- Ethereum price today trades at $4,096 after a sharp breakdown below $4,300 support, testing the $4,000–$3,950 zone.

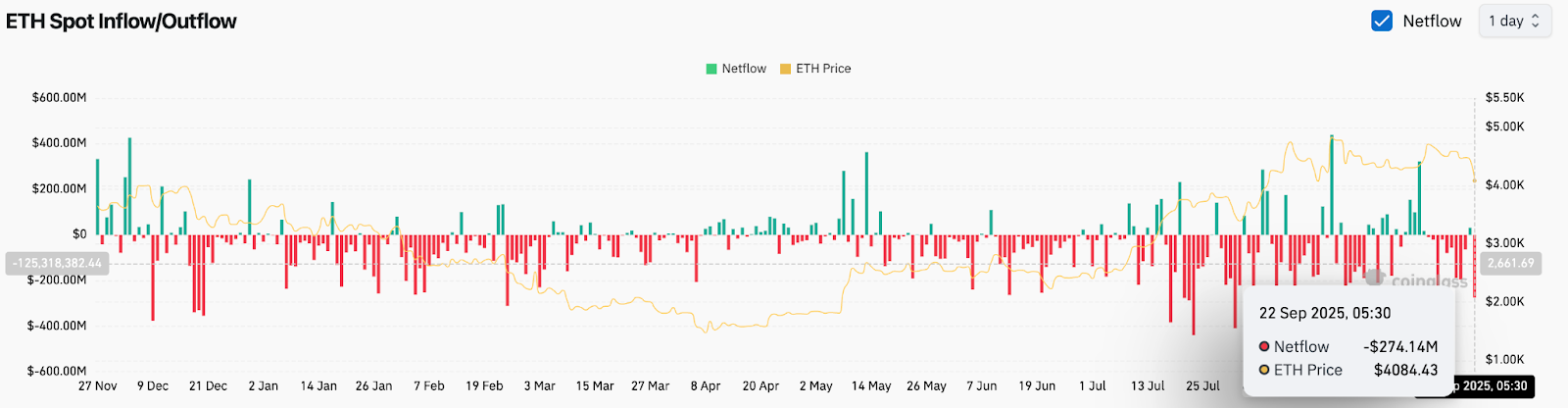

- On-chain data shows $274M in net outflows on September 22, one of the largest single-day withdrawals this quarter.

- Ethereum ETF inflows hit $1.12B last week, with BlackRock leading accumulation despite bearish spot flows.

Ethereum price today is trading near $4,096, down almost 5% after a sharp selloff broke below $4,300 support. The move came despite strong ETF inflows last week, highlighting a clash between institutional accumulation and heavy spot exchange outflows.

Ethereum Price Breaks Key Support

The 4-hour chart shows ETH collapsing below the $4,300–$4,350 demand zone, triggering stops and sending price to a low of $4,096. This drop cut through the 20-day EMA at $4,440 and the 50-day EMA at $4,473, leaving the $4,665 resistance as a distant hurdle.

Trend support now sits lower near $4,000–$3,950, with deeper demand zones around $3,800 and $3,600 if sellers remain in control. On the upside, buyers will need to reclaim $4,440 and $4,537 to stabilize momentum.

Related: Solana (SOL) Price Prediction For September 23

Parabolic SAR dots remain above price, signaling bearish continuation. Momentum is tilted lower, though the broader 200-day EMA at $3,992 continues to act as a long-term pivot for ETH price action.

On-Chain Flows Show Heavy Outflows

Exchange data from Coinglass paints a bearish picture. On September 22, Ethereum recorded net outflows of $274 million from spot exchanges, one of the largest single-day withdrawals this quarter. Persistent negative netflows have created liquidity pressure, explaining why Ethereum price volatility spiked during the latest breakdown.

The flows suggest large holders are de-risking positions after the $4,700 rejection, even as institutional buying persists through ETFs. Without a reversal in on-chain trends, the downside risk toward $3,950 remains elevated.

ETFs Deliver Strong Inflows

Despite bearish spot flows, ETFs continue to act as a buffer. Data shows Ethereum ETFs absorbed over $1.12 billion last week, led by BlackRock’s share of the $2.3 billion combined BTC and ETH inflows. This institutional wave marks one of the strongest weeks since July, highlighting growing investor appetite.

Related: Dogecoin (DOGE) Price Prediction For September 23

Analysts point out that consistent ETF demand could help offset exchange-driven weakness. If sustained, this structural shift may limit downside and prepare the market for another breakout once spot sellers exhaust supply.

Technical Outlook For Ethereum Price

Ethereum price prediction for the near term hinges on reclaiming key moving averages:

- Upside levels: $4,300, $4,440, and $4,665 as immediate resistance zones. A break above $4,665 would open the door to $4,820 and $5,000.

- Downside levels: $4,000, $3,950, and $3,800 as major defense zones. Losing $3,800 would risk a deeper pullback toward $3,600.

- Trend support: The 200-day EMA at $3,992 remains the structural floor for ETH price action.

Outlook: Will Ethereum Go Up?

Ethereum’s outlook depends on whether ETF inflows can outweigh the heavy spot outflows that drove the latest breakdown. As long as ETH holds the $3,950–$4,000 region, the broader bullish cycle remains intact. A decisive close back above $4,440 would restore confidence and invite momentum traders to target $4,665 and beyond.

Related: Avantis Price Prediction: Can AVNT Sustain Momentum After $10M Spot Inflows?

For now, traders face a tug-of-war between institutional accumulation and exchange-driven liquidation. Ethereum price today is under pressure, but sustained ETF inflows suggest that any stabilization above $4,000 could set the stage for another rebound toward $4,700 in the coming weeks.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/ethereum-eth-price-prediction-for-september-23-2025/