- $153 million in short and long positions liquidated.

- Increased market volatility amid mass crypto liquidations.

- BTC and ETH face major liquidation impact.

Coinglass data indicates that within the past 24 hours, the cryptocurrency market experienced liquidations totaling $153 million, with $51 million in long positions and $102 million in short positions.

This liquidation event underscores ongoing market volatility, emphasizing risk for traders utilizing leverage. Top exchanges like Binance and Bybit are integral to these transactional activities.

Crypto Markets See $153 Million in Liquidation Frenzy

Coinglass reported a $153 million liquidation across cryptocurrency markets, comprising $51.1324 million in long positions and $102 million in short positions. Major exchanges such as Binance and Bybit were centers of these fluctuations. BTC accounted for $17.6445 million, while ETH saw $17.8983 million liquidated, illustrating their vulnerability in this event.

Increased market volatility resulted in substantial Bitcoin and Ethereum positions being cleared. The Open Interest remains notably high at over $220 billion, indicating the level of exposure and leverage within the market.

There is a noticeable absence of official responses from key market figures such as CEOs of major exchanges, but Coinglass warns of potential further “high leverage liquidity” events. Trader reaction on social platforms reflects cautious optimism and a watchful stance on market developments.

“High leverage liquidity. Both long and short high leveraged positions will be liquidated.” — Coinglass Analytics Team, Coinglass

Bitcoin and Ethereum: Volatility Amid Liquidation Events

Did you know? Despite market volatility, Bitcoin’s market dominance has fluctuated historically, peaking over 70% in past cycles and affecting liquidation trends.

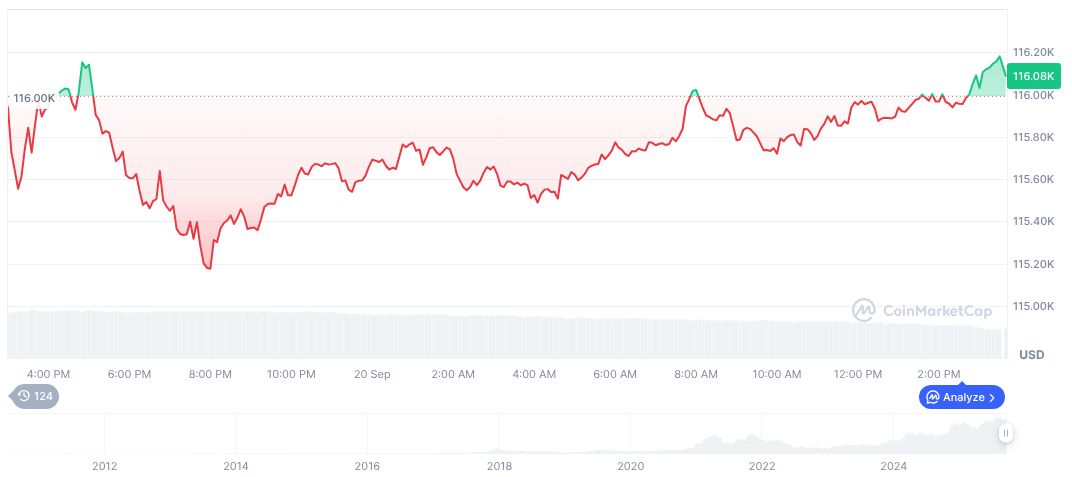

As of September 20, 2025, Bitcoin is priced at $116,108.64, with a market cap of $2.31 trillion according to CoinMarketCap. The 24-hour trading volume saw a decrease of 37.92%, indicating reduced activity amid market shifts. BTC’s price rose 0.33% in 24 hours but had a notable 90-day increase of 16.65%.

The Coincu research team identifies possible financial shifts as liquidation risks may propel regulatory scrutiny. Furthermore, historical trends often correlate sharp liquidation events with subsequent market corrections, which might prompt further analysis and caution among institutional traders.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/crypto-market-liquidations-impact/