- Bitcoin supply on exchanges hits seven-year low.

- Institutional demand is a key driver of this trend.

- Potential for increased market volatility and price rallies.

Crypto analyst The DeFi Investor reports Bitcoin supply on centralized exchanges hits a seven-year low, signaling strong institutional buying, as noted on X platform on September 18, 2025.

Institutional accumulation of Bitcoin has greatly reduced liquidity, sparking volatility and potential bullish price movements, reminiscent of past bull market cycles observed in 2013, 2017, and 2021.

Institutional Demand Drives Exchange BTC Supply Below 2.56 Million

The recent analysis by The DeFi Investor signals a pivotal shift in Bitcoin’s market dynamics as the supply on centralized exchanges declines notably. Key institutional players, including hedge funds and asset managers, are actively accumulating Bitcoin, highlighting a strategic move away from traditional financial assets.

The decreasing Bitcoin reserves suggest notable changes in market structure. The current drop, involving a reduction to below 2.56 million BTC, suggests potential consequences for volatility, reflecting past patterns often linked with subsequent price rallies.

“The supply of BTC on centralized exchanges is at its lowest level in seven years. The scale of funds invested by institutions in purchasing Bitcoin in this cycle is incredible.” — The DeFi Investor, Crypto Analyst, X

Historical Lows Hint at Potential Bull Runs

Did you know? Historical patterns show that reduced supply on exchanges often precedes significant price increases.

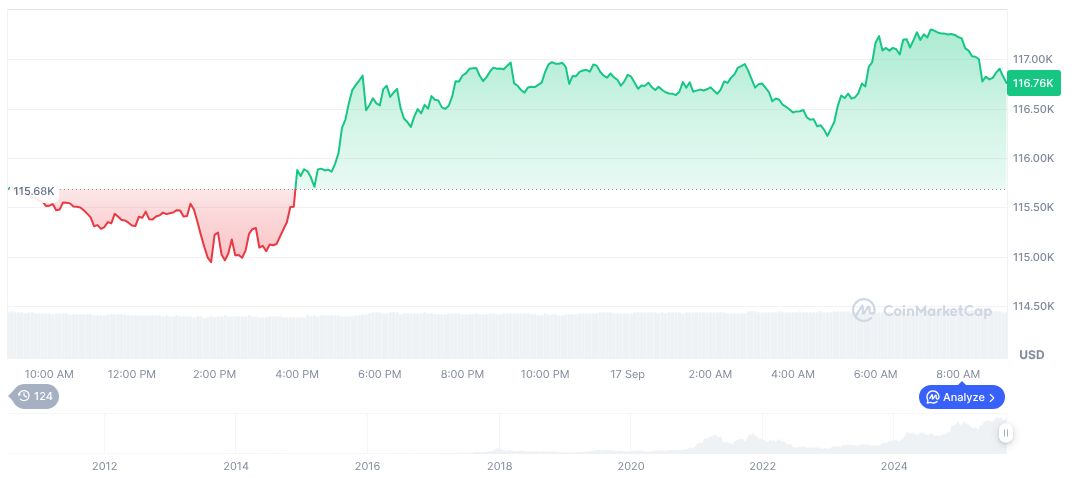

As of September 18, 2025, Bitcoin (BTC) is trading at $116,690.85, according to CoinMarketCap. Its market capitalization is $2.32 trillion, with a trading volume increase of 40.59% over the last 24 hours. Bitcoin’s supply stands at 19,922,396 coins, with a maximum cap of 21 million.

Coincu experts point out that institutional interest could drive regulatory focus while technological innovations in blockchain could enhance Bitcoin’s appeal as a store of value. Market scarcity and interest in self-custody are expected to increase, affecting future price volatility and investment strategies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/bitcoin-exchanges-supply-low-2025/