- Bitcoin price holds rising channel support with $120K–$123.6K resistance defining the next breakout zone.

- Derivatives data shows open interest at $85.5B and whale positioning skewed bullish despite cautious retail flow.

- BTC dominance slips to 57.8% as altcoins attract flows, while political narratives add a fresh tailwind.

Bitcoin price today is trading near $117,460, holding gains after rebounding from the $111,000 support zone earlier this week. The recovery has carried BTC back toward the $117,500–$120,000 resistance band, a region defined by the 0.618–0.786 Fibonacci retracement and capped by the July peak. The battle now rests on whether buyers can force a breakout toward $123,600 or if profit-taking halts the advance.

Bitcoin Price Holds Rising Channel Support

The daily chart shows Bitcoin trading firmly within its ascending channel, with spot price now testing the midrange. Support has consistently held near $111,000, where the 0.236 Fib level aligns with the 100-day EMA. Overhead, immediate resistance sits at $120,054, with the next barrier at $123,600.

Momentum indicators lean positive. RSI has risen to 62, reflecting improving demand without breaching overbought territory. EMAs remain stacked bullishly, with the 20-day average above $114,300 and the 50-day at $113,800. A decisive close above $120,000 could confirm bullish continuation toward the 1.618 Fibonacci extension at $133,550.

Derivatives Data Shows Rising Conviction

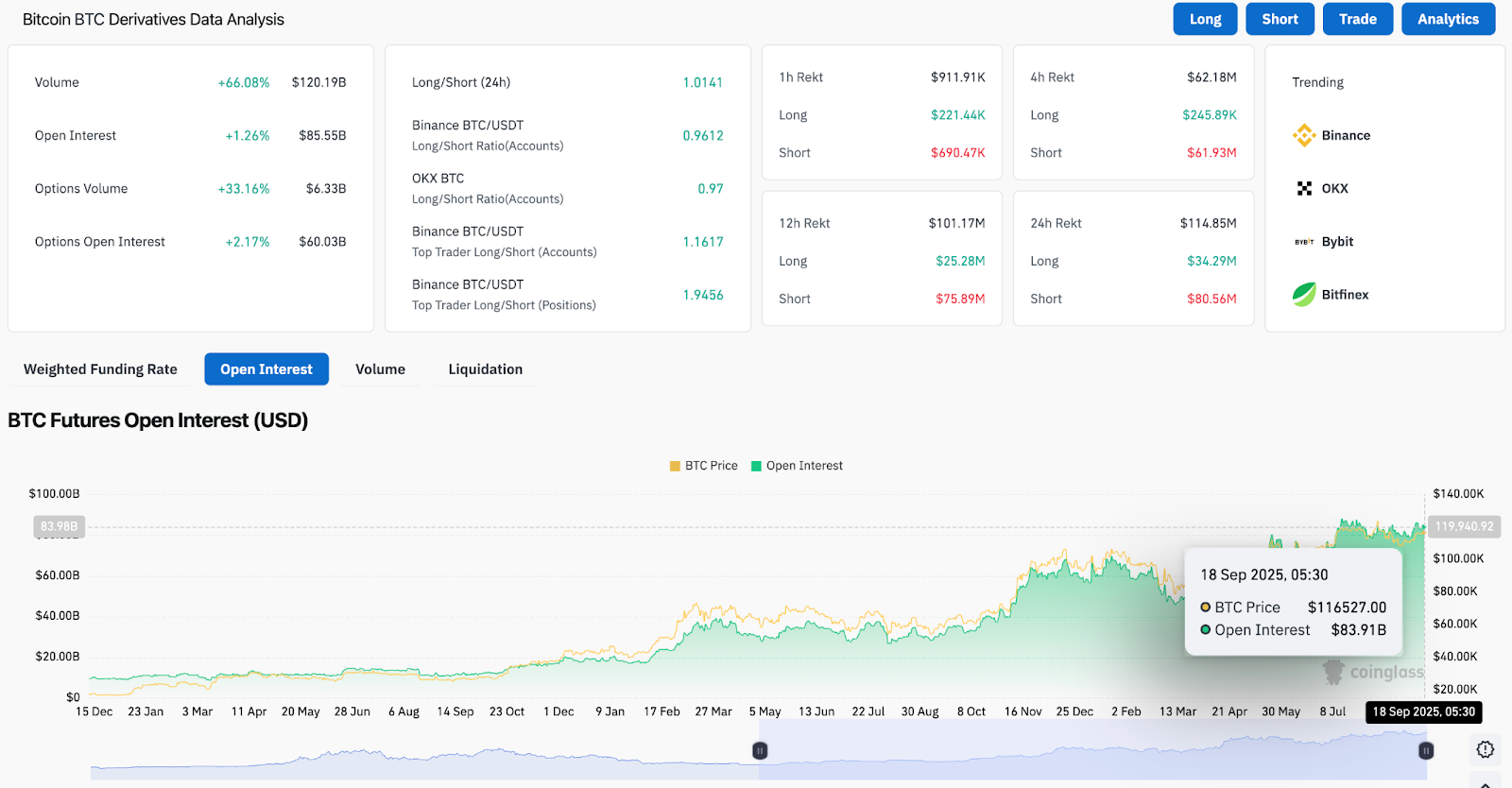

Bitcoin derivatives markets confirm growing appetite for exposure. Total open interest has climbed 1.26% to $85.5 billion, while trading volume surged 66% to $120 billion. Options activity is particularly notable, with volume up 33% to $6.3 billion and open interest at $60 billion.

The long-to-short ratio across exchanges remains close to neutral at 1.01, but Binance’s top traders show aggressive positioning with a long/short ratio of 1.94. This skew suggests larger accounts are leaning toward further upside, even as retail participation remains cautious.

BTC Dominance Drops As Altcoins Attract Flows

Weekly dominance charts highlight Bitcoin’s slipping market share, now near 57.8% after falling from July’s 66% peak. The decline signals renewed rotation into altcoins as traders diversify exposure.

Still, Bitcoin maintains structural support along its multi-year ascending dominance channel. If dominance stabilizes here, capital could circle back toward BTC during any sharp breakout above $120,000. RSI for dominance sits near 34, indicating oversold conditions that may soon trigger a rebound.

Political Symbolism Adds Narrative Tailwind

Bitcoin’s cultural relevance added another layer of attention this week after a golden statue of former President Donald Trump holding a Bitcoin was unveiled outside the U.S. Capitol. While symbolic, the display reinforces Bitcoin’s growing political narrative, a theme already influencing investor sentiment in this election cycle.

Analysts argue such moments, though not directly tied to fundamentals, contribute to Bitcoin’s perception as a mainstream political and financial asset. That narrative support may provide additional cushion for BTC’s price action at a critical resistance juncture.

Technical Outlook For Bitcoin Price

Key levels for Bitcoin in the short term:

- Upside targets: $120,000, $123,600, and $133,500 if momentum builds.

- Downside supports: $114,300, $111,100, and $105,500 as trendline and EMA defense zones.

Outlook: Will Bitcoin Go Up?

Bitcoin’s path forward hinges on whether it can close above $120,000 with conviction. On-chain and derivatives data show cautious but rising bullish conviction, while macro narratives and political symbolism are adding fresh visibility.

As long as BTC defends the $111,000 level, analysts remain constructive. A breakout above $120,000 could trigger acceleration toward $123,600 and $133,500, while failure to clear resistance risks a pullback to the $114,000–$111,000 zone. For now, Bitcoin price remains in a consolidation phase with bias tilted toward bullish continuation.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/bitcoin-btc-price-prediction-for-september-19-2025/