- Federal Reserve Chairman Stephen Milan signals potential departure over Trump intervention.

- Expects deeper interest rate cuts for economic stimulus.

- Bitcoin and Ethereum prices influenced by ongoing policy adjustments.

Federal Reserve Governor Stephen Milan, newly appointed with Trump’s support, expressed his willingness to resign from the Economic Advisory Committee if Trump requests him to stay, reflecting ongoing monetary policy debates.

This development highlights potential shifts in U.S. monetary approaches and could affect market dynamics, including interest rate expectations and asset pricing, particularly within the cryptocurrency sectors.

Federal Reserve Tensions Amidst Milan’s Potential Exit

Federal Reserve Governor Stephen Milan, supported by Trump, has threatened to leave the Economic Advisory Committee if Trump demands his retention. Milan, sworn in before September’s FOMC meeting, strongly advocates for more significant rate cuts to boost economic activity.

Milan’s stance on interest rates contrasts with the Federal Reserve’s cautious approach. Arguing for a 50 basis point cut, Milan thinks this would better support economic recovery, amplifying calls for a shift in the Fed’s broader strategy. As Milan stated, “I believe the interest rate should be cut by 50 basis points” to align with market expectations.

Bitcoin and Ethereum markets have responded positively to the anticipation of dovish monetary policies. Federal Reserve disagreements could further influence asset valuations, potentially impacting long-term investor confidence.

Cryptocurrencies React to Federal Policy Disputes

Did you know? Following the 1995 preemptive rate cuts, Bitcoin’s value increased rapidly, showing historical alignment with Milan’s current strategy, potentially driving future asset surges.

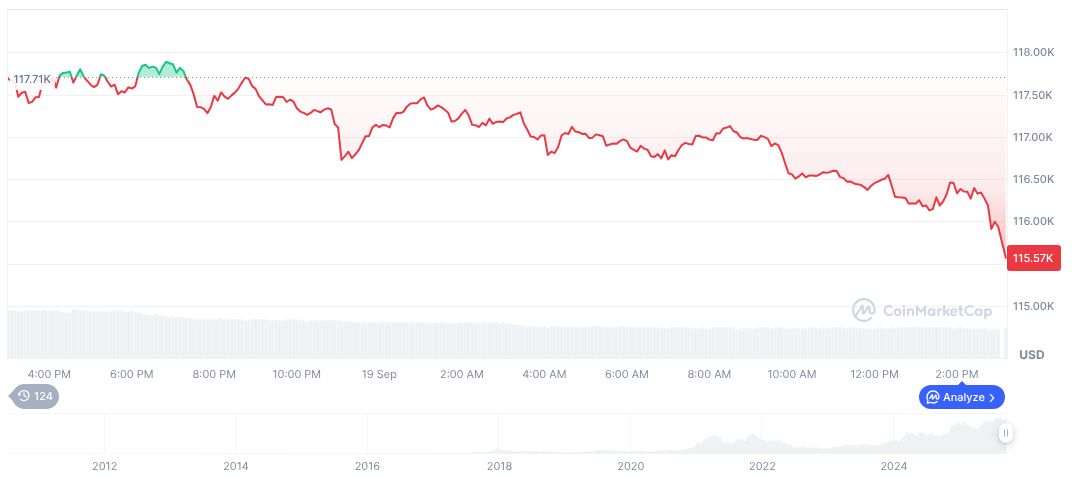

Bitcoin (BTC) currently trades at $115,730.34, with a market cap of formatNumber(2305715025102, 2). Over the past 90 days, BTC prices rose by 11.84%, suggesting resilience despite recent setbacks. Data from CoinMarketCap indicates risk appetites are high amid today’s macroeconomic environment.

Expert insights suggest Milan’s departure could lead to financial uncertainty and potential shifts in regulatory frameworks. The Coincu team identifies that risk asset volatility may increase if Trump’s influence persistently affects Federal Reserve decisions. Historical patterns indicate that preemptive rate cuts often align with market rallies, suggesting possibilities for substantial crypto price growth.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/federal-reserve-milan-threatens-exit-trump/