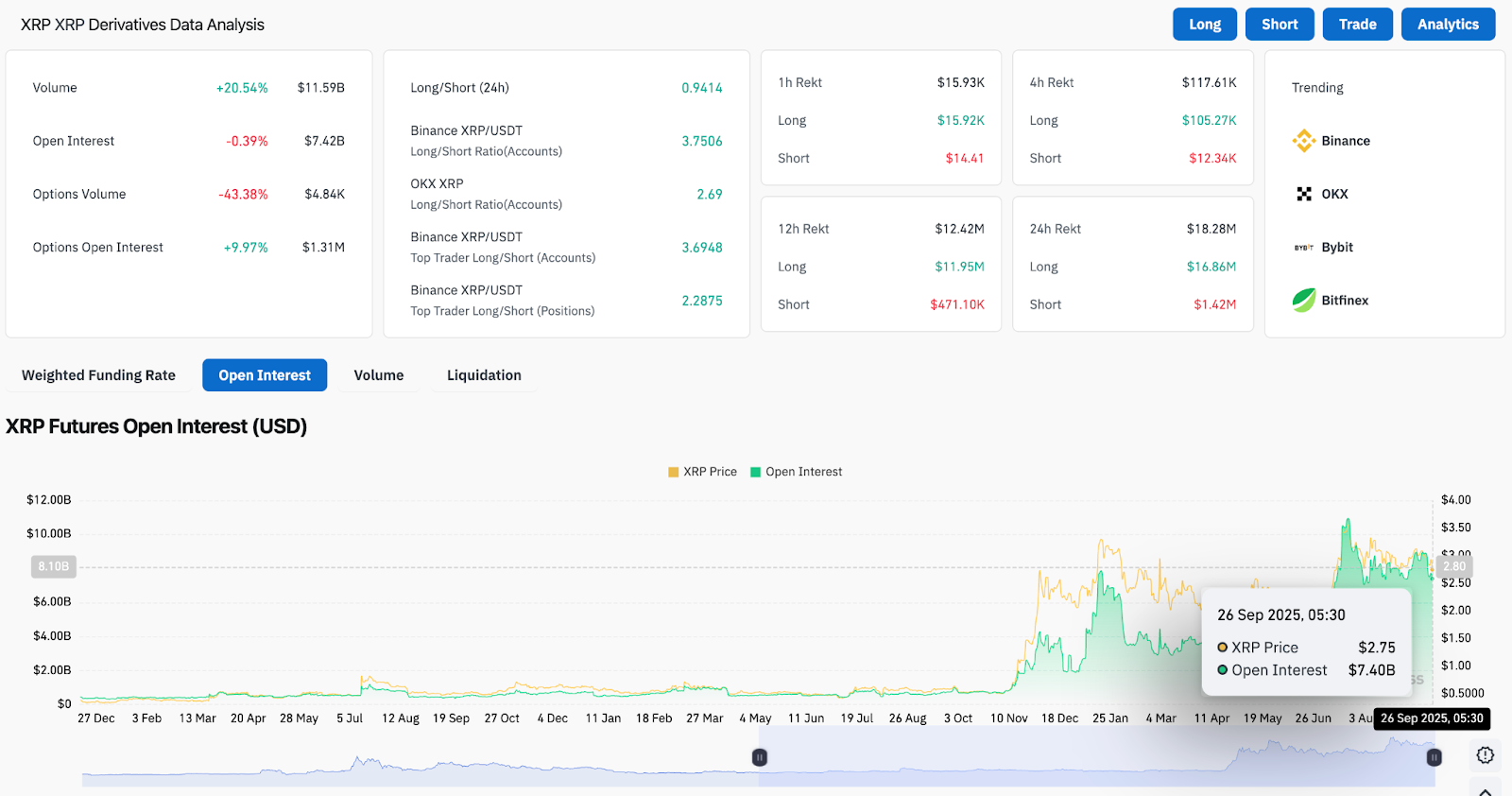

- Futures open interest slips to $7.4B as volumes jump, signaling cautious positioning in derivatives markets.

- Short-term charts show bearish bias, with sellers capping attempts to reclaim $2.89–$2.90 resistance.

XRP price today is trading near $2.77, holding just above the $2.75 zone after recent pressure pushed the token to a one-month low. Buyers are attempting to stabilize price around key Fibonacci levels, but sliding futures interest and bearish short-term signals leave the outlook cautious.

XRP Price Holds Near Critical Support

The daily chart shows XRP consolidating after dipping toward $2.74, just above the 200-day EMA at $2.60. Fibonacci retracement levels highlight $2.95 and $3.08 as the immediate resistance band, while $2.60 remains the most important support floor.

A sustained close below $2.60 would mark a major breakdown, exposing $2.40 as the next liquidity zone. On the upside, regaining $2.95 would ease pressure and open the door for a retest of $3.19 and $3.30. RSI at 39 reflects weak momentum, though not yet in oversold territory.

Related: Solana Price Prediction: SOL Struggles at $196 as Futures Interest Drops

Futures Data Highlights Cautious Positioning

Derivatives data shows open interest near $7.4 billion, slipping 0.39% over the past day even as trading volumes rose more than 20% to $11.6 billion. This divergence indicates rising short-term speculation without meaningful commitment in futures positioning.

Options activity was notably weak, with volume down 43%. Top trader ratios across Binance and OKX remain skewed toward longs, but the lack of fresh open interest suggests a cautious stance. Until conviction returns, XRP price action may continue to trade with fragile support.

Short-Term Charts Show Bearish Bias

The 1-hour chart underscores a persistent bearish structure. XRP remains capped below the Supertrend resistance at $2.85, with Parabolic SAR signals also aligned to the downside. Attempts to reclaim $2.89–$2.90 have repeatedly failed, confirming sellers remain in control.

Momentum across intraday timeframes remains muted, with price action locked under declining resistance levels. Only a decisive break above $2.90 would shift bias and suggest a short-term rebound is underway.

Technical Outlook For XRP Price

XRP price prediction in the near term revolves around the $2.60–$2.95 range.

- Upside levels: $2.95, $3.08, and $3.19 as immediate targets.

- Downside levels: $2.74 as minor support, $2.60 as the critical defense, and $2.40 if that breaks.

- Trend markers: 200-day EMA at $2.60 anchors the cycle.

Related: Dogecoin Price Prediction: Analysts Target $0.30 Amid Support Test

Outlook: Will XRP Go Up?

The immediate path for XRP depends on whether buyers can defend the $2.60–$2.74 region. Holding above this band could allow for a rebound toward $2.95 and $3.08, while failure would risk triggering a deeper correction.

Analysts remain cautious as futures positioning weakens and short-term charts lean bearish. A break back above $2.95 would improve sentiment, but until then, XRP’s outlook remains fragile with $2.60 as the key line in the sand.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/xrp-price-prediction-futures-data-highlights-cautious-positioning/