- Interest rates reduced by 25 bps by HKMA and Fed.

- Coordinates with global monetary trends.

- No immediate effect on crypto assets reported.

The Hong Kong Monetary Authority reduced its benchmark interest rate by 25 basis points to 4.50% on September 18, 2025, following a similar move by the US Federal Reserve.

This synchronized rate cut aims to maintain monetary stability and stimulate economic activity, potentially impacting cryptocurrency market dynamics through altered risk sentiment in global trading environments.

Global Rate Cuts Target Economic Slowdown

HKMA and Fed’s decision to cut rates comes amid signs of a slowing global economy. The rate cut is aimed at stimulating lending and liquidity. According to Chief Executive, HKMA Eddie Yue, the move is expected to support the local property market and wider economy. He advised households and businesses to remain cautious due to possible rate swings.

The impact on financial markets is poised to be significant, with expectations of increased lending and economic activity. The cut did not directly announce funding towards DeFi or crypto projects. Attention remains on digital asset initiatives as Hong Kong seeks wide adoption of these technologies.

Eddie Yue, Chief Executive, HKMA, said the rate cut “should support the property market and broader economy.” He urged continued caution: “Households and businesses [should] stay cautious in property, investment, and borrowing decisions, citing the risk of further interest rate swings as global monetary conditions evolve.”

Hong Kong’s Currency Peg Influences Crypto and Markets

Did you know? Hong Kong’s interest rates are closely tied to the US due to its currency peg, making synchronized rate cuts a regular feature. Historically, these cuts have prompted liquidity boosts and temporary fluctuations in Asian equity and crypto markets.

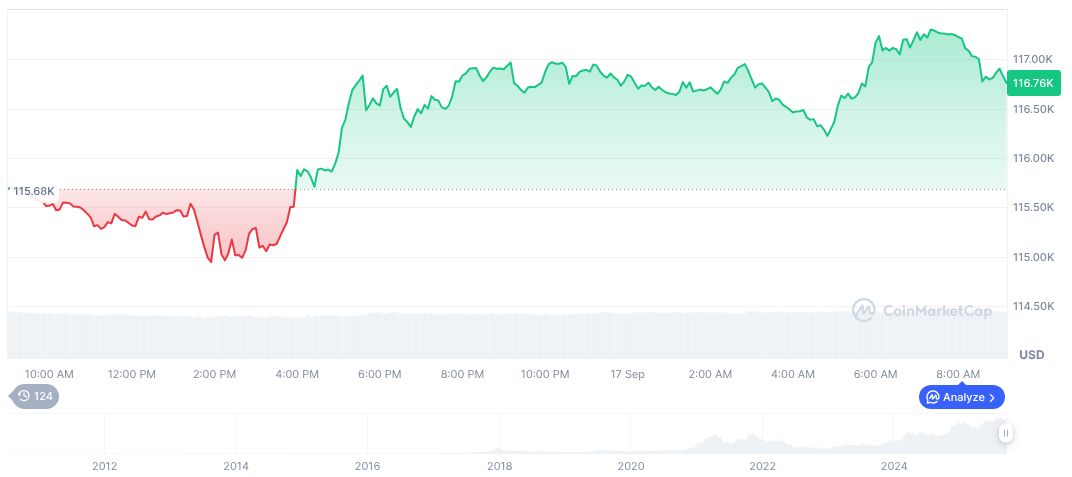

Bitcoin currently stands at $116,553.24, marking a slight daily decline of 0.25%, yet showing an 11.47% gain over 90 days. The market cap reaches approximately 2,322,019,835,761 with a market dominance of 56.92%, according to CoinMarketCap as of September 18, 2025.

Coincu’s team suggests that leveraging digital finance initiatives could potentially cushion economic impacts on local markets. Strengthening the regulatory framework for digital assets might enhance market confidence and drive innovation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/hong-kong-fed-rate-cuts-2025/