- Federal Reserve Governor Milan supports 50 basis point rate cuts.

- Rate policy impacts cryptocurrency markets.

- Bitcoin stabilized but market reactions varied.

On September 19, Federal Reserve Governor Stephen Milan announced a dissenting vote for a 50 basis point interest rate cut, asserting the decision’s independence from political influence.

Milan’s stance could impact major cryptocurrencies like Bitcoin and Ethereum by affecting U.S. dollar liquidity, though no immediate market shift has been reported.

Milan’s Advocacy for 50 Basis Point Adjustments

Federal Reserve Governor Stephen Milan emphasized moving towards a neutral interest rate in 50 basis point increments. This approach reflects a shift in policy strategy made apparent during September’s meeting. Governor Milan, newly appointed in 2025, ensures his decisions are independent and uninfluenced by political forces. Milan stated, “I cast a dissenting vote in this interest rate decision, advocating for a larger rate cut of 50 basis points.” This highlights his stance on neutrality in the Federal Reserve’s rate policy decisions. While no primary source statements are available directly from Milan, official press notes clarify his supportive vote for neutral policy orientation.

Did you know? When Federal Reserve decisions in 2020 leaned dovish, Bitcoin saw rallies, indicating market sensitivity to rate cuts, similar to Milan’s advocacy for 50 basis points.

Insights from Coincu emphasize that such monetary adjustments by the Federal Reserve can prompt fluctuations, especially in BTC and ETH markets, reflecting changes in global liquidity dynamics. These iterative rate adjustments hold potential for broader financial shifts as market actors realign strategies around new monetary policy cues.

Bitcoin and Crypto Market Dynamics Amid Fed Decisions

Did you know? When Federal Reserve decisions in 2020 leaned dovish, Bitcoin saw rallies, indicating market sensitivity to rate cuts, similar to Milan’s advocacy for 50 basis points.

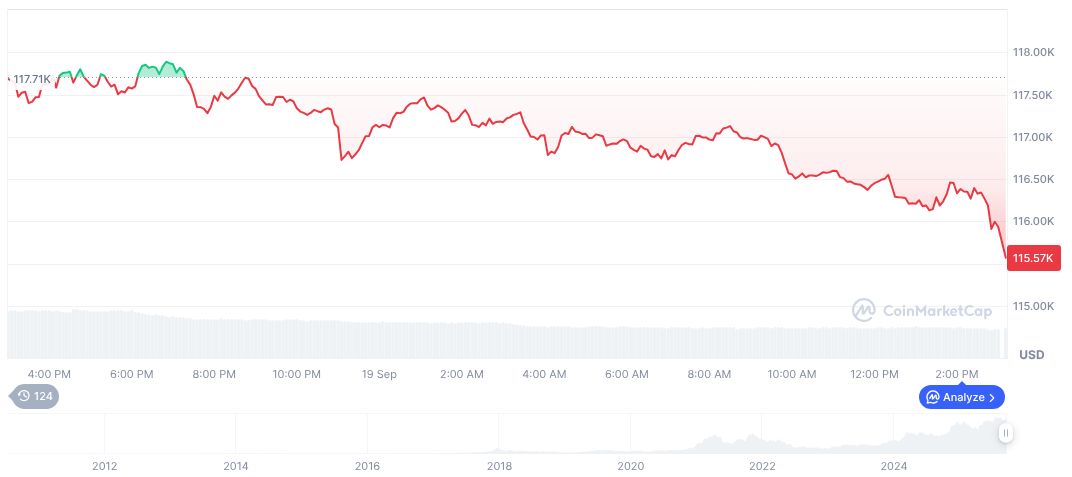

Bitcoin’s current price is $115,388.16 with a market cap of $2.29 trillion, per CoinMarketCap data. It holds a 57.17% market dominance. Recent trends show minor fluctuations with Bitcoin declining 1.86% over 24 hours but maintaining a 12.45% increase over 90 days. Trading volumes dropped by 22.47% in the last 24 hours.

Crypto stability amid Fed rate cut discussions signals evolving market resilience.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/federal-reserve-50-basis-point-cuts/