Key Takeaways

Why is TRON’s network activity rising?

TRON recorded 9–10 million daily transactions, $25 billion in USDT transfers, and 15.1 million Active Accounts, signaling broad usage despite price weakness.

What explains TRX’s bearish trend?

Spot Taker CVD data showed sellers dominated with -35 million Delta, suggesting pressure could push TRX toward $0.32 unless sentiment reverses.

Since hitting $0.35 four days ago, TRON [TRX] showed short-term weakness. Over this period, the altcoin dropped sharply, hitting a low of $0.335.

In fact, at press time, TRON traded at $0.336, marking a 3.03% drop on daily charts and a 3.96% decline on weekly charts.

Despite this weak market performance, TRON’s network activity remained relatively strong.

TRON Network hits new baseline

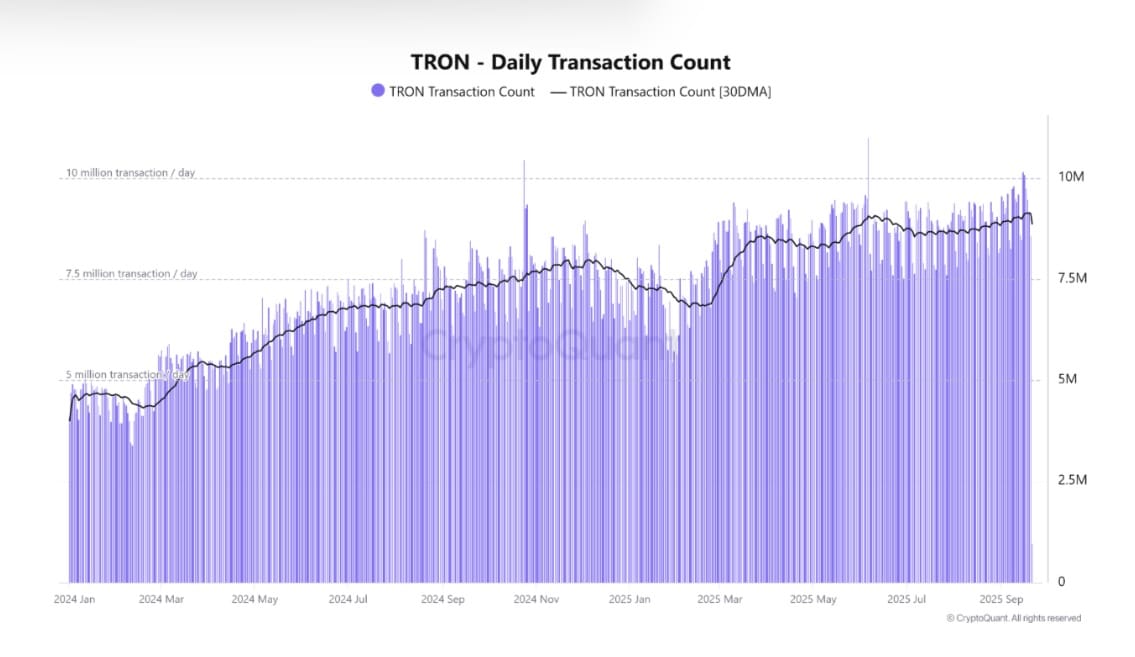

According to CryptoQuant, the number of Daily Transactions on TRON ranged between 9 and 10 million throughout September.

As such, the 30-day moving average (30DMA) indicated that the network has consistently recorded over 9 million daily transactions, marking a 20% increase from January.

Source: CryptoQuant

Such a substantial uptick in transactions suggests that the network growth is primarily driven by increased usage, a clear sign of rising adoption.

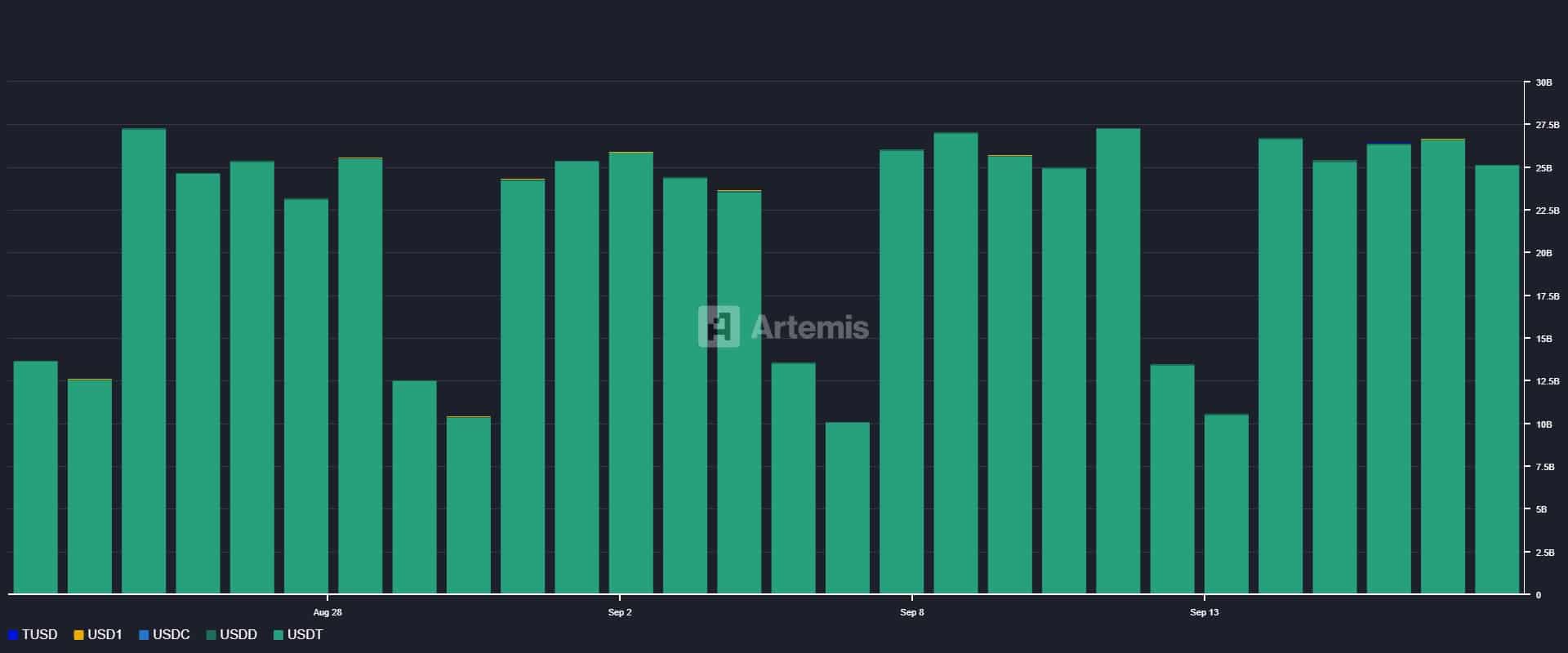

Stablecoins played a key role. USDT transfers on TRON formed a baseline of $25 billion in Transaction Volume, according to Artemis data.

Source: Artemis

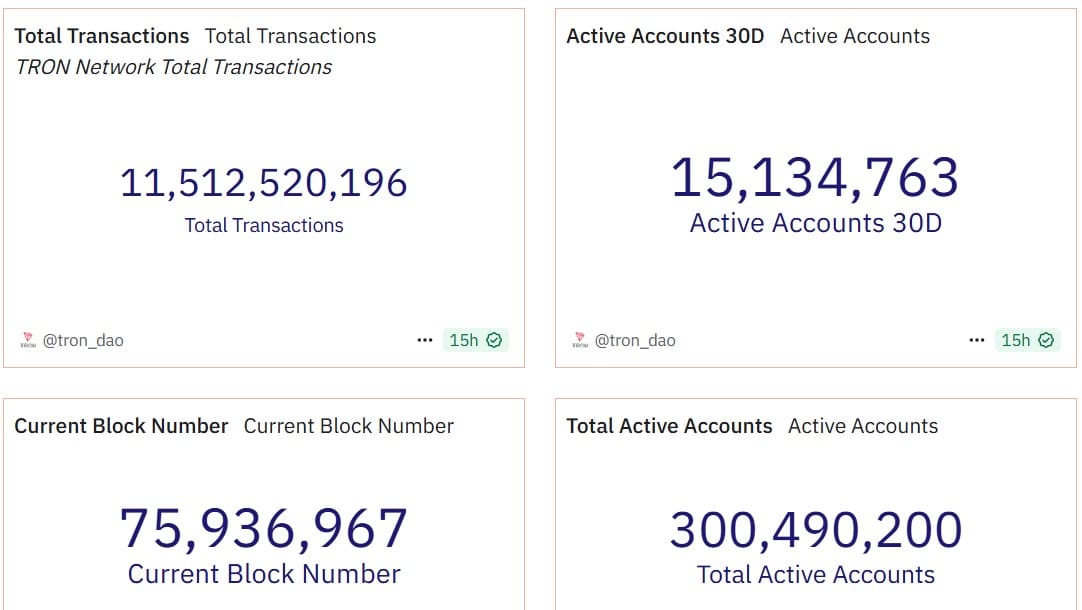

On top of that, TRON’s Active Accounts (30D) also recorded sustained growth, hitting 15.1 million. At the same time, the network’s Total Accounts have surged to 300.4 million.

Source: Dune

Such spikes in active users alongside transactions acts as a clear sign of organic network growth.

Retention concerns remain

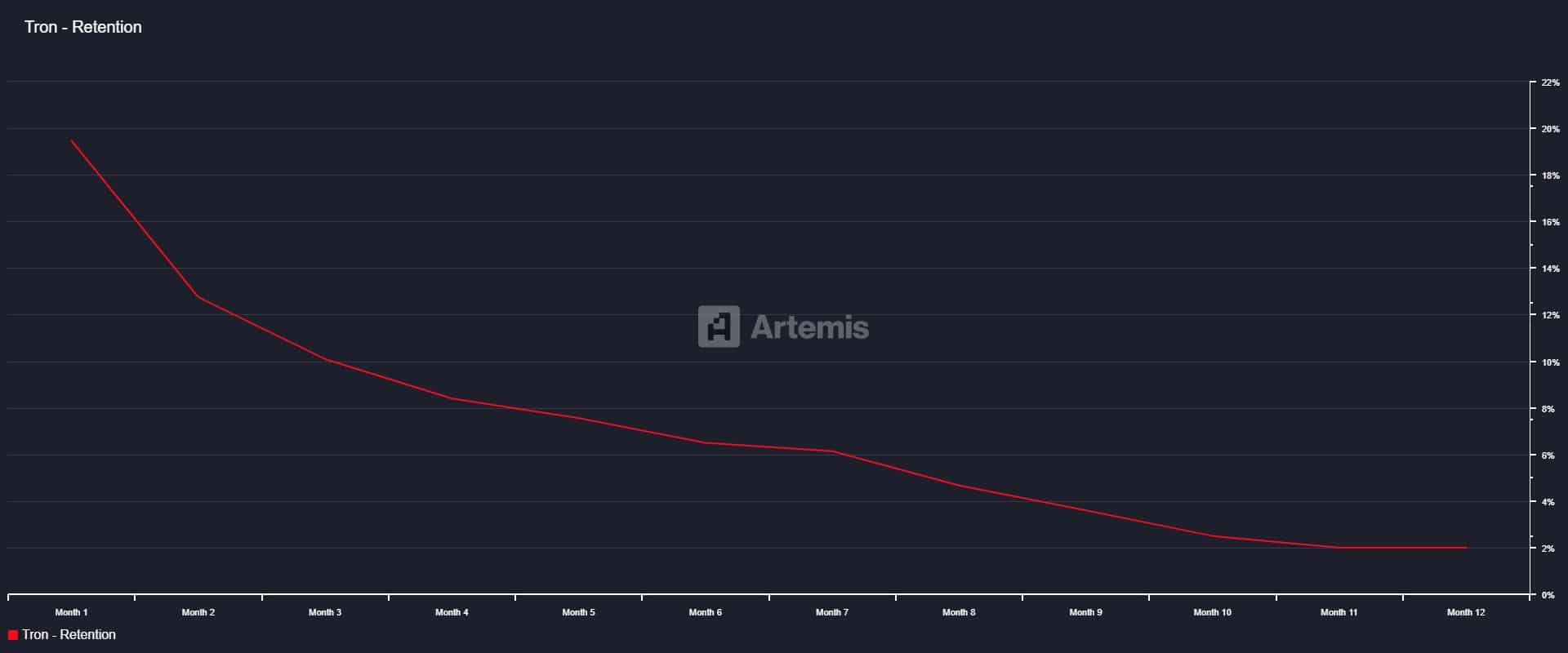

Surprisingly, while the TRON network recorded increased usage, retention was still a significant issue.

AMBCrypto observed that most users entered the network but disappeared shortly after. According to Artemis, TRON’s Monthly Cohort Retention Rate fell from 19% to 2% at press time.

Source: Artemis

This implies that fewer users have consistently returned every month, thus new users churn fast, with only a small committed base sticking around.

Take the May 2025 cohort, for example. The month saw 6.2 million entrants, but only 12% remained by August 2025.

Impact on TRX market

Interestingly, while TRON’s activity continued to rise, this had not translated into bullishness among TRX investors.

On the contrary, TRX investors have turned bearish, and their spending has soared significantly. Spot Taker CVD data showed that sellers dominated the market over the past week.

Source: CryptoQuant

When the Spot market indicates Seller dominance, it means more sell orders executed than buy orders. A negative Spot Buy Sell Delta confirmed this.

As per Coinalyze, TRX saw 206 million in Sell Volume compared to 171 million Buy Volume, creating a -35 million Delta in 24 hours.

Source: Coinalyze

Historically, a higher selling activity in the Spot market has preceded lower prices. Thus, if sellers continued to dominate, TRX could drop further to $0.32.

Even so, if strong network usage translated into bullish sentiment, TRON might rebound toward $0.35 resistance.

Source: https://ambcrypto.com/trons-9-mln-daily-transactions-fail-to-lift-trx-heres-why/