Key Takeaways

Why did IP rally 9.2%?

Strong Futures demand drove IP’s surge as Open Interest jumped 18% to $330M.

What price levels could determine IP’s next move?

If demand holds, IP could break $10.6 and target $11.8, but if bearish pressure intensifies, a drop to $9.5 or even $8.8 remains possible.

After hitting an all-time high a week ago, Story [IP] retraced and traded within a thin margin. Over this period, the altcoin remained stuck between the $9.5 and $10.2 consolidation range.

In fact, as of this writing, IP was trading at $10.25, marking a 9.25% increase over the past 24 hours. Can the altcoin sustain the uptrend?

Futures demand drives IP

With the market cooling down, investors have taken the opportunity to take Futures positions.

According to CryptoQuant, Story’s Futures Taker CVD has remained green over the past two weeks. This reflects buyer dominance in Futures.

Source: CryptoQuant

Markets are recording more buying orders compared to selling, indicating steady capital inflow into Futures. In fact, IP’s Open Interest surged 18% to $330 million on the 17th of September, per CoinGlass.

Source: CoinGlass

When OI rises while buyers are dominating, it means that capital has flowed into opening new positions, be it long or short.

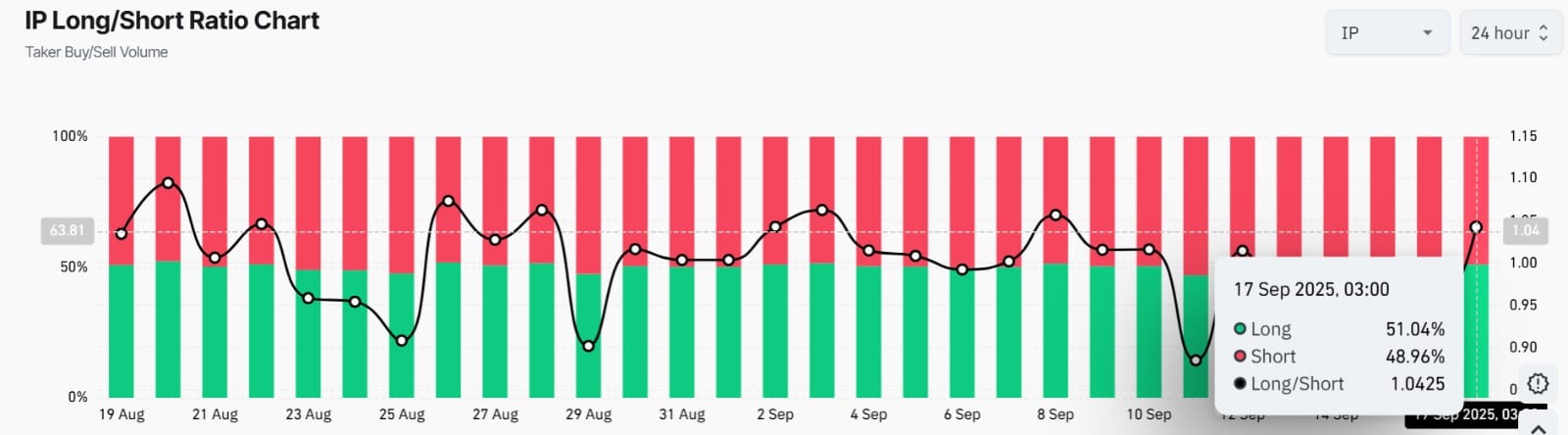

Meanwhile, the altcoin’s Long/Short Ratio increased to 1.04, with longs accounting for 51% and shorts accounting for 48.9% of the positions. This reflected market bullishness as well.

Source: Coinglass

The Spot market is not sitting idle, either.

After dominating the market for nine consecutive days, buyers finally managed to outpace sellers on the 17th of September.

Per Coinalyze, IP saw 116.7k in Buy Volume compared to 108.12k in Sell Volume. As a result, the altcoin recorded a positive Buy Sell Delta of 8.58k, a clear sign of aggressive spot accumulation.

Source: Coinalyze

On-chain activity rebounds as well

As demand soared on both Futures and Spot markets, On-chain transactions bounced back as well.

AMBCrypto’s look at Artemis data found that Daily Transactions surged to a five-month high of 333k, reflecting growing utility and usage beyond speculation.

Source: Artemis

At the same time, Daily Active Addresses recovered from the recent dip to 8.2k to reach 9.2k, further confirming growing network usage.

A Breakout for IP?

Story traded within a strong range at the time of writing, as demand across all market participants remained elevated.

Holding other factors constant, if demand remains stable, IP could finally break out of its current consolidation. This will see the altcoin successfully retest $10.6 resistance and reclaim $11.8.

However, upward momentum remains weak while the downward momentum strengthened slowly.

Source: Tradingview

In fact, Stochastic RSI declined to 14 while its signal line sat above it at 15.3. At the same time, the altcoin’s RSI dropped below its signal line to 67.

When these momentum indicators drop in such a manner, they signal bearish bias. That said, if bears attempt to displace bulls, Story can drop to $9.5 with $8.8 as critical support.

Source: https://ambcrypto.com/story-ip-surges-9-defends-key-support-is-11-8-within-reach/