Key Takeaways

What is happening with Bitcoin?

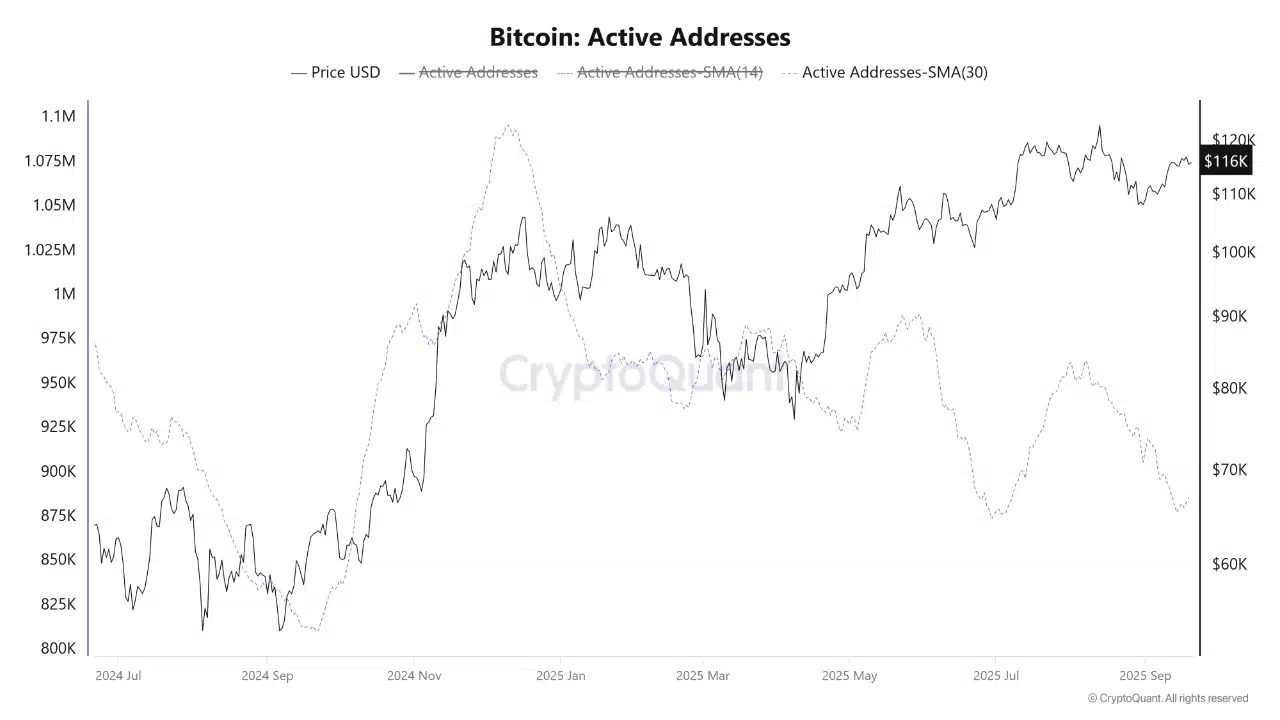

Long-term holders are selling, and active addresses are at an 11-month low despite high transaction counts.

Why could Bitcoin be at risk of a correction?

Surging low-quality, speculative transactions hide weakening fundamentals, making the rally potentially unsustainable.

Bitcoin [BTC] may be holding steady near $115K, but the actual picture looks less convincing.

LTHs are cashing out, and active addresses have slipped to their lowest point in almost a year. At the same time, a surge in small, speculative transactions is keeping activity numbers from falling even further.

Are we about to see BTC fall?

Smart money out the door?

One of the clearest warning signs for Bitcoin right now is the spike in Coin Days Destroyed (CDD). This is a metric that tracks when long-held coins move.

The 30-day MA has climbed to its highest level in 18 months, showing that LTHs are selling into strength.

Such behavior near price peaks is usually a sign of distribution, where seasoned investors exit while newer entrants keep buying.

Source: CryptoQuant

This shift doesn’t show profit-taking. Rather, it is indicative of a concern that the rally is losing support from its strongest base. Without LTHs backing the trend, Bitcoin’s price looks increasingly fragile.

Speculative activity skews the data

Source: CryptoQuant

Active addresses have dropped to an 11-month low, even as transaction counts soared to YTD highs.

Source: CryptoQuant

At first glance, the spike in activity looks bullish, but it’s largely an illusion. Much of this surge is fueled by speculative protocols like Runes, where bots and a handful of users generate thousands of tiny transactions.

This kind of low-quality traffic inflates network data without adding real adoption or meaningful value transfer.

What you need to look at

The warning signs make us look at BTC’s key levels.

Source: Alphractal

The $117K zone has already proven to be strong resistance.

Source: Alphractal

According to Joao Wedson, CEO, Alphractal, a breakout above $118.6K would confirm fresh buying momentum and potentially trigger another leg higher.

On the flip side, losing $113.7K could expose the market to deeper downside, with $110K and even $104K-$100K as possible targets.

These levels may ultimately dictate whether Bitcoin sustains its rally or slides into a sharper correction.

Source: https://ambcrypto.com/is-bitcoins-bull-run-ending-what-to-expect-as-cracks-start-to-show/