- The TD Sequential has flashed a buy signal for XRP and has shown strong accuracy on its higher timeframes since 2022.

- Key catalysts like ETF approvals and volume spikes have amplified XRP’s rebounds.

- Despite past success, analysts advise confirming the signal with other indicators.

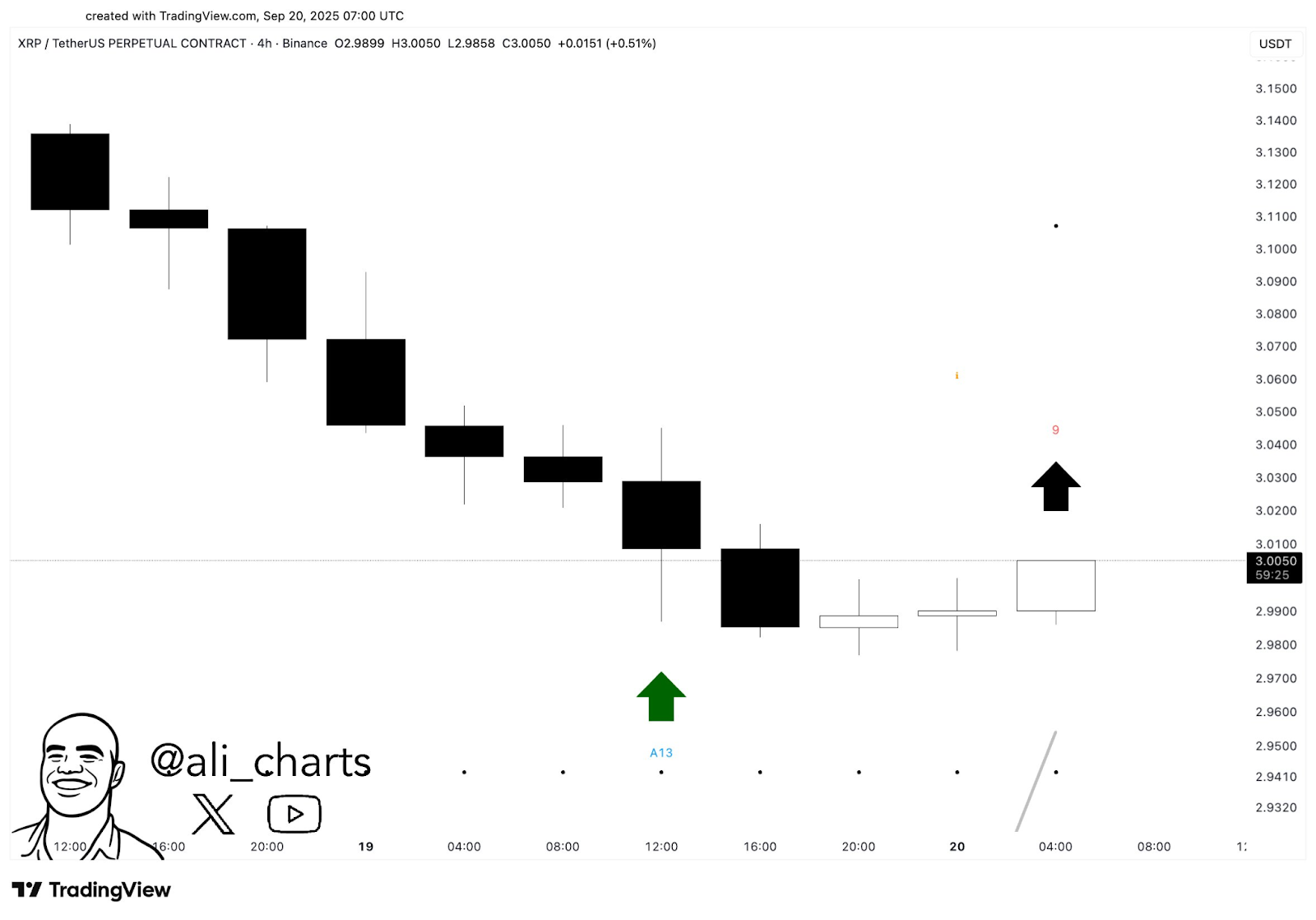

The XRP 4-hour chart has just triggered a classic TD Sequential buy setup, a signal that often indicates the end of a downtrend. This pattern forms after nine consecutive candles close lower than the candles four periods earlier.

Traders typically watch for this signal as an early indication that selling pressure may be easing and a rebound could follow.

XRP is Now a “Buy”

Notably, the latest buy signal comes after XRP has hovered around $3 with little progress for several weeks. Analyst Ali Martinez highlighted this development in a tweet yesterday, informing his followers that XRP is now a “buy.”

This suggests that those entering the market now may soon see profits from their positions, as an upside breakout appears overdue.

To support this outlook, XRP advocate Bill Morgan pointed to the strong track record of accurate buy calls from the TD Sequential indicator. Specifically, he referenced statements from the X platform’s Grok AI.

Related: XRP ETFs and CME Options: Is Wall Street Finally Paying Attention?

Strong Track Record on Higher Timeframes

AI platform Grok noted that since 2022, the TD Sequential has proven “highly accurate” on longer-term XRP charts. On the 2-week timeframe, buy signals preceded major rallies in three out of four instances.

Grok added that weekly signals have been about 65% reliable. Historical backtests from 2017 to 2024 show a 60–70% success rate, significantly better than random chance.

Catalysts That Can Strengthen the Signal for XRP

Furthermore, Grok pointed out that past rebounds were strongest when the buy signal appeared near key support zones, such as around $0.50 in 2024 and $2.70 in 2025. Volume spikes and bullish news, like ETF approvals or major Ripple announcements, have also amplified reversals.

Wealth manager Nate Geraci predicts a “wild” few months for XRP as major ETF developments unfold. REX Shares recently launched the first U.S.-listed ETFs offering spot exposure to XRP (XRPR) and Dogecoin (DOJE). Simultaneously, the SEC approved Grayscale’s multi-crypto fund, which also includes XRP.

Related: First Spot XRP ETF Goes Live, XRPR Structured Under 1940 Act; XRP Holds $3.10

The SEC faces October deadlines for over 10 spot XRP ETF applications, with analysts estimating a 95% chance of approval. Combined with the recent ETF launches, this momentum has sparked bullish sentiment, with some forecasting XRP could triple in value.

Not a Guarantee

Despite its track record, the TD Sequential is not foolproof. A mid-2023 buy signal failed amid regulatory uncertainty, resulting in a 5% drawdown.

Analysts recommend pairing the indicator with additional confirmations, such as bullish candlestick patterns or a MACD crossover, before taking positions.

With XRP now flashing a fresh buy signal, traders will be watching closely to see if history repeats itself and a new bullish phase unfolds.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/xrp-buy-signal-flashes-history-backs-70-chance-of-major-price-rally/