- Cardano price today sits at $0.82 after breaking below $0.84 support, with $0.80 as key defense.

- On-chain flows show $2.16M in net inflows, but conviction remains weak without stronger accumulation.

- Cardano advances RWA tokenization with London Stock Exchange-backed fund recorded on its blockchain.

Cardano price today is trading near $0.82, down from the $0.84 resistance level after sellers forced a break below key trendline support. The token’s latest slide has erased much of September’s recovery, leaving ADA pinned near its weakest levels in three weeks. The market now faces the question of whether on-chain demand and fresh fundamental catalysts can stabilize price action.

Cardano Price Breaks Key Support

The 4-hour chart shows ADA slipping beneath the rising channel that had guided its advance since early September. Sellers broke through the $0.84 level, which previously aligned with the 0.236 Fibonacci retracement and the 200-EMA. The move triggered a sharp drop toward $0.80, with only a modest rebound to $0.82 so far.

Related: XRP Price Prediction: Why Is XRP Going Down?

Momentum indicators highlight the pressure. RSI sits near 35, reflecting bearish conditions, while the 20-EMA remains well below the 50-EMA and 100-EMA, keeping downside bias intact. If ADA fails to reclaim $0.84, traders warn of deeper tests near $0.78 and $0.75. On the upside, the $0.87–$0.90 area is now the first major supply zone to watch.

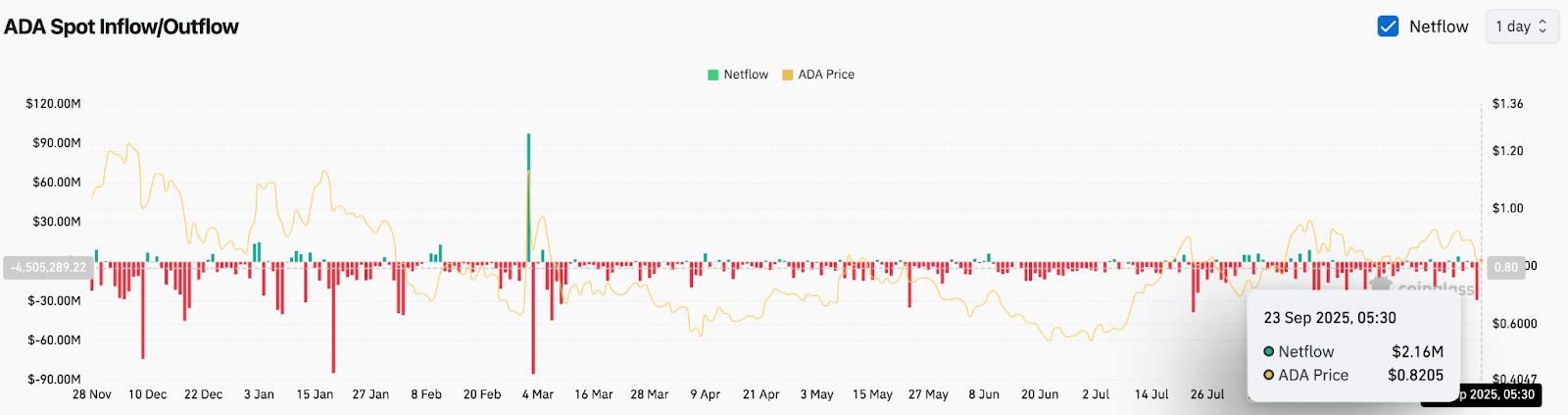

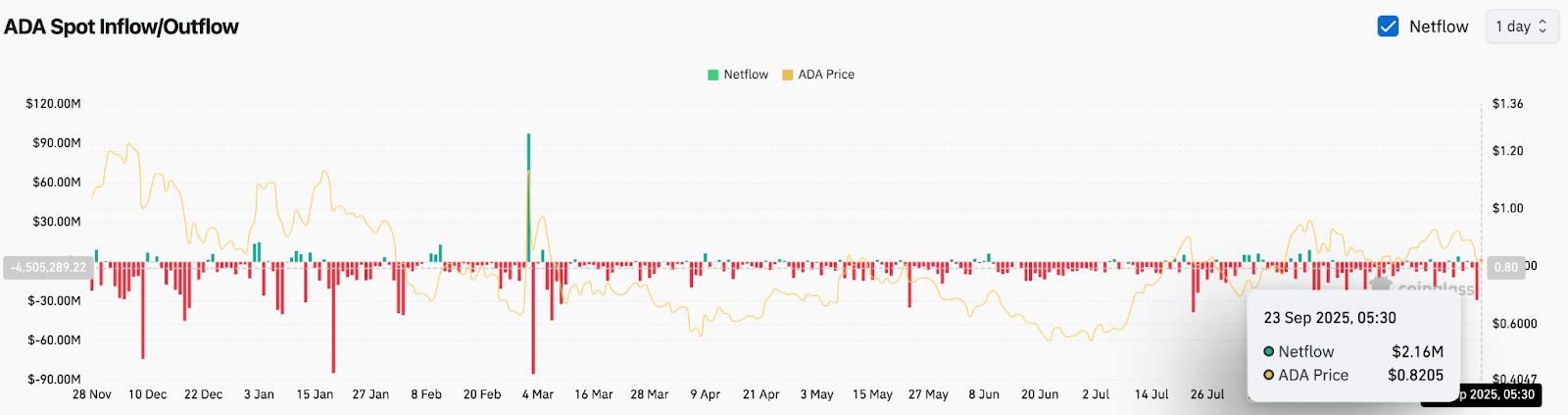

On-Chain Data Shows Modest Inflows

Spot exchange flows reveal cautious optimism despite recent weakness. Data from September 23 shows a $2.16 million net inflow into ADA, a reversal after persistent outflows earlier in the month. While small in scale, this suggests selective accumulation near the $0.80 level.

Still, conviction remains fragile. Net flows throughout the quarter have leaned negative, reflecting hesitant demand. Analysts caution that without sustained inflows above $10–$15 million, ADA price action may struggle to maintain upward momentum.

Derivatives Market Signals Caution

Cardano derivatives data underscores the cautious stance. Futures open interest has declined 3.5% in the past 24 hours to $1.51 billion, with total trading volume down more than 32%. Options activity has nearly dried up, with volumes plunging over 90%.

While the long/short ratio on Binance remains skewed bullish at 3.17, this is driven by smaller positioning rather than aggressive new bets. Liquidations remain modest, showing that most traders are avoiding leveraged exposure until ADA price establishes clearer direction.

Cardano Advances In RWA Tokenization

Fundamentally, Cardano continues to secure high-profile use cases that could provide long-term support. On September 22, the London Stock Exchange Group welcomed Members Capital Management to celebrate the launch of its flagship MCM Fund I. The fund was the first institutional-grade reinsurance product to be tokenized on LSEG’s Digital Markets Infrastructure and recorded on the Cardano blockchain.

Archax oversaw the tokenization process, while the Cardano Foundation provided support. CEO Frederik Gregaard hailed the milestone as proof of Cardano’s ability to deliver compliant, secure, and resilient infrastructure for real-world asset tokenization.

Related: Avalanche (AVAX) Price Prediction: Will AVAX Hit $50 Soon?

This follows earlier partnerships where EMURGO, a co-founding entity of Cardano, supported gold-backed token issuance and continues to push for tokenized U.S. bonds, private credit, and insurance factoring. The steady stream of RWA adoption highlights Cardano’s expanding utility even as price action lags.

Technical Outlook For Cardano Price

Cardano price prediction for the short term remains tilted toward downside risk unless buyers reclaim lost ground. Immediate support rests at $0.80, followed by $0.78 and $0.75 if bearish pressure extends. On the upside, resistance lies at $0.84, with stronger barriers at $0.87 and $0.90 near the 0.382 Fibonacci retracement.

As long as RSI stays suppressed and EMAs maintain bearish alignment, ADA may remain under pressure. A decisive break above $0.87 would be required to signal a shift in trend momentum.

Outlook: Will Cardano Go Up?

Cardano’s outlook hinges on whether accumulation at the $0.80 level can offset weak technicals. On-chain inflows and institutional tokenization milestones provide a constructive long-term backdrop, but derivatives data shows traders remain cautious in the near term.

If ADA price today holds above $0.80 and inflows strengthen, analysts see potential for a rebound toward $0.87–$0.90. Failing this, the risk of a deeper pullback toward $0.75 remains. For now, Cardano remains caught between promising fundamental progress and near-term technical weakness.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/cardano-price-prediction-ada-stalls-below-0-84-amid-rwa-tokenization-hype/